Get the free S Corporation Apportionment Credit

Show details

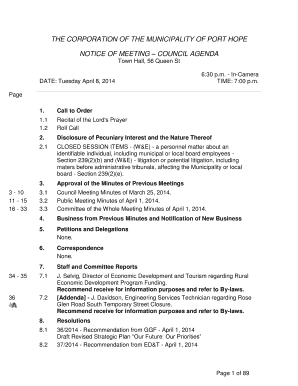

Reset Form Print Form Iowa Department of Revenue www.iowa.gov/tax 2011 IA 134 S Corporation Apportionment Credit Name(s) as shown on IA 1040 SSN Name of S Corporation Spouses SSN if filing status

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign s corporation apportionment credit

Edit your s corporation apportionment credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your s corporation apportionment credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit s corporation apportionment credit online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit s corporation apportionment credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out s corporation apportionment credit

How to Fill out S Corporation Apportionment Credit:

01

Gather the necessary information: Before filling out the apportionment credit form, make sure you have all the required information at hand. This may include the S corporation's federal income tax return, state income tax returns for all relevant states, and any supporting documents or records.

02

Determine eligible states: The apportionment credit is typically applicable when an S corporation operates in multiple states. Identify the states in which the S corporation conducted business during the tax year and determine if these states allow for apportionment credits.

03

Calculate the apportionment: Each state may have its own rules and formulas for calculating the apportionment of income. Generally, the apportionment is based on factors such as sales, payroll, and property within each state. Consult the specific guidelines provided by each state to accurately calculate the apportionment percentage.

04

Allocate income and deductions: Once the apportionment percentage is determined for each state, allocate the S corporation's income and deductions accordingly. This ensures that the taxable income is appropriately assigned to each state where business was conducted.

05

Complete the apportionment credit form: Obtain the S corporation apportionment credit form specific to each state where the credit is applicable. Fill out the form accurately and provide all the required information, including the calculated apportionment percentages, applicable income and deductions, and any additional supporting documentation.

06

Review and double-check: Before submitting the apportionment credit form, thoroughly review all the information provided. Check for any errors or omissions that may lead to unnecessary delays or potential penalties. It's always a good idea to have a second set of eyes review the form as well to ensure its accuracy.

07

Submit the form: Once you are confident that the apportionment credit form is correctly filled out, submit it to the appropriate state tax authorities. Be sure to adhere to any specific filing deadlines, as late submissions may result in penalties or loss of the apportionment credit.

Who needs S Corporation Apportionment Credit?

01

Multistate S corporations: The S corporation apportionment credit is primarily required by S corporations that conduct business operations in multiple states. It allows for the proper allocation of income and deductions among the states where business is conducted, ensuring that each state's tax liabilities are appropriately accounted for.

02

S corporations with state tax obligations: If an S corporation operates in states that impose income taxes, they may be subject to filing requirements and tax obligations in each of those states. The apportionment credit helps S corporations mitigate the potential double taxation that may arise from income being taxed at both the federal and state levels.

03

S corporations seeking tax optimization: By properly filling out the S corporation apportionment credit and accurately allocating income and deductions among various states, S corporations can potentially minimize their overall tax liability. This enables them to optimize their tax planning strategies and maximize their after-tax profits.

Note: The specific eligibility criteria for the S corporation apportionment credit may vary by state. It is essential to consult the tax laws and regulations of each state where an S corporation conducts business to determine its applicability and any additional requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is s corporation apportionment credit?

S corporation apportionment credit is a tax credit given to S corporations that operate in multiple states and need to apportion their income accordingly.

Who is required to file s corporation apportionment credit?

S corporations that operate in multiple states and need to apportion their income accordingly are required to file s corporation apportionment credit.

How to fill out s corporation apportionment credit?

To fill out s corporation apportionment credit, the S corporation must report their total income and expenses from each state they operate in and calculate the apportionment percentage for each state.

What is the purpose of s corporation apportionment credit?

The purpose of s corporation apportionment credit is to ensure that S corporations are taxed fairly based on the amount of income they generate in each state they operate in.

What information must be reported on s corporation apportionment credit?

S corporations must report their total income, expenses, and apportionment percentages for each state they operate in on the s corporation apportionment credit form.

How do I fill out the s corporation apportionment credit form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign s corporation apportionment credit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit s corporation apportionment credit on an iOS device?

You certainly can. You can quickly edit, distribute, and sign s corporation apportionment credit on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out s corporation apportionment credit on an Android device?

Use the pdfFiller mobile app and complete your s corporation apportionment credit and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your s corporation apportionment credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

S Corporation Apportionment Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.