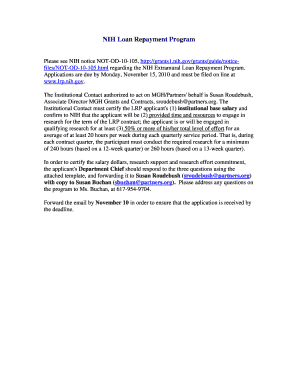

Get the free F-65 (GA-1A) - dca state ga

Show details

This document is a report used by the State of Georgia's local governments to submit their financial reporting, including details on revenues, expenditures, and debts for counties and municipalities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign f-65 ga-1a - dca

Edit your f-65 ga-1a - dca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f-65 ga-1a - dca form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit f-65 ga-1a - dca online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit f-65 ga-1a - dca. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out f-65 ga-1a - dca

How to fill out F-65 (GA-1A)

01

Obtain the F-65 (GA-1A) form from the relevant authority or download it from their website.

02

Fill out your personal information in the designated fields, including your name, address, and contact details.

03

Provide any relevant identification numbers, such as Social Security Number or tax identification number, as requested.

04

Complete the sections detailing your employment history and income sources.

05

Include any necessary documentation to support your claims, such as proof of income or employment records.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form to the designated agency either online or through mail, as instructed.

Who needs F-65 (GA-1A)?

01

Individuals applying for certain benefits or services that require financial verification.

02

Employees seeking to report income for tax or social security purposes.

03

Persons needing to provide documentation of income for loans, housing assistance, or other financial evaluations.

Fill

form

: Try Risk Free

People Also Ask about

What is the General Assembly resolution?

A United Nations General Assembly resolution is a decision or declaration voted on by all member states of the United Nations in the General Assembly. General Assembly resolutions usually require a simple majority (more yes votes than no votes) to pass.

What was the resolution 59 of the General Assembly adopted in 1946?

At its very first session in 1946, the United Nations General Assembly adopted the Resolution A/RES/59, which refers to freedom of information in its widest sense, stating: “Freedom of information is a fundamental human right and is the touchstone of all the freedoms to which the United Nations is consecrated.”

What does General Assembly 1 do?

The Assembly makes recommendations to States on international issues within its competence. It has also taken actions across all pillars of the United Nations, including with regard to political, economic, humanitarian, social and legal matters.

What was the first resolution of the United Nations?

Resolution 1 (I): The very first General Assembly resolution, entitled “Establishment of a Commission to Deal with the Problems Raised by the Discovery of Atomic Energy”, was adopted on recommendation by the First Committee on 24 January 1946, in London.

What is the United Nations resolution 1?

The UN General Assembly's first resolution, passed 75 years ago on January 24, 1946, looked to “deal with the problems raised by the discovery of atomic energy.” Specifically, Resolution 1(I) created the UN Atomic Energy Commission (UNAEC) and charged it with making proposals for “the elimination from national

What was the first resolution of the General Assembly?

Resolution 1 (I): The very first General Assembly resolution, entitled “Establishment of a Commission to Deal with the Problems Raised by the Discovery of Atomic Energy”, was adopted on recommendation by the First Committee on 24 January 1946, in London.

What was the General Assembly resolution 1?

The very first resolution adopted by the GA in 1946 identified the goal of eliminating atomic weapons and all other major weapons adaptable to mass destruction from national armaments. General Assembly of the United Nations.

What is the vote resolution of the United Nations?

A United Nations General Assembly resolution is a decision or declaration voted on by all member states of the United Nations in the General Assembly. General Assembly resolutions usually require a simple majority (more yes votes than no votes) to pass.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is F-65 (GA-1A)?

F-65 (GA-1A) is a tax form used to report certain financial information to the state, typically related to income and expenses for businesses.

Who is required to file F-65 (GA-1A)?

Businesses operating in the jurisdiction that meet specific revenue criteria or those engaging in certain types of transactions are generally required to file F-65 (GA-1A).

How to fill out F-65 (GA-1A)?

To fill out F-65 (GA-1A), gather the necessary financial records, complete the required sections accurately, and ensure all calculations are correct before submitting the form.

What is the purpose of F-65 (GA-1A)?

The purpose of F-65 (GA-1A) is to ensure compliance with state tax regulations by providing a comprehensive overview of a business's financial activities.

What information must be reported on F-65 (GA-1A)?

F-65 (GA-1A) typically requires reporting of business income, expenses, deductions, and other relevant financial data, as well as identifying information about the business entity.

Fill out your f-65 ga-1a - dca online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

F-65 Ga-1a - Dca is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.