Get the free A minimum donation of 2000 is suggested St Aloysius

Show details

Each gift is deductible for tax purposes. Each gift is acknowledged with an appropriate card sent according to your wishes. The amount of your gift will not be disclosed. Date Enclosed is my gift

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a minimum donation of

Edit your a minimum donation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a minimum donation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

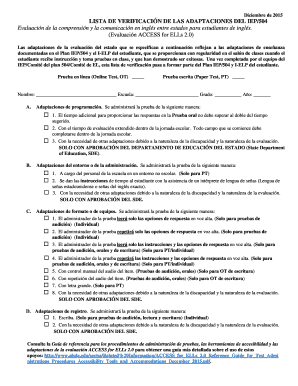

How to edit a minimum donation of online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a minimum donation of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a minimum donation of

How to fill out a minimum donation of?

01

Determine the organization or cause you would like to make a donation to. Research and choose a reputable organization that aligns with your values and beliefs.

02

Decide on the amount of your minimum donation. Consider your financial situation and how much you are comfortable donating. Remember, every donation, no matter the size, can make a difference.

03

Visit the organization's website or contact them directly to find out the different ways you can make a donation. They may provide options such as online donations, bank transfers, mailing a check, or donating in person.

04

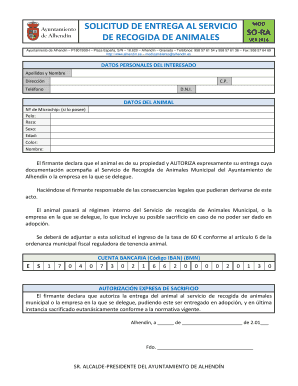

If you choose to donate online, navigate to the organization's donation page on their website. Fill out the required fields, including personal information such as your name, email address, and phone number.

05

Enter the donation amount, making sure it matches your desired minimum donation. Some organizations may have pre-set amounts, while others allow you to enter a custom donation amount.

06

Select the payment method that works best for you. Common options include credit/debit cards, PayPal, or electronic fund transfers. Follow the instructions provided to complete the payment process securely.

07

If you prefer to donate by check or bank transfer, follow the organization's guidelines for these methods. They may require you to fill out a donation form or include certain information with your donation to ensure it is properly processed.

Who needs a minimum donation?

01

Non-profit organizations: Non-profit organizations rely on donations to fund their operations and support their important causes. A minimum donation can help these organizations by providing a steady stream of funding, even if it is a small amount.

02

Individuals with limited financial resources: Not everyone can afford to make significant donations, but a minimum donation allows individuals with limited financial resources to still contribute and support causes that they believe in. It allows them to be part of the difference-making process, no matter how small their contribution may seem.

03

Fundraising events: In some cases, fundraising events may set a minimum donation requirement to participate. This ensures that participants are committed to raising a certain amount of funds for the cause or event. The minimum donation requirement helps in planning and executing the event successfully by ensuring a minimum level of financial support.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is a minimum donation of?

A minimum donation is a specified amount of money that must be donated to a charity or organization.

Who is required to file a minimum donation of?

Individuals or businesses who wish to claim a tax deduction for their donation are required to file a minimum donation.

How to fill out a minimum donation of?

To fill out a minimum donation, you need to provide the details of the donation, including the amount donated, the recipient organization, and any relevant tax information.

What is the purpose of a minimum donation of?

The purpose of a minimum donation is to encourage charitable giving and provide a tax benefit to individuals and businesses who donate to qualified organizations.

What information must be reported on a minimum donation of?

The information that must be reported on a minimum donation includes the amount donated, the name and address of the recipient organization, and any supporting documentation for tax purposes.

How do I make changes in a minimum donation of?

The editing procedure is simple with pdfFiller. Open your a minimum donation of in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the a minimum donation of in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit a minimum donation of straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit a minimum donation of.

Fill out your a minimum donation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Minimum Donation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.