Get the free 2016-2017 Verification of Income for Student Non bTaxb Filers - ucdenver

Show details

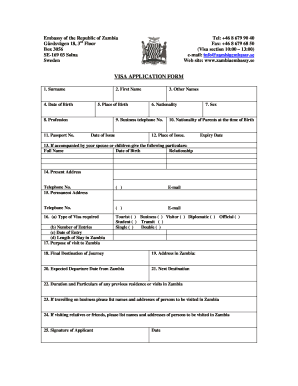

FA Student Non-filer Form / PEONS 2016-2017 Verification of Income for Student Non Tax Filers Student Name: Student ID: Your FAFSA was selected for a review process called verification. Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016-2017 verification of income

Edit your 2016-2017 verification of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016-2017 verification of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

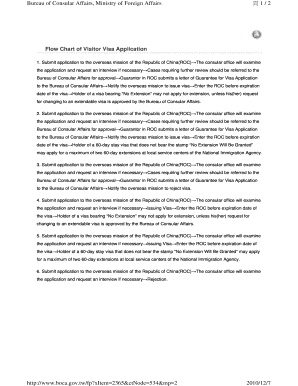

How to edit 2016-2017 verification of income online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2016-2017 verification of income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2016-2017 verification of income

Point by point, here's how to fill out the 2016-2017 verification of income form. Additionally, we will discuss who needs this verification.

How to fill out 2016-2017 verification of income:

01

Start by gathering all necessary documents: You will need your tax returns, W-2 forms, 1099 forms, and any other relevant income documents for the specified years (2016 and 2017).

02

Carefully read the form: Review the entire verification of income form to familiarize yourself with the requirements and information needed. Make sure you understand each section and what is being asked.

03

Personal information: Fill in your personal details, such as your name, address, social security number, and date of birth accurately. Double-check for any errors or typos.

04

Household size: Indicate the number of people living in your household, including yourself, your spouse, and any dependents.

05

Verification period: Clearly state the income verification period for which you are providing information (2016-2017 in this case).

06

Income sources: Provide detailed information about your various income sources during the specified period. This may include employment wages, self-employment income, dividends, interest, rental income, etc. Fill in each source separately and make sure to include accurate figures.

07

Calculating total income: Based on the provided income sources, calculate your total income for each year and clearly state it in the designated section.

08

Sign and date: Once you have completed the form, sign and date it according to the instructions provided. Make sure your signature is legible and matches the name you provided.

09

Submit the form: Depending on the institution or organization requesting the verification of income, you may need to submit the form online, by mail, or in person. Follow the specified submission instructions.

Who needs the 2016-2017 verification of income:

01

Students applying for financial aid: Students who are applying for financial aid, such as scholarships, grants, or loans, may be required to submit the verification of income to determine their eligibility and the amount of aid they are eligible for.

02

Employees seeking income-based benefits: Individuals who are applying for income-based benefits, such as housing assistance, healthcare subsidies, or government assistance programs, may need to provide the verification of income to demonstrate their financial need.

03

Mortgage or loan applicants: Individuals applying for mortgages, loans, or refinancing options may need to provide income verification to prove their ability to repay the loan and qualify for favorable terms.

04

Landlords or rental agencies: Landlords or rental agencies may require prospective tenants to provide income verification to assess their ability to afford the rent and ensure timely payments.

05

Other specific requirements: Various organizations, institutions, or government agencies may have specific requirements for income verification based on their particular programs.

Remember, it's essential to carefully read the instructions and provide accurate information when filling out the verification of income form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2016-2017 verification of income for eSignature?

To distribute your 2016-2017 verification of income, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit 2016-2017 verification of income on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 2016-2017 verification of income, you need to install and log in to the app.

Can I edit 2016-2017 verification of income on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 2016-2017 verification of income from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is verification of income for?

Verification of income is used to confirm an individual's income for purposes such as applying for loans, government assistance programs, or rental applications.

Who is required to file verification of income for?

Individuals who need to provide proof of their income or financial status may be required to file a verification of income.

How to fill out verification of income for?

To fill out a verification of income, individuals usually need to provide documents such as pay stubs, tax returns, or bank statements.

What is the purpose of verification of income for?

The purpose of verification of income is to ensure accuracy and honesty in reporting financial information.

What information must be reported on verification of income for?

Information such as income sources, amount of income, and employment status may need to be reported on a verification of income form.

Fill out your 2016-2017 verification of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016-2017 Verification Of Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.