Get the free Useful Tax Tips - Kim Borysewicz Bookkeeping amp Tax Service

Show details

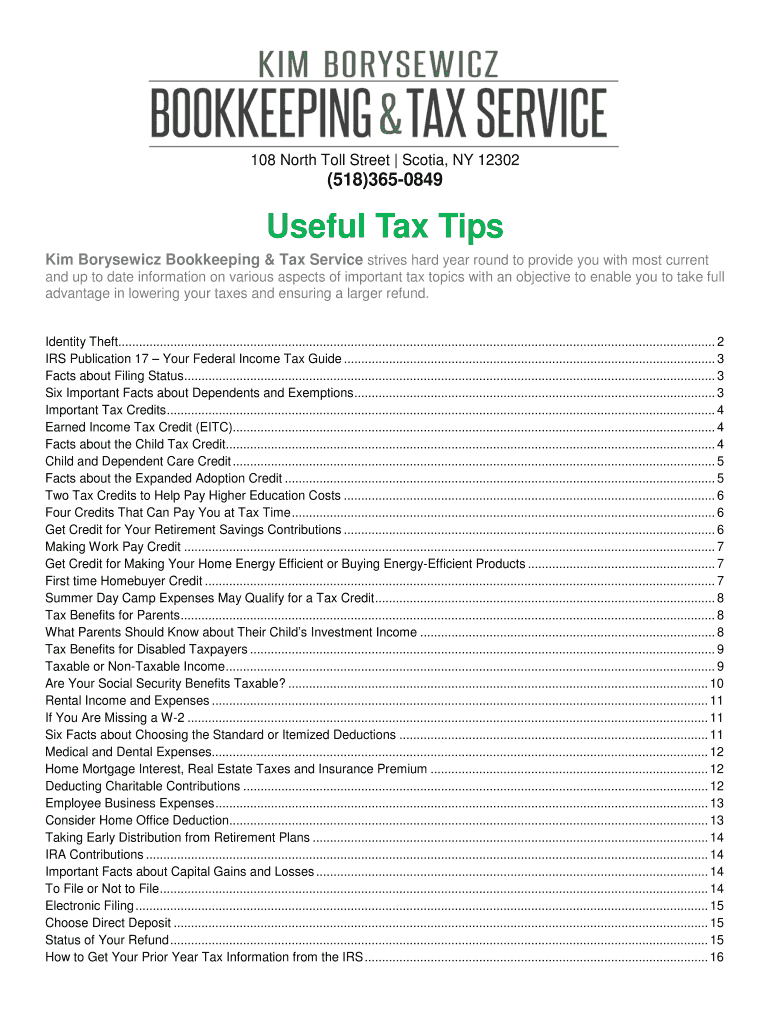

108 North Toll Street Scotia, NY 12302 (518)3650849 Useful Tax Tips Kim Borysewicz Bookkeeping & Tax Service strives hard year round to provide you with most current and up to date information on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign useful tax tips

Edit your useful tax tips form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your useful tax tips form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit useful tax tips online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit useful tax tips. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out useful tax tips

01

Start by organizing all relevant financial documents such as W-2s, 1099s, and other income statements.

02

Determine your filing status (single, married filing jointly, married filing separately, head of household, etc.) as this will affect your tax brackets and deductions.

03

Use tax software or hire a tax professional to ensure accurate filing, especially if you have complex financial situations.

04

Research and understand the different tax credits and deductions you may qualify for, such as education expenses, home mortgage interest, or medical expenses.

05

Keep track of any charitable contributions you made throughout the year, as these can potentially be deducted.

06

Be aware of important tax deadlines, and make sure to file your taxes or request an extension if needed.

07

Consider consulting with a tax professional or financial advisor to devise a tax planning strategy that can help minimize your tax liability and maximize your savings.

08

Keep in mind that tax laws and regulations may change each year, so staying updated on the latest tax-related information is crucial for accurate filing.

Who needs useful tax tips?

01

Individuals who are self-employed or have multiple sources of income may benefit from useful tax tips as their tax filing may be more complex.

02

Homeowners, especially those with mortgage interest or property tax payments, should be aware of potential deductions and credits related to their home ownership.

03

Families with children or dependents may benefit from understanding tax credits and deductions available for child-related expenses.

04

Small business owners or entrepreneurs who have their own business should familiarize themselves with tax obligations and potential deductions that apply to their industry.

05

Retirees or individuals approaching retirement age should stay informed about tax strategies that can help them make the most of their retirement savings and investments.

06

Students or individuals with education-related expenses may need useful tax tips to navigate the various credits and deductions available to them.

Overall, anyone who wants to ensure accurate and efficient tax filing, maximize potential tax savings, and stay compliant with tax laws would benefit from useful tax tips.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find useful tax tips?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the useful tax tips in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete useful tax tips online?

Filling out and eSigning useful tax tips is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in useful tax tips without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your useful tax tips, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is useful tax tips?

Useful tax tips are advice or recommendations on how to manage taxes effectively, save money, and minimize tax liabilities.

Who is required to file useful tax tips?

Any individual or business entity that earns income is required to file tax returns and can benefit from useful tax tips.

How to fill out useful tax tips?

To fill out useful tax tips, you need to gather all relevant financial information, report income and deductions accurately, and comply with tax laws and regulations.

What is the purpose of useful tax tips?

The purpose of useful tax tips is to help taxpayers navigate the complexities of the tax system, maximize tax savings, and avoid costly mistakes.

What information must be reported on useful tax tips?

Useful tax tips may include information on deductions, credits, filing statuses, income sources, and tax planning strategies.

Fill out your useful tax tips online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Useful Tax Tips is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.