Get the free Transient Occupancy Tax Return

Show details

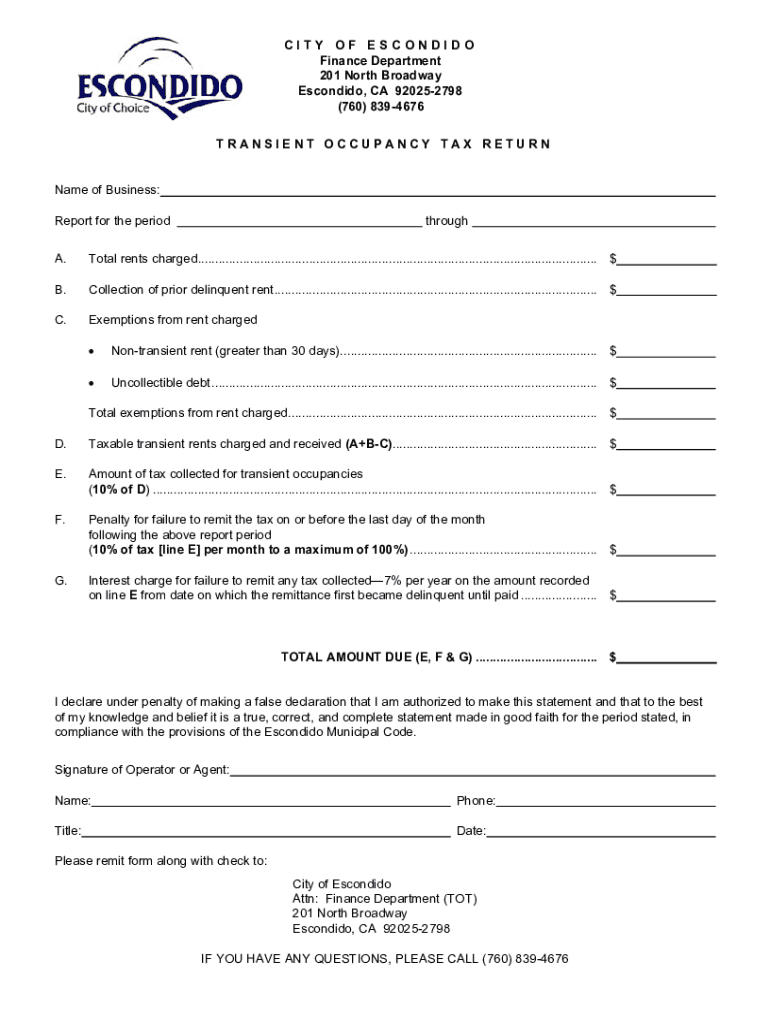

This document is used for reporting transient occupancy tax for businesses in Escondido, detailing rents charged, exemptions, and the total amount due including penalties and interest.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transient occupancy tax return

Edit your transient occupancy tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transient occupancy tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transient occupancy tax return online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transient occupancy tax return. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transient occupancy tax return

How to fill out Transient Occupancy Tax Return

01

Obtain the Transient Occupancy Tax Return form from your local tax authority's website or office.

02

Fill in your name and contact information at the top of the form.

03

Enter the address of the property for which you are reporting.

04

Specify the reporting period for which you are submitting the tax return.

05

Calculate the total number of rooms rented during the reporting period.

06

Determine the total gross rental income received.

07

Apply the appropriate local Transient Occupancy Tax rate to your total gross rental income.

08

Subtract any applicable exemptions or deductions, if allowed.

09

Calculate the total tax due based on the taxable amount.

10

Sign and date the form before submission.

11

Submit the completed form along with any payment to the local tax authority by the due date.

Who needs Transient Occupancy Tax Return?

01

Businesses and individuals who rent out accommodations to transient guests, such as hotels, motels, bed and breakfasts, vacation rentals, and similar establishments, are required to file a Transient Occupancy Tax Return.

Fill

form

: Try Risk Free

People Also Ask about

What does tot stand for in transient occupancy tax?

Transient Occupancy Tax ( TOT ) is a rental tax that is paid by the guest for short-term rentals within a period of 30 consecutive calendar days or less. It is also known by names such as room tax, a use tax, a tourist tax, or hotel tax.

What is an occupancy tax for hotels in the USA?

Occupancy tax is simply another name for hotel tax, lodging tax and bed tax. It's the name, or one of the names, used by many states, including Alabama, California, Connecticut, Illinois, New Jersey, Tennessee, Texas, Virginia and West Virginia.

What is the transient occupancy tax used for in the USA?

The Transient Occupancy Tax (TOT) is a tax that California vacation rental hosts must charge their guests. The proceeds from the tax fund local public services such as police, fire, and parks and recreation.

What is a local transient fee?

Transient Occupancy Tax ( TOT ) is a rental tax that is paid by the guest for short-term rentals within a period of 30 consecutive calendar days or less. It is also known by names such as room tax, a use tax, a tourist tax, or hotel tax.

What is the transient occupancy tax in Texas?

The state hotel occupancy tax rate is 6 percent (. 06) of the cost of a room. Cities and certain counties and special purpose districts are authorized to impose an additional local hotel tax that the local taxing authority collects.

What is the TID tax in San Francisco?

A: A 1% TID assessment increase was unanimously approved by the TID Board in August 2024 and went into effect November 1, 2024. The current TID assessment is 2.25% of room revenue for hotels in Zone 1 and 2.00% of room revenue for hotels in Zone 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transient Occupancy Tax Return?

The Transient Occupancy Tax Return is a form used by businesses that provide temporary lodging to report and remit taxes collected on behalf of their guests.

Who is required to file Transient Occupancy Tax Return?

Entities such as hotels, motels, bed and breakfasts, and short-term rental operators are required to file a Transient Occupancy Tax Return if they rent out accommodations for a transient period.

How to fill out Transient Occupancy Tax Return?

To fill out the form, businesses need to provide details about the total revenue from lodging, the tax rate applied, the total tax collected, and any exemptions or deductions applicable, along with contact information.

What is the purpose of Transient Occupancy Tax Return?

The purpose of the Transient Occupancy Tax Return is to ensure that tax on temporary lodging is accurately reported and paid to the local government, which can use the funds for public services.

What information must be reported on Transient Occupancy Tax Return?

Information that must be reported includes the total number of rental nights, total revenue from rentals, the transient occupancy tax rate, total tax collected, and any deductions or exemptions claimed.

Fill out your transient occupancy tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transient Occupancy Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.