Get the free Tax preparer hiring guide - W Edward Newton Jr CPA

Show details

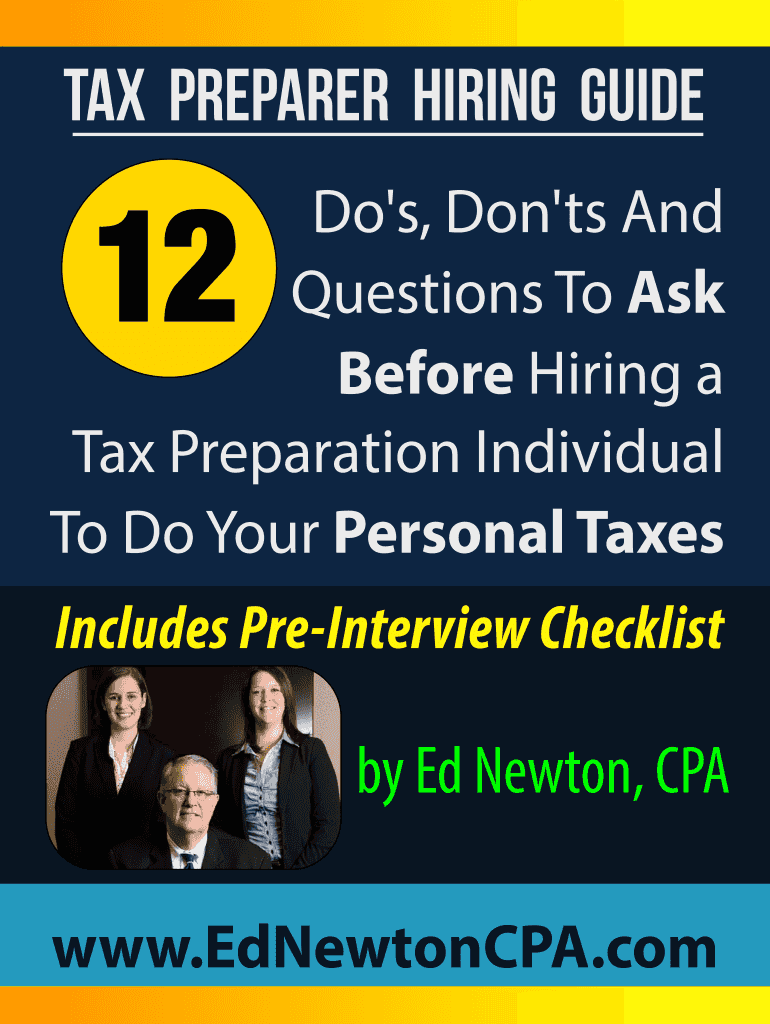

TAX PREPARER HIRING GUIDE Do's, Don'ttots And Questions To Ask Before Hiring a Tax Preparation Individual To Do Your Personal Taxes 12 Includes Interview Checklist by Ed Newton, CPA www.EdNewtonCPA.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax preparer hiring guide

Edit your tax preparer hiring guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparer hiring guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax preparer hiring guide online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax preparer hiring guide. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparer hiring guide

How to fill out tax preparer hiring guide:

01

Start by gathering all the necessary information about the tax preparer position you're hiring for. This includes understanding the job responsibilities, required qualifications, and desired skills.

02

Create a job description that clearly outlines the duties and responsibilities of the tax preparer role. Include details about the necessary qualifications, such as previous experience, knowledge of tax regulations, and familiarity with tax preparation software.

03

Determine the compensation and benefits package for the tax preparer position. Consider factors like industry standards, the complexity of the job, and the experience required.

04

Develop a recruitment strategy to attract qualified candidates. This may involve posting the job opening on relevant job boards, sharing it on social media platforms, or reaching out to professional organizations or networks.

05

Review resumes and applications received from interested candidates. Look for relevant experience, education, certifications, and skills that align with the requirements outlined in the job description.

06

Conduct interviews with shortlisted candidates to assess their suitability for the tax preparer position. Ask questions that evaluate their knowledge of tax regulations, problem-solving skills, attention to detail, and ability to work within deadlines.

07

Assess the candidates' references to gain insights into their past performance and work ethics. Contact previous supervisors or colleagues to confirm their work history and professionalism.

08

Once you have selected the candidate for the tax preparer position, extend them a job offer. Discuss the terms and conditions of employment, including salary, benefits, start date, and any additional details or requirements.

09

Before the new tax preparer starts working, ensure they have the necessary resources and access to tax software or tools required for their job. Provide them with any training or onboarding materials that may be necessary.

10

Regularly monitor the performance and progress of the tax preparer. Provide feedback, guidance, and opportunities for professional development, if necessary, to help them excel in their role.

Who needs tax preparer hiring guide?

01

Small businesses that rely on tax preparers to handle their taxation needs.

02

Accounting firms or professional service providers that offer tax preparation services to clients.

03

Individuals or organizations hiring seasonal tax preparers for specific tax periods, such as tax season or year-end filings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax preparer hiring guide for eSignature?

tax preparer hiring guide is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find tax preparer hiring guide?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific tax preparer hiring guide and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the tax preparer hiring guide in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax preparer hiring guide and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is tax preparer hiring guide?

Tax preparer hiring guide provides information on how to hire a tax preparer for your tax needs.

Who is required to file tax preparer hiring guide?

Any individual or business hiring a tax preparer is required to file the tax preparer hiring guide.

How to fill out tax preparer hiring guide?

The tax preparer hiring guide can be filled out by providing the necessary information about the tax preparer being hired.

What is the purpose of tax preparer hiring guide?

The purpose of the tax preparer hiring guide is to ensure that taxpayers are hiring qualified and reputable tax preparers to assist them with their tax needs.

What information must be reported on tax preparer hiring guide?

The tax preparer hiring guide must include the name, contact information, and qualifications of the tax preparer being hired.

Fill out your tax preparer hiring guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Preparer Hiring Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.