Get the free Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling ...

Show details

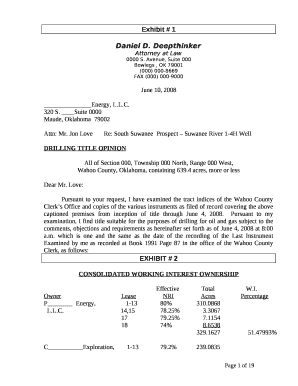

This document outlines the request for proposals from firms to act as Senior Managing Underwriters and Co-Managers for Single Family housing bonds issued by the Georgia Housing and Finance Authority.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for proposals for

Edit your request for proposals for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for proposals for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for proposals for online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit request for proposals for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for proposals for

How to fill out Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues

01

Begin by gathering all necessary information regarding the Single Family Housing Bond Issues.

02

Clearly define the scope of work and objectives for the Senior Managing Underwriter(s) and Co-Manager/Selling Group Pool Members.

03

Prepare a detailed timeline for the proposal process, including deadlines for submission and review.

04

Draft a comprehensive RFP document that includes background information, project requirements, and evaluation criteria.

05

Specify the qualifications and experience required for the underwriters and co-managers.

06

Outline the proposal submission format and any necessary supporting documents needed from the applicants.

07

Include any mandatory disclosures or compliance requirements that respondents must meet.

08

Distribute the RFP to a targeted list of potential respondents and ensure it is accessible.

09

Allow time for questions and clarifications from potential respondents before the submission deadline.

10

Review all submitted proposals against the established criteria and shortlist candidates for interviews or further discussions.

Who needs Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

01

Housing finance agencies looking to issue bonds to promote homeownership.

02

Local governments seeking funding for affordable housing projects.

03

Real estate developers in need of financing through bonded programs.

04

Financial institutions interested in investing in housing bonds.

05

Consultants or firms specializing in municipal finance.

Fill

form

: Try Risk Free

People Also Ask about

What is the underwriting agreement of a bond?

A typical underwriting agreement specifies: (1) the maximum aggregate amount of securities the issuer is offering for sale, (2) the underwriters' purchase price for these securities (3) the payment and delivery procedures for the securities and (4) the procedures for the offering and sale of the securities to the

What is the difference between a municipal advisor and an underwriter?

A municipal advisor provides advice to school and community college districts on the issuance of financings and an underwriter sells the financings to investors. A municipal advisor is required to act as a fiduciary while an underwriter is not.

What is the underwriting of municipal bonds?

How does municipal bond underwriting work? A municipal bond underwriter is a firm, or group of firms, that purchases bonds directly from a bond issuer and resells them to investors.

How does municipal underwriting work?

Municipal bonds typically are brought to market through an underwriting process. As part of this process, one or more municipal securities dealers – also known as underwriters – purchase newly issued securities from the issuer and sell the securities to investors.

What is the role of the underwriter in the bond issuance?

Definition: The underwriter is responsible for bringing municipal bonds to market. Also known as municipal securities dealers, underwriters set the yields of new bond issues and then find investors that want to purchase the bonds.

What is the underwriting spread of a municipal bond?

The underwriting spread is the difference between the amount that an underwriter pays an issuer for its securities and the total proceeds gained from the securities during a public offering.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

The Request for Proposals (RFP) for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues is a formal solicitation process where issuers seek proposals from underwriting firms to manage the sale of bonds that finance single-family housing projects. This process allows the issuer to evaluate potential underwriters based on their qualifications, experience, and proposed fees.

Who is required to file Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

Issuers of single-family housing bonds, typically state or local housing finance agencies, are required to file Requests for Proposals. They use this process to select qualified underwriting firms to ensure compliance with public finance regulations and to achieve favorable financing terms.

How to fill out Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

To fill out the Request for Proposals, issuers should provide detailed information including project descriptions, financing objectives, selection criteria, timelines, and submission guidelines. Clear instructions on how firms should structure their proposals and what specific qualifications or experience they should highlight should also be included.

What is the purpose of Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

The purpose of the Request for Proposals is to identify and select the most qualified underwriting firms to effectively manage the sale of housing bonds. This process ensures transparency, promotes competition among firms, and helps secure the best financing terms for the issuer's housing projects.

What information must be reported on Request for Proposals for Senior Managing Underwriter(s) and the Co-Manager/Selling Group Pool Members for Single Family Housing Bond Issues?

The information that must be reported includes the issuer's objectives, the scope of services required, firm qualifications, experience with similar projects, team members involved, proposed fees or compensation structure, and a timeline for the transaction process.

Fill out your request for proposals for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Proposals For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.