Get the free Year of W2 Request - payroll tcnj

Show details

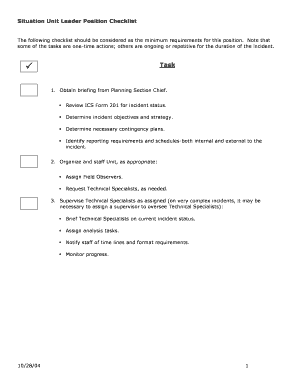

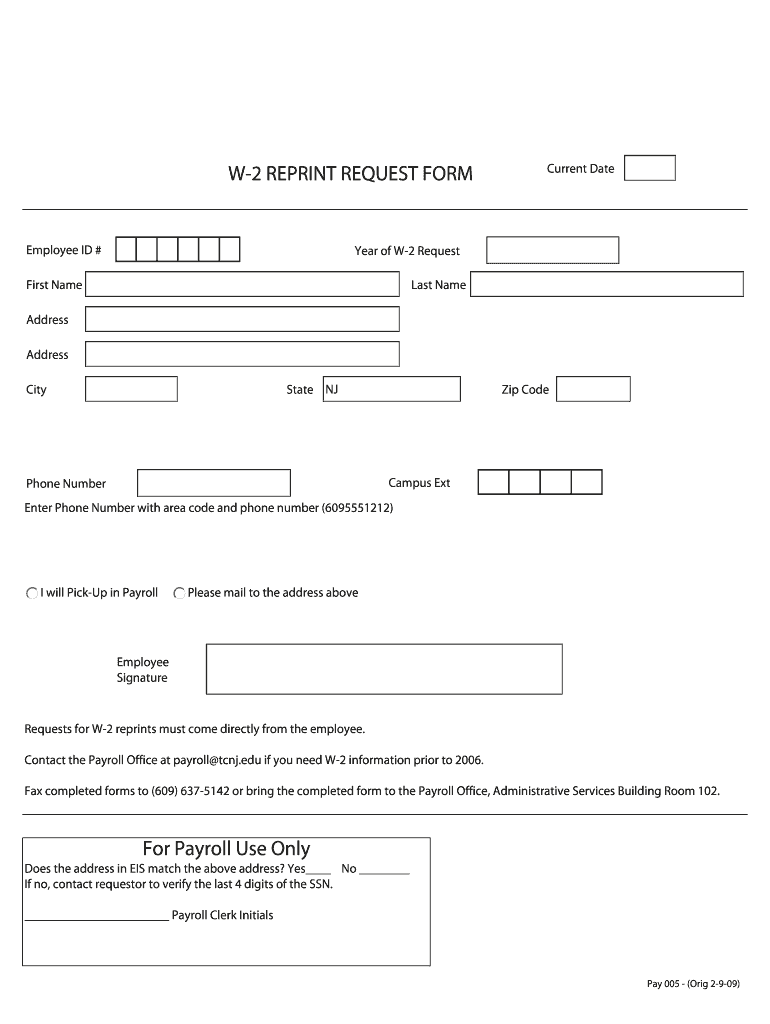

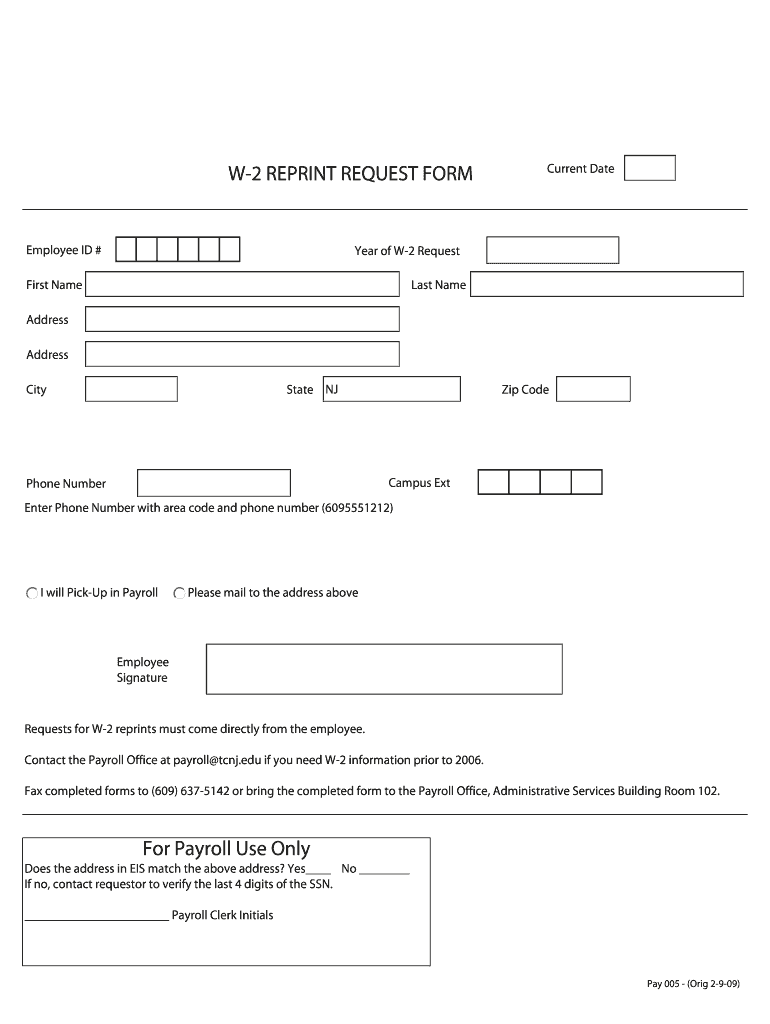

W2 REPRINT REQUEST FORM Employee ID # Current Date Year of W2 Request First Name Last Name Address State NJ City Zip Code Campus Ext Phone Number Enter Phone Number with area code and phone number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign year of w2 request

Edit your year of w2 request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year of w2 request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit year of w2 request online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit year of w2 request. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year of w2 request

How to fill out a year of W2 request:

01

Start by obtaining the necessary form: You can usually request a year of W2 form from your employer or by downloading it from the official website of the tax authority in your country.

02

Provide your personal information: Fill out the required fields on the form, including your full name, social security number or tax identification number, and contact information. Make sure to double-check the accuracy of your personal details.

03

Select the year of the W2: Indicate the specific tax year for which you are requesting the W2 form. This is usually the year in which you earned the income that you need to report for tax purposes.

04

Follow the instructions: Read the instructions provided on the form carefully and follow them step by step. The form may require you to provide additional information or attach supporting documents, depending on your situation.

05

Submit the request: Once you have completed the form, ensure that it is signed and dated if required. Submit the form along with any necessary supporting documents to the relevant tax authority or to your employer, depending on their specific instructions.

Who needs a year of W2 request:

01

Individuals filing taxes: If you are required to file an income tax return, you will likely need a year of W2 form to accurately report your income. This applies to both employees and self-employed individuals.

02

