Get the free Broker Good Faith Estimate Certification Form Broker Good Faith Estimate Certificati...

Show details

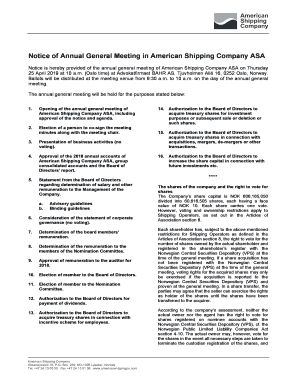

MUG UNION BANK, N.A. LOAN ESTIMATE CERTIFICATION NOTICE: This form to be used when the Brokers' application date is on or after October 3rd, 2015 The undersigned certifies that the following consumer(s):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broker good faith estimate

Edit your broker good faith estimate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broker good faith estimate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit broker good faith estimate online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit broker good faith estimate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out broker good faith estimate

How to fill out a broker good faith estimate:

01

Begin by obtaining a broker good faith estimate form from your mortgage broker or lender. This form is typically provided when applying for a mortgage loan.

02

Fill in your personal information, including your name, address, contact information, social security number, and employment details. The accuracy of this information is crucial for the loan process.

03

Provide details about the property you are planning to purchase or refinance. Include the property address, type of property, and estimated purchase price or current value.

04

Indicate the loan amount you are seeking and the desired loan term. Specify whether you are applying for a fixed-rate or adjustable-rate mortgage.

05

Include any additional costs and fees associated with the loan application, such as origination fees, appraisal fees, credit report fees, and other closing costs.

06

Calculate the estimated monthly payment, including principal, interest, taxes, insurance, and any mortgage insurance premiums.

07

Disclose any potential lender credits or discounts that may be applicable to your loan. These can help lower your closing costs or interest rate.

08

Make sure to review the provided terms and conditions, interest rate, annual percentage rate (APR), and any prepayment penalties or lock-in periods that may apply.

09

Sign the broker good faith estimate form, acknowledging that the provided information is accurate to the best of your knowledge.

Who needs a broker good faith estimate?

A broker good faith estimate is required for individuals who are applying for a mortgage loan. Whether you are purchasing a new home or refinancing an existing mortgage, this estimate helps borrowers understand the costs and terms associated with the loan. Lenders are legally obligated to provide this document to ensure transparency and protect borrowers from potential hidden fees or predatory lending practices. Therefore, anyone in the process of obtaining a mortgage loan should request a broker good faith estimate to make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the broker good faith estimate electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your broker good faith estimate and you'll be done in minutes.

Can I create an eSignature for the broker good faith estimate in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your broker good faith estimate right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out broker good faith estimate using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign broker good faith estimate and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is broker good faith estimate?

Broker good faith estimate is an estimate provided by a broker to a client that outlines the costs and terms associated with a real estate transaction.

Who is required to file broker good faith estimate?

Real estate brokers are required to provide a good faith estimate to their clients.

How to fill out broker good faith estimate?

A broker can fill out the estimate by detailing the costs of services, commission rates, and any other fees associated with the real estate transaction.

What is the purpose of broker good faith estimate?

The purpose of broker good faith estimate is to provide transparency to clients about the costs and terms associated with a real estate transaction.

What information must be reported on broker good faith estimate?

Information such as commission rates, service fees, and any other costs associated with the real estate transaction must be reported on the broker good faith estimate.

Fill out your broker good faith estimate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broker Good Faith Estimate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.