Get the free Mileage 2011 - Effective 07-01-11xls - abcadultschool

Show details

ABC UNIFIED SCHOOL DISTRICT 16700 Norwalk Blvd Burritos, California 90703 VENDOR # MONTHLY MILEAGE EXPENSE CLAIM PLEASE PRINT OR TYPE LEGAL NAME OF EMPLOYEE (LAST, FIRST, MI) EMPLOYEE IDENTIFICATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mileage 2011 - effective

Edit your mileage 2011 - effective form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mileage 2011 - effective form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mileage 2011 - effective online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mileage 2011 - effective. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

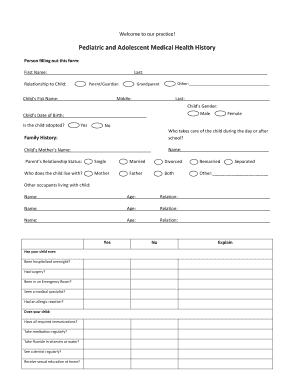

How to fill out mileage 2011 - effective

How to fill out mileage 2011 - effective:

01

Make sure you have the necessary documents: Before filling out the mileage 2011 form, gather all relevant documents such as your vehicle registration, maintenance records, and any other supporting documentation.

02

Start with basic information: Begin by entering your personal identification details, such as your name, address, and contact information, as required on the form. This ensures that your mileage records are properly attributed to you.

03

Enter vehicle information: Provide accurate details about your vehicle, including the make, model, year, and vehicle identification number (VIN). This information helps establish the vehicle for which you are reporting mileage.

04

Record the beginning mileage: Note down the starting mileage for the year in question. This is usually the mileage reading of your vehicle at the beginning of the calendar year.

05

Document business mileage: If you are using the mileage 2011 form to report business-related travel, accurately record each business trip's details. Include the date, purpose of the trip, starting and ending locations, and the total mileage driven. It is vital to maintain a mileage logbook to support these entries in case of an audit.

06

Track personal mileage: Similarly, if you need to account for personal trips, record the necessary details such as the date, purpose, starting and ending locations, and total mileage driven. Although personal mileage is typically not tax-deductible, it's important to have an accurate record for complete mileage tracking.

07

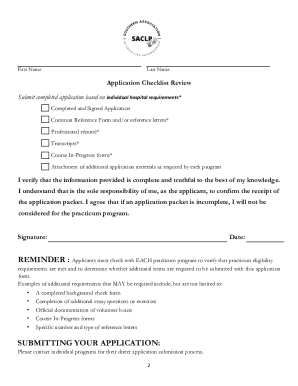

Submitting the form and supporting documentation: Once you have filled out all the required information, review the form for accuracy and completeness. Attach any additional supporting documentation as required, such as gas receipts or parking tickets related to the reported mileage.

Who needs mileage 2011 - effective?

01

Self-employed individuals: Freelancers, consultants, or independent contractors who use their personal vehicles for work-related purposes often require the mileage 2011 form to accurately track and report their business mileage for tax deductions.

02

Small business owners: If you own a small business and use vehicles in your operations, the mileage 2011 form helps to keep track of the total mileage driven for business and personal purposes. This information is crucial for accurate expense reporting and tax deductions.

03

Employees with reimbursed mileage: Some employers reimburse their employees for mileage incurred during business travel. Using the mileage 2011 form allows employees to accurately document and report their business mileage, ensuring they receive the appropriate reimbursement.

04

Individuals for personal records: Even if you are not self-employed or eligible for tax deductions, keeping track of your mileage using the mileage 2011 form can be useful for personal records, budgeting, or monitoring your vehicle's usage over time.

Remember, accurate mileage tracking is essential for various purposes, including tax obligations, expense reimbursements, and personal records. By following the prescribed format and diligently recording your mileage, you can effectively utilize the mileage 2011 form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mileage 2011 - effective in Chrome?

Install the pdfFiller Google Chrome Extension to edit mileage 2011 - effective and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit mileage 2011 - effective straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing mileage 2011 - effective.

How do I edit mileage 2011 - effective on an Android device?

You can make any changes to PDF files, like mileage 2011 - effective, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mileage - effective 07-01-11xls?

Mileage - effective 07-01-11xls refers to the rate at which mileage expenses are calculated and reimbursed.

Who is required to file mileage - effective 07-01-11xls?

Employees who use their personal vehicles for work purposes and are eligible for mileage reimbursement are required to file mileage - effective 07-01-11xls.

How to fill out mileage - effective 07-01-11xls?

To fill out mileage - effective 07-01-11xls, employees need to record the starting and ending odometer readings for each trip, along with the purpose of the trip.

What is the purpose of mileage - effective 07-01-11xls?

The purpose of mileage - effective 07-01-11xls is to accurately track and reimburse employees for the business use of their personal vehicles.

What information must be reported on mileage - effective 07-01-11xls?

The information that must be reported on mileage - effective 07-01-11xls includes the date of the trip, starting and ending odometer readings, total miles traveled, and the purpose of the trip.

Fill out your mileage 2011 - effective online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mileage 2011 - Effective is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.