Get the free Good Faith Estimate of Settlement Costs Estimate the closing costs on the sale of yo...

Show details

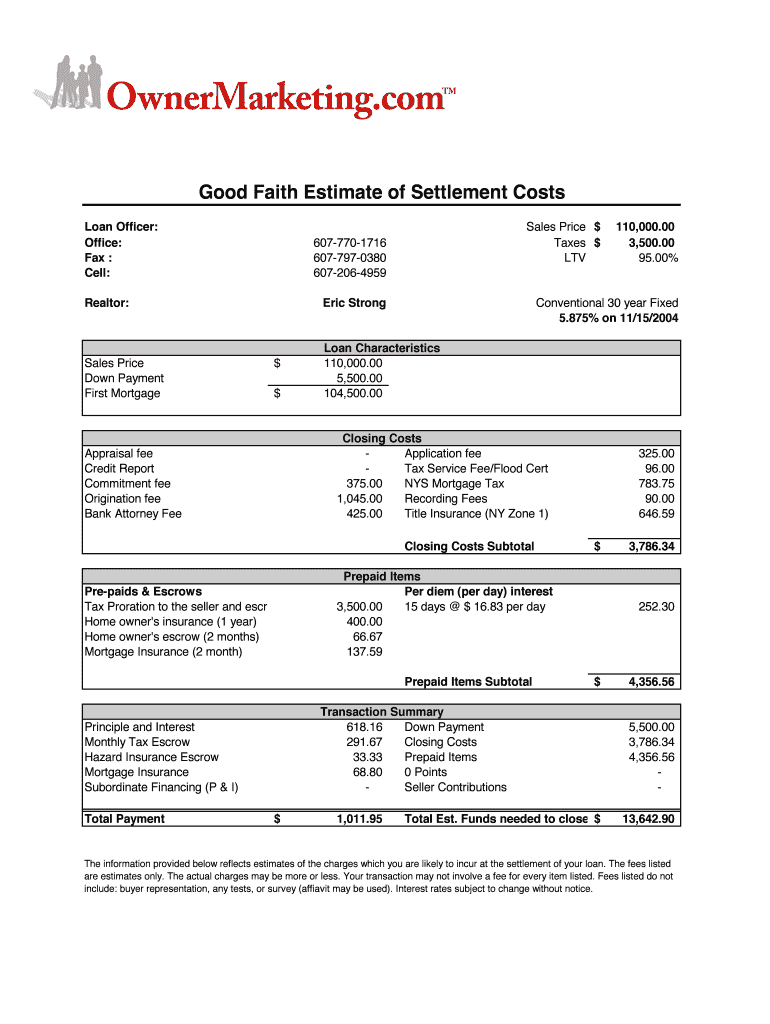

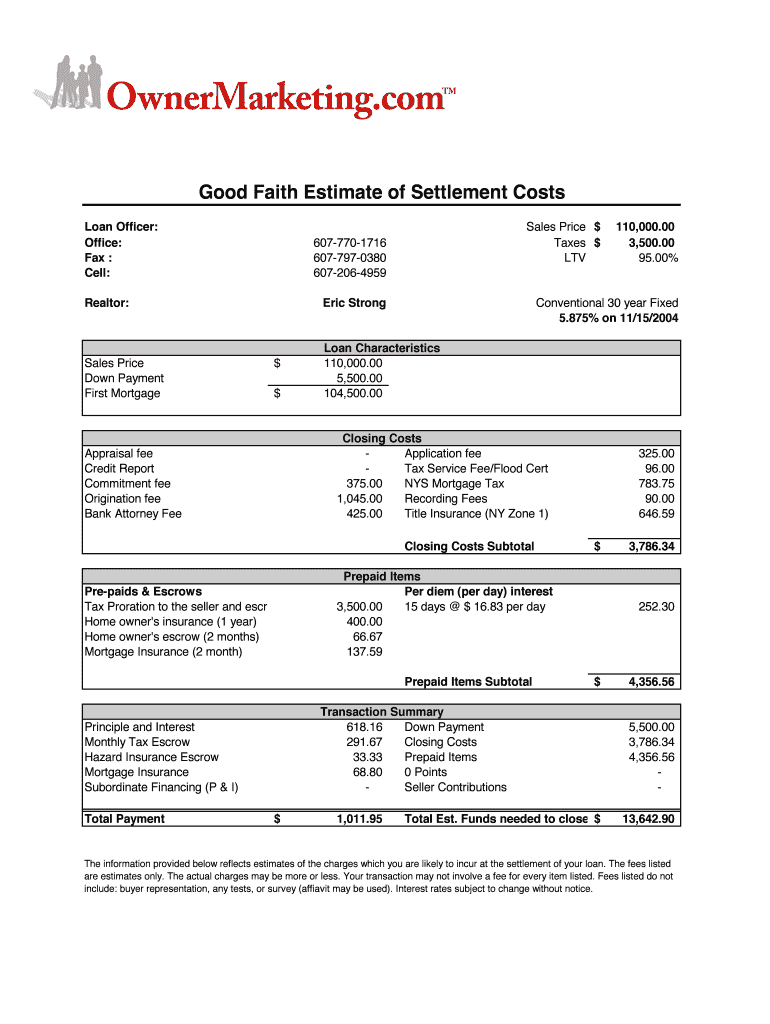

OwnerMarketing.com TM Good Faith Estimate of Settlement Costs Loan Officer: Office: Fax : Cell: Realtor: Sales Price Down Payment First Mortgage Sales Price $ Taxes $ LTV 6077701716 6077970380 6072064959

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign good faith estimate of

Edit your good faith estimate of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your good faith estimate of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit good faith estimate of online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit good faith estimate of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out good faith estimate of

How to fill out a Good Faith Estimate (GFE):

01

Begin by obtaining a GFE form. This form is typically provided by a mortgage lender or broker when you apply for a loan. Make sure you have the most up-to-date version of the GFE.

02

Start by providing your personal information, such as your name, address, and Social Security number. This information is necessary for the lender to accurately identify you and process your loan application.

03

Next, fill in the details about the property you are purchasing or refinancing. Include the address, purchase price or estimated property value, and the loan amount you are seeking.

04

Provide information about the loan term, interest rate, and type of loan. This will determine the estimated monthly payment and other costs associated with the loan.

05

Include any additional charges and fees associated with the loan, such as loan origination fees, closing costs, or discount points. These charges should be clearly stated on the GFE, allowing you to compare them with other loan offers.

06

Review the summary of your estimated settlement charges, which should include an itemized breakdown of the loan costs, escrow accounts, and other charges. The GFE should also indicate whether certain charges are subject to change or are locked in.

07

Carefully review all the terms, conditions, and disclosures provided in the GFE. Make sure you understand each section before proceeding. Seek clarification from your lender if any information seems unclear or if you have any questions.

Who needs a Good Faith Estimate (GFE):

01

