Get the free Retirement Budget Worksheet - tiaa

Show details

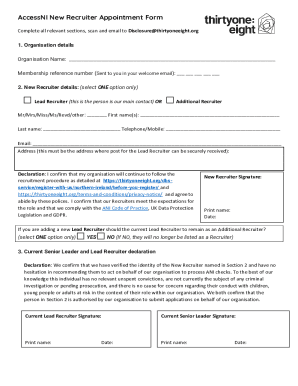

Retirement Budget Worksheet

Many retirees find that their essential expenses in retirement take up a lot of their income. Creating a budget to help get a

general idea of what you're spending is a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement budget worksheet

Edit your retirement budget worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement budget worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement budget worksheet online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement budget worksheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement budget worksheet

How to fill out a retirement budget worksheet:

01

Gather financial information: Start by collecting all relevant financial information, such as your income sources, expenses, assets, and liabilities. This may include details of your retirement accounts, pensions, Social Security benefits, investment accounts, mortgages, loans, and monthly bills.

02

Estimate retirement income: Determine your expected income during retirement. This may include sources like pensions, annuities, Social Security, part-time work, or rental income. Estimate the amount you anticipate receiving from each source on a monthly or annual basis.

03

Calculate retirement expenses: List all your anticipated expenses in retirement, including housing costs, groceries, healthcare, transportation, travel, entertainment, and any other regular or anticipated expenditures. Be sure to include both essential and discretionary expenses.

04

Track fixed and variable costs: Differentiate between fixed expenses (e.g., mortgage payments, insurance premiums) and variable expenses (e.g., utility bills, vacations). Fixed expenses generally remain the same each month, while variable expenses may fluctuate.

05

Account for inflation: Consider the impact of inflation on your retirement expenses. Adjust your estimated expenses to account for potential increases in the cost of living over time.

06

Calculate the retirement savings gap: After determining your estimated retirement income and expenses, calculate the difference between the two. This will help you identify whether you are saving enough for retirement or if adjustments are needed.

07

Adjust your budget: If your retirement savings gap is substantial, consider making adjustments to your budget. Look for areas where you can reduce expenses or increase savings to bridge the gap.

08

Regularly review and adjust: Your retirement budget worksheet should not be a static document. Review and update it periodically to account for changes in your financial situation, expenses, or income. Revisiting your retirement budget regularly will help ensure you stay on track toward your retirement goals.

Who needs a retirement budget worksheet?

01

Individuals approaching retirement: Pre-retirees can benefit from using a retirement budget worksheet to assess their financial readiness for retirement. It helps them understand their income sources, expenses, and potential savings gaps, allowing them to make adjustments as necessary.

02

Current retirees: Even if you're already in retirement, a budget worksheet can be valuable for managing your finances and ensuring you have enough income to sustain your desired lifestyle throughout retirement.

03

Financial planners: Financial professionals may utilize retirement budget worksheets to help their clients plan for retirement, evaluate their financial situation, and provide appropriate advice and guidance.

04

Anyone seeking financial security in retirement: Whether you're far from retirement or already in the midst of it, using a retirement budget worksheet can help you create a clear financial plan and take proactive steps towards achieving a secure and comfortable retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete retirement budget worksheet online?

Filling out and eSigning retirement budget worksheet is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the retirement budget worksheet in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your retirement budget worksheet right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit retirement budget worksheet on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing retirement budget worksheet.

What is retirement budget worksheet?

The retirement budget worksheet is a document that helps individuals plan and track their expenses during retirement.

Who is required to file retirement budget worksheet?

Individuals who are approaching retirement or are already retired may benefit from using a retirement budget worksheet to better manage their finances.

How to fill out retirement budget worksheet?

To fill out a retirement budget worksheet, individuals can start by listing their sources of income, expenses, and savings. They can then calculate their total monthly or yearly budget and adjust as needed.

What is the purpose of retirement budget worksheet?

The purpose of a retirement budget worksheet is to help individuals understand and plan for their financial needs during retirement, ensuring they have enough savings and income to cover expenses.

What information must be reported on retirement budget worksheet?

Information such as monthly income, expenses, savings, investments, and any other sources of funds should be reported on a retirement budget worksheet.

Fill out your retirement budget worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Budget Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.