Get the free Deed trust transfer - TeamV - teamv

Show details

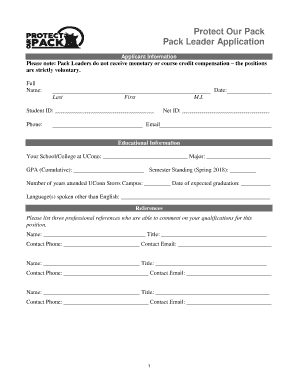

RECORDING REQUESTED BY: AND WHEN RECORDED MAIL THIS DEED AND, UNLESS OTHERWISE SHOWN BELOW, TO: Order No.: Escrow No.: A.P.N.: SPACE ABOVE THIS LINE IS FOR RECORDER IS USE TRUST TRANSFER DEED GRANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed trust transfer

Edit your deed trust transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed trust transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed trust transfer online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deed trust transfer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed trust transfer

How to fill out deed trust transfer:

01

Gather all necessary documents: Before filling out the deed trust transfer, make sure you have all the required documents handy. This may include the original deed, trust agreement, and any other relevant paperwork.

02

Identify the parties involved: Clearly identify the grantor (the person or entity transferring the property), the trustee (the party holding the property in trust), and the beneficiary (the person or entity benefiting from the trust).

03

Describe the property: Provide a detailed description of the property being transferred. This should include the address, legal description, and any other relevant details.

04

Specify the type of transfer: Determine whether the transfer is an inter vivos transfer (during the lifetime of the grantor) or a testamentary transfer (taking effect upon the grantor's death). This will depend on the specific circumstances and intentions of the parties involved.

05

Include any necessary provisions: Depending on the nature of the trust and the specific requirements, you may need to include additional provisions in the transfer document. These could include specific instructions, restrictions, or special conditions for the transfer.

06

Obtain signatures: Ensure that all parties involved in the transfer sign the deed trust transfer document. This is typically done in the presence of a notary public to ensure the document's legality and validity.

Who needs deed trust transfer:

01

Property owners seeking to transfer ownership: Deed trust transfers are commonly used when property owners want to transfer ownership of their property to a trust, allowing for the property to be managed and distributed according to specific instructions outlined in the trust agreement.

02

Individuals establishing a living trust: Those who wish to create a living trust often utilize a deed trust transfer to transfer their property into the trust. This can help avoid probate and ensure seamless property management during their lifetime.

03

Estate planners and attorneys: Professionals in the field of estate planning and law often work with clients who require deed trust transfers. They help navigate the legal requirements and ensure the transfer is executed accurately and in accordance with the applicable laws.

In conclusion, to fill out a deed trust transfer, it is important to gather the necessary documents, clearly identify the parties involved, describe the property, specify the type of transfer, include any relevant provisions, and obtain the required signatures. This process is commonly used by property owners, individuals establishing living trusts, and professionals in estate planning and law.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find deed trust transfer?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the deed trust transfer in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit deed trust transfer online?

The editing procedure is simple with pdfFiller. Open your deed trust transfer in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the deed trust transfer in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your deed trust transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Trust Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.