Get the free Capital Budget Ordinance

Show details

This document outlines the adoption of the Capital Budget for Fiscal Year 2011 for the City of Wilmington, indicating that the budget amount is zero dollars as part of a two-year spending plan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital budget ordinance

Edit your capital budget ordinance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital budget ordinance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capital budget ordinance online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit capital budget ordinance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital budget ordinance

How to fill out Capital Budget Ordinance

01

Begin with the header of the ordinance, including the title 'Capital Budget Ordinance' and the date.

02

Identify and list all proposed capital projects for the budget period.

03

For each project, provide a detailed description including objectives, estimated costs, and expected benefits.

04

Specify the funding sources for each project, such as grants, bonds, or internal funds.

05

Outline the timeline for each project's completion, including major milestones.

06

Include any necessary approvals from governing bodies or committees.

07

Review and revise the ordinance to ensure all information is accurate and aligned with legal requirements.

08

Present the ordinance to the relevant governing body for discussion and approval.

09

Once approved, ensure proper distribution and communication of the ordinance to stakeholders.

Who needs Capital Budget Ordinance?

01

Local government officials responsible for budget planning and allocation.

02

City or county council members who approve funding for capital projects.

03

Department heads seeking funding for infrastructure improvements.

04

Community stakeholders and residents interested in understanding public expenditures.

05

Financial institutions or entities evaluating the fiscal health of the municipality.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of capital budgeting?

The three most commonly used evaluation methods in capital budgeting are the payback period, the net present value, and an evaluation of the internal rate of return.

What is the term capital budget?

Capital budgeting involves making investment decisions about projects that will impact a company's future. Since the future is inherently uncertain, there's always risk associated with these choices. Risk analysis helps assess this risk by identifying potential problems and estimating how likely they are to occur.

What is a capital budget example?

Capital Budgeting Example The initial investment includes outlays for buildings, equipment, and working capital. $110,000 of cash revenue is projected for each of the 10 years of the project. After variable and fixed cash expenses are subtracted, $50,000 of net cash flow (before taxes) is generated.

What is capital budgeting in simple words?

What Is Capital Budgeting? Capital budgeting is a process that businesses use to evaluate potential major projects or investments. Building a new plant or taking a large stake in an outside venture are examples of initiatives that typically require capital budgeting before they are approved or rejected by management.

What is capital budgeting policy?

While the operating budget focus is the twelve months of the fiscal year, the focus of capital budgeting is the planning process used to determine an organization's long term investment in assets that have a useful life of greater than one year.

What are the five-five steps in capital budgeting?

Capital Budgeting Analysis Step 1 – Determining the Total Amount of the Investment. Step 2 – Determining the Cash Flows that the Investment will return. Step 3 – Determining the residual/terminal value. Step 4 – Calculating the annual cash flows of the investment. Step 5 – Calculating the NPV of the cash flows.

What is capital budgeting in English?

Capital budgeting is a method of estimating the financial viability of a capital investment over the life of the investment. Unlike some other types of investment analysis, capital budgeting focuses on cash flows rather than profits.

What is the capital budget Act?

The capital budget act establishes the maximum amount of debt that may be issued during any given fiscal year for capital projects. This legislation is typically enacted annually along with other budget-related legislation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

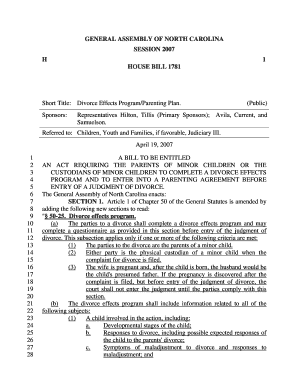

What is Capital Budget Ordinance?

A Capital Budget Ordinance is a legal document that outlines the planned capital expenditures of a government entity for a specific fiscal year, detailing how funds will be allocated for various projects and initiatives.

Who is required to file Capital Budget Ordinance?

Typically, local government entities such as municipalities, counties, and school districts are required to file a Capital Budget Ordinance to provide transparency regarding planned capital investments.

How to fill out Capital Budget Ordinance?

To fill out a Capital Budget Ordinance, one generally needs to include a detailed list of capital projects, the estimated costs, funding sources, and a timeline for proposed expenditures. It is essential to adhere to local regulatory requirements and guidelines.

What is the purpose of Capital Budget Ordinance?

The purpose of a Capital Budget Ordinance is to ensure that government agencies plan and manage their capital expenditures in a responsible manner, providing a framework for approval and accountability of spending on long-term investments.

What information must be reported on Capital Budget Ordinance?

The information that must be reported typically includes the names of projects, estimated costs, funding sources, project timelines, and any relevant fiscal data necessary for stakeholders to understand the financial implications of the planned capital budget.

Fill out your capital budget ordinance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Budget Ordinance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.