Homebuyers: Anyone planning to purchase a home and obtain a mortgage loan should request a GFE. This estimate will outline the expected costs associated with the loan and enable buyers to compare offers from different lenders.

02

Mortgage Refinancers: Those looking to refinance their existing mortgage should also seek a GFE. This estimate will help them understand the costs associated with refinancing and evaluate whether it is financially beneficial.

03

Real Estate Professionals: Agents, brokers, and other professionals involved in the home buying process can benefit from understanding the GFE. It allows them to guide their clients and provide accurate information about loan costs and potential savings.

In summary, filling out a Good Faith Estimate involves providing personal and property information, specifying loan terms and fees, and carefully reviewing all the details. Anyone who intends to obtain a mortgage loan or assist others in the home buying process should be familiar with the GFE and its significance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify good faith estimate of without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your good faith estimate of into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find good faith estimate of?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the good faith estimate of in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the good faith estimate of in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your good faith estimate of in minutes.

What is good faith estimate of?

Good faith estimate is an estimate of the closing costs associated with a mortgage loan.

Who is required to file good faith estimate of?

Lenders are required to provide borrowers with a good faith estimate of closing costs.

How to fill out good faith estimate of?

The good faith estimate should be filled out by the lender or mortgage broker and provided to the borrower.

What is the purpose of good faith estimate of?

The purpose of the good faith estimate is to help borrowers understand the costs associated with their mortgage loan.

What information must be reported on good faith estimate of?

The good faith estimate must include an itemized list of all the closing costs associated with the mortgage loan.

Fill out your good faith estimate of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Good Faith Estimate Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.