Get the free MARYLAND FORM EL101 E-file DECLARATION FOR ELECTRONIC FILING 2015

Show details

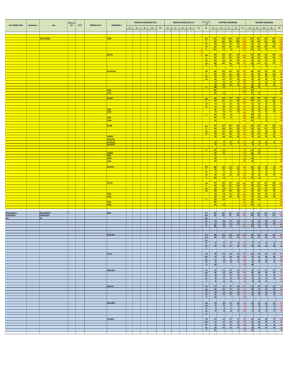

MARYLAND FORM EL101 2015 file DECLARATION FOR ELECTRONIC FILING Print using blue or black ink only. Keep this form for your records. Do not send this form to the State of Maryland unless requested

We are not affiliated with any brand or entity on this form

Instructions and Help about maryland form el101 e-file

How to edit maryland form el101 e-file

How to fill out maryland form el101 e-file

Instructions and Help about maryland form el101 e-file

How to edit maryland form el101 e-file

To edit the Maryland Form EL101 e-file, you can utilize various online tools designed for tax forms. Using pdfFiller, you can upload the form, make changes as necessary, and save the updated version easily. This process simplifies the task of correcting any errors before submission, ensuring compliance with Maryland tax regulations.

How to fill out maryland form el101 e-file

Filling out the Maryland Form EL101 e-file involves a systematic approach. Start by entering the taxpayer's identification information accurately in the designated fields. Next, complete the sections that specify income, deductions, and credits applicable to the tax year. It is crucial to review all entries for accuracy before submitting the form electronically via the state’s e-filing system or through authorized e-file providers.

Latest updates to maryland form el101 e-file

Latest updates to maryland form el101 e-file

The Maryland Form EL101 e-file undergoes periodic updates reflecting changes in tax laws and regulations. The most recent updates may include modifications to income thresholds, deduction limits, or compliance requirements. Always refer to official Maryland state resources for the latest information on the EL101 e-file form.

All You Need to Know About maryland form el101 e-file

What is maryland form el101 e-file?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About maryland form el101 e-file

What is maryland form el101 e-file?

The Maryland Form EL101 e-file is an electronic filing form used by residents to report their individual income tax to the state of Maryland. It serves as a means for taxpayers to submit their income details, calculate their tax liabilities, and claim any eligible deductions or credits.

What is the purpose of this form?

The purpose of the Maryland Form EL101 e-file is to facilitate the electronic submission of individual income tax returns. By using this form, taxpayers can efficiently communicate essential financial information to the Maryland State Comptroller, ensuring that their tax filings are accurate and executed in a timely manner.

Who needs the form?

Maryland residents who earn income and are required to file an income tax return must complete the Maryland Form EL101 e-file. This includes individuals with salaries, wages, business income, or other taxable sources of income that exceed the state's filing thresholds.

When am I exempt from filling out this form?

Certain individuals may be exempt from filing the Maryland Form EL101 e-file. For example, if a taxpayer's income is below the state’s minimum filing requirement or if they qualify for specific exemptions such as non-resident status, they may not need to complete this form. Always check the Maryland State Comptroller's guidelines for specific conditions related to exemptions.

Components of the form

The Maryland Form EL101 e-file comprises various sections that require detailed information. These sections typically include personal identification, income details, deductions, and tax credits. Each component must be filled out accurately to reflect the taxpayer's financial situation for the fiscal year.

Due date

The due date for submitting the Maryland Form EL101 e-file typically aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify with current state guidance for any specific changes or extensions applicable to the filing deadline.

What are the penalties for not issuing the form?

Failure to file the Maryland Form EL101 e-file by the due date can result in penalties, which may include late fees and interest on unpaid taxes. The penalties structure may vary based on the length of the delay in filing and the amount owed. It's essential for taxpayers to file on time to avoid these additional costs.

What information do you need when you file the form?

When filing the Maryland Form EL101 e-file, taxpayers need specific information such as their Social Security number, income details, and any applicable deductions or credits. Documentation like W-2 forms, 1099 forms, and previous year's tax returns may be necessary to support the entries made on the form.

Is the form accompanied by other forms?

The Maryland Form EL101 e-file may require the inclusion of accompanying forms depending on the taxpayer’s financial situation. For instance, additional schedules may be necessary for specific credits or deductions claimed. Taxpayers should review the instructions for the EL101 to determine if supplementary forms are needed.

Where do I send the form?

The Maryland Form EL101 e-file is submitted electronically through the state’s e-filing portal or through authorized e-file providers. Make sure to follow the instructions provided on the official Maryland State Comptroller website to ensure your form is submitted correctly and received on time.

See what our users say