Get the free Insurance Guidelines - escondido

Show details

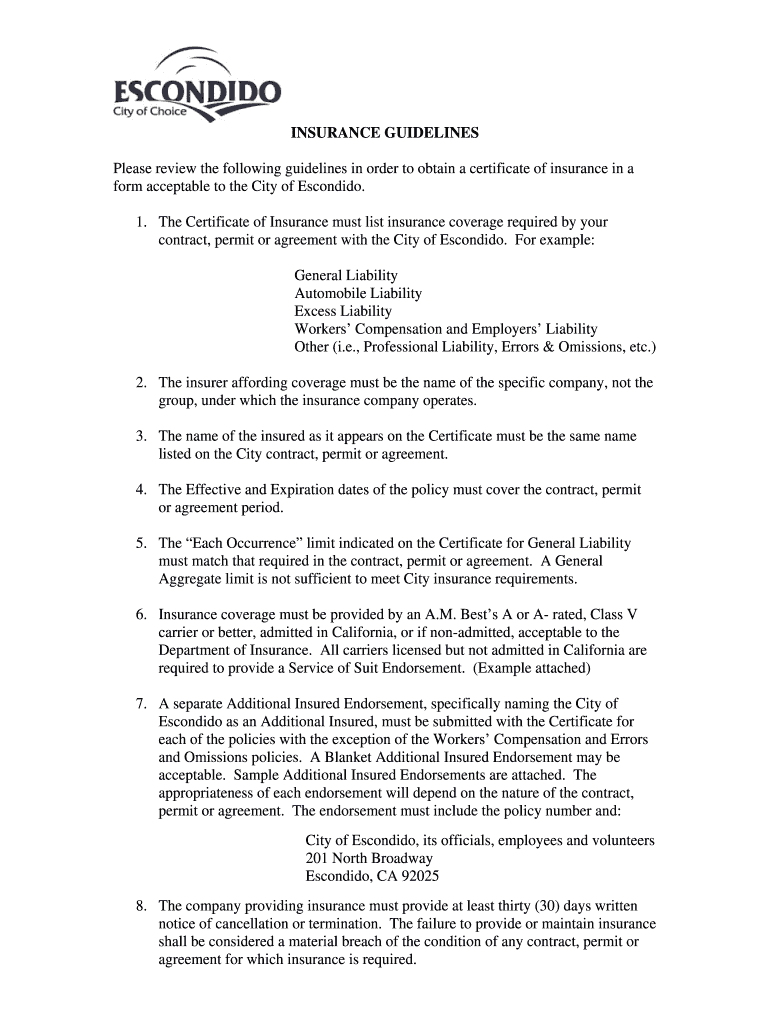

This document outlines the guidelines for obtaining a certificate of insurance that is acceptable to the City of Escondido, including coverage requirements and endorsements needed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance guidelines - escondido

Edit your insurance guidelines - escondido form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance guidelines - escondido form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance guidelines - escondido online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance guidelines - escondido. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance guidelines - escondido

How to fill out Insurance Guidelines

01

Gather all necessary personal information, including your name, contact details, and insurance policy number.

02

Read through the insurance guidelines carefully to understand the requirements and instructions.

03

Complete the required sections of the guidelines, ensuring accuracy in filling out dates, names, and numbers.

04

Provide any additional documentation or evidence that supports your application or claim as specified in the guidelines.

05

Review all entries for completeness and correctness before submission.

06

Submit the completed guidelines through the specified method, whether online or via postal mail.

Who needs Insurance Guidelines?

01

Individuals applying for insurance coverage.

02

Policyholders filing a claim or making modifications to their existing policies.

03

Insurance agents and representatives assisting clients with applications or claims.

04

Businesses needing to understand coverage requirements for employees.

Fill

form

: Try Risk Free

People Also Ask about

What are the 6 principles of insurance?

In the insurance world there are six basic principles that must be met, ie insurable interest, Utmost good faith, proximate cause, indemnity, subrogation and contribution. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.

What are the top five insurance policies?

List of Best Life Insurance Plans & Policies in India in 2025 S. NoPlan NameCSR (2023-24) 2 Bajaj Allianz e Touch II 99.23% 3 HDFC Life Click 2 Protect Super 99.5% 4 ICICI Prudential iProtect Return of Premium 99.17% 5 SBI Life Wealth Assure Plan 98.25%6 more rows

What are the 7 basic principles of insurance?

In insurance, there are 7 basic principles that should be upheld, ie Insurable interest, Utmost good faith, proximate cause, indemnity, subrogation, contribution and loss of minimization.

What is the 3 D rule in insurance?

The 3 D's of insurance are “delay, deny, and defend.” They represent the 3-part strategy insurance companies use to avoid paying policyholders what they may be owed. These tactics may pressure some Americans into accepting lowball settlements, and they can result in claims being held up in court for years.

What is the insurance risk guideline?

Key Components of Insurance Risk Assessment Risk Identification. This step involves identifying potential hazards or exposures. Risk Evaluation and Scoring. This involves assessing the severity and frequency of risk events. Risk Classification in Insurance. Risk Mitigation Strategies in Insurance. Ongoing Monitoring.

What are the 7 rules of insurance?

The principles of insurance include seven key concepts: insurable interest, utmost good faith, proximate cause, indemnity, subrogation, contribution, and loss minimisation.

What are the 5 P's of insurance?

This article outlines the “Five P's of Insurance” that I discuss with my clients when designing group benefits plans. The five “P's” include premium, plan, providers, participation, and performance. Consider these five elements of benefits design and rank them by importance.

What are the six basic principles of insurance?

In the insurance world there are six basic principles that must be met, ie insurable interest, Utmost good faith, proximate cause, indemnity, subrogation and contribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurance Guidelines?

Insurance Guidelines are a set of rules and regulations that govern how insurance companies operate, including underwriting standards, claims handling procedures, and policy issuance.

Who is required to file Insurance Guidelines?

Insurance companies and organizations operating in the insurance sector are required to file Insurance Guidelines to ensure compliance with regulatory standards.

How to fill out Insurance Guidelines?

To fill out Insurance Guidelines, one must collect relevant data, follow the specified format provided by the regulatory authority, and ensure all required fields are completed accurately before submission.

What is the purpose of Insurance Guidelines?

The purpose of Insurance Guidelines is to establish a standardized framework for the insurance industry to promote fairness, transparency, and consumer protection.

What information must be reported on Insurance Guidelines?

Insurance Guidelines must include information such as insurance policy details, premium amounts, claims processed, underwriting criteria, and compliance with state or federal regulations.

Fill out your insurance guidelines - escondido online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Guidelines - Escondido is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.