Financial institutions: Banks and other financial institutions may request a year of W2 form when considering loan applications or conducting credit evaluations. This helps them verify your income and assess your financial situation.

03

Government agencies: Various government agencies may also require a year of W2 form for purposes such as determining eligibility for certain social welfare programs or benefits.

It is important to note that the specific requirements for requesting a year of W2 form may vary depending on the country and its tax regulations. It is advisable to consult the relevant tax authority or seek guidance from a tax professional to ensure compliance with applicable regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send year of w2 request to be eSigned by others?

To distribute your year of w2 request, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find year of w2 request?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the year of w2 request. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the year of w2 request in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your year of w2 request and you'll be done in minutes.

What is year of w2 request?

The year of w2 request refers to the specific tax year for which an individual is requesting their W-2 form.

Who is required to file year of w2 request?

Any individual who received income and had taxes withheld from their pay during the tax year is required to file a year of w2 request to obtain their W-2 form.

How to fill out year of w2 request?

To fill out a year of w2 request, individuals typically need to provide their personal information, including their name, address, social security number, and the specific tax year for which they are requesting their W-2 form.

What is the purpose of year of w2 request?

The purpose of the year of w2 request is to obtain the necessary documentation for filing taxes, including reporting income and claiming tax deductions.

What information must be reported on year of w2 request?

The year of w2 request must include specific information about the individual's income for the tax year, including wages, tips, and other compensation received.

Fill out your year of w2 request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year Of w2 Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.