Get the free Mortgage and General Insurance - Santander for Intermediaries - santanderforintermed...

Show details

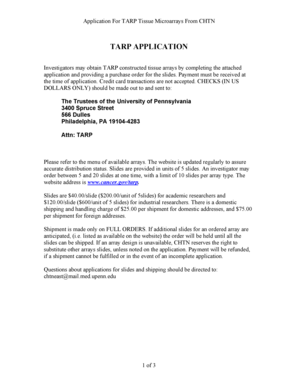

INTERMEDIARIES & INVESTMENT PROFESSIONALS ONLY: NOT FOR PUBLIC DISTRIBUTION Mortgage and General Insurance Registration form New Firm/Returning Firm Please fill in the form using BLOCK CAPITALS and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage and general insurance

Edit your mortgage and general insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage and general insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage and general insurance online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage and general insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage and general insurance

How to fill out a mortgage and general insurance:

Gather the necessary documentation:

01

For the mortgage application: Prepare your personal identification documents, proof of income, bank statements, and details of the property you wish to purchase.

02

For general insurance: Collect information about the belongings or assets you want to insure, including their value and any relevant details.

Research and compare options:

01

Explore different mortgage lenders to find the best interest rates and terms that suit your financial situation.

02

For general insurance, obtain quotes from multiple insurance providers to compare coverage options and premiums.

Complete the mortgage application:

01

Fill out the application form provided by your chosen lender, providing accurate and verifiable information about your personal and financial circumstances.

02

Attach the required documents to support your application.

Review and understand the mortgage terms:

01

Carefully read and comprehend the terms and conditions of the mortgage agreement, including interest rates, repayment schedule, and any associated fees.

02

Seek clarification from the lender if any aspects are unclear.

Submit the application:

01

Once you have completed the application form and gathered all necessary documents, submit them to your mortgage lender for review.

02

Follow up with the lender to ensure they have received your application and ask about the next steps in the process.

Who needs mortgage and general insurance:

Homebuyers:

01

Individuals or families who are purchasing a property typically require a mortgage to finance the purchase. Mortgage insurance may be necessary if the down payment is less than 20% to protect the lender in case of default.

02

General insurance is important to protect the structure and contents of the property against risks like fire, theft, or natural disasters.

Property owners:

Owners of homes, rental properties, or commercial spaces may need a mortgage to secure their investment or make improvements. General insurance can help protect these properties from potential damages and liabilities.

Financial institutions:

01

Lenders and financial institutions require mortgage insurance to protect their investment in case the borrower defaults on the loan.

02

General insurance may also be necessary for banks or mortgage lenders to ensure the properties they finance are adequately protected against potential risks.

In conclusion, anyone looking to purchase a property or secure their investment in real estate may need to fill out a mortgage application and consider obtaining general insurance to protect their assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mortgage and general insurance?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the mortgage and general insurance in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the mortgage and general insurance in Gmail?

Create your eSignature using pdfFiller and then eSign your mortgage and general insurance immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit mortgage and general insurance on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing mortgage and general insurance, you need to install and log in to the app.

What is mortgage and general insurance?

Mortgage insurance protects the lender in case the borrower defaults on the loan, while general insurance provides protection against a range of risks.

Who is required to file mortgage and general insurance?

Borrowers and property owners are typically required to have mortgage insurance, while anyone looking to protect against various risks may opt for general insurance.

How to fill out mortgage and general insurance?

To fill out mortgage insurance, you will need to provide information about the property and your financial situation. General insurance requires details about the risks you want to protect against.

What is the purpose of mortgage and general insurance?

The purpose of mortgage insurance is to protect the lender and ensure they are covered in case of default. General insurance aims to protect against a range of potential risks.

What information must be reported on mortgage and general insurance?

Mortgage insurance requires details about the property and borrower's finances, while general insurance needs information about the risks being covered.

Fill out your mortgage and general insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage And General Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.