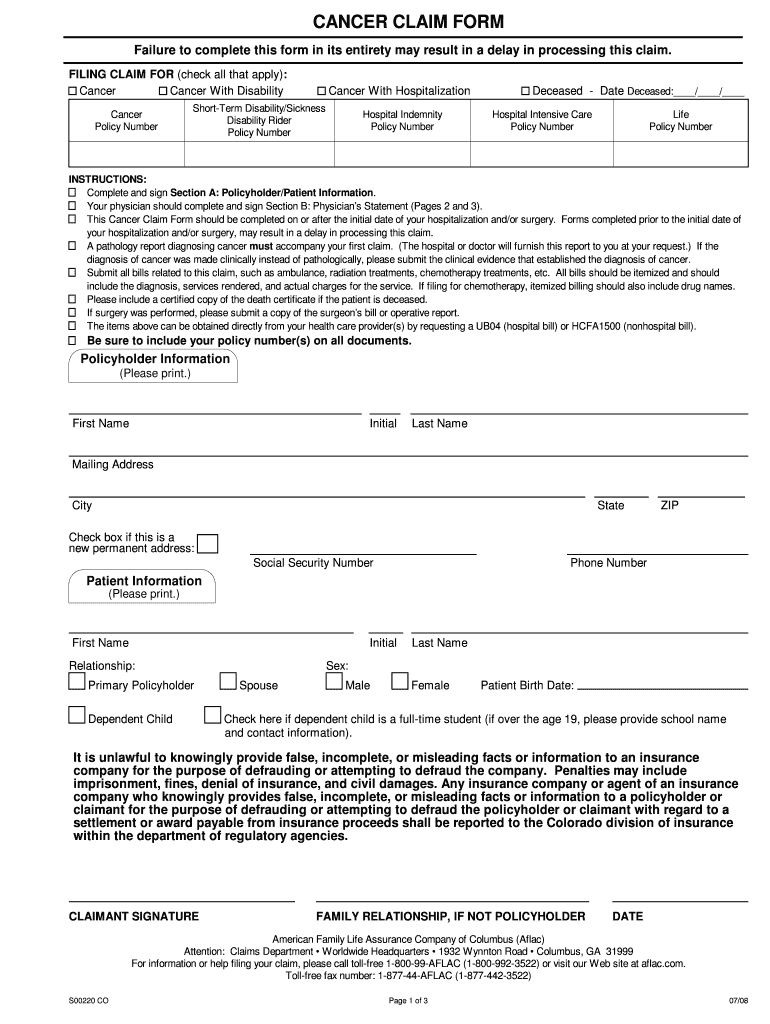

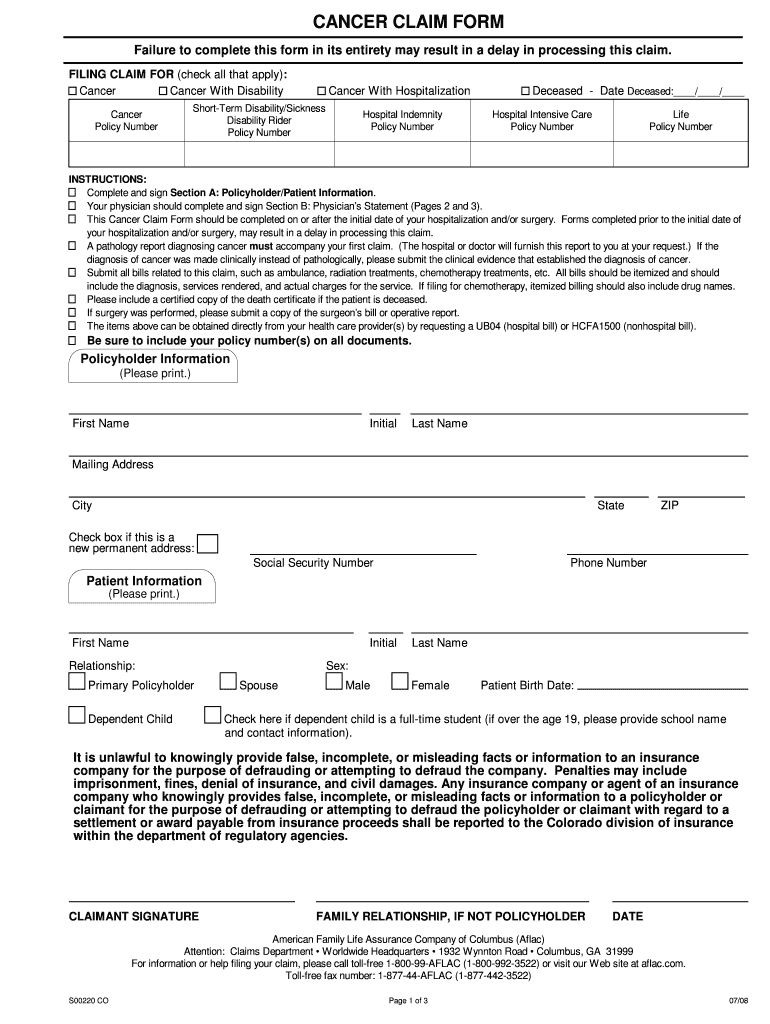

Get the free All bills should be itemized and should - connect d51schools

Show details

For information or help filing your claim, please call toll-free 1-800-99-AFLAC (1- 800-992-3522) or visit our Website at ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all bills should be

Edit your all bills should be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all bills should be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit all bills should be online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit all bills should be. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all bills should be

01

To fill out all bills correctly, start by gathering all the necessary information such as the invoice date, customer details, itemized list of goods or services, and the total amount owed.

02

Use a standardized billing template or software to ensure consistency and professionalism in your bills. This will make it easier for both you and your customers to keep track of payments.

03

Begin by entering the invoice date at the top of the bill, followed by your business name, address, and contact information. Include a unique invoice number for reference purposes.

04

Indicate the customer's details, including their name, address, and any other relevant contact information. Ensure accuracy to avoid sending bills to the wrong recipient.

05

Provide a detailed list of the goods or services provided, including item descriptions, quantity, unit price, and any applicable discounts or taxes. This will help the customer understand what they are paying for and prevent any confusion later.

06

Calculate the total amount owed by adding up the costs of all items and applying any applicable taxes or discounts. Make sure to clearly indicate the currency in which payment is expected.

07

Specify your preferred payment terms and methods, such as bank transfer, credit card, or check. Include any additional instructions or directions on how the customer should proceed with payment.

08

Double-check all the information on the bill for accuracy and completeness. Ensure all calculations are correct and that there are no typos or errors in the customer's details.

Who needs all bills should be?

01

Small and medium-sized businesses: Keeping well-organized bills is essential for maintaining proper financial records and ensuring smooth cash flow. It helps businesses track income, manage expenses, and accurately track outstanding payments.

02

Freelancers and independent contractors: Individuals working on a freelance or contract basis often need to provide detailed invoices to their clients. This not only helps them keep track of their earnings but also presents a professional image and assists in receiving timely payments.

03

Consumers: While consumers may not generate bills themselves, understanding how to read and interpret bills is crucial. It allows them to verify charges, track expenses, and ensure they are being billed correctly for goods or services they have received.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find all bills should be?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the all bills should be. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in all bills should be without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your all bills should be, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit all bills should be straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit all bills should be.

What is all bills should be?

All bills should be accurate and complete.

Who is required to file all bills should be?

All individuals or entities who have incurred expenses that need to be reported.

How to fill out all bills should be?

All bills should be filled out accurately and thoroughly, including details on the date, amount, and purpose of the expense.

What is the purpose of all bills should be?

The purpose of all bills should be is to provide transparency and accountability in financial reporting.

What information must be reported on all bills should be?

Information such as the date, amount, and purpose of the expense must be reported on all bills.

Fill out your all bills should be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Bills Should Be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.