Get the free Aetna Life Insurance Company 151 Farmington Avenue Hartford, CT 06156 Aetna VisionSM...

Show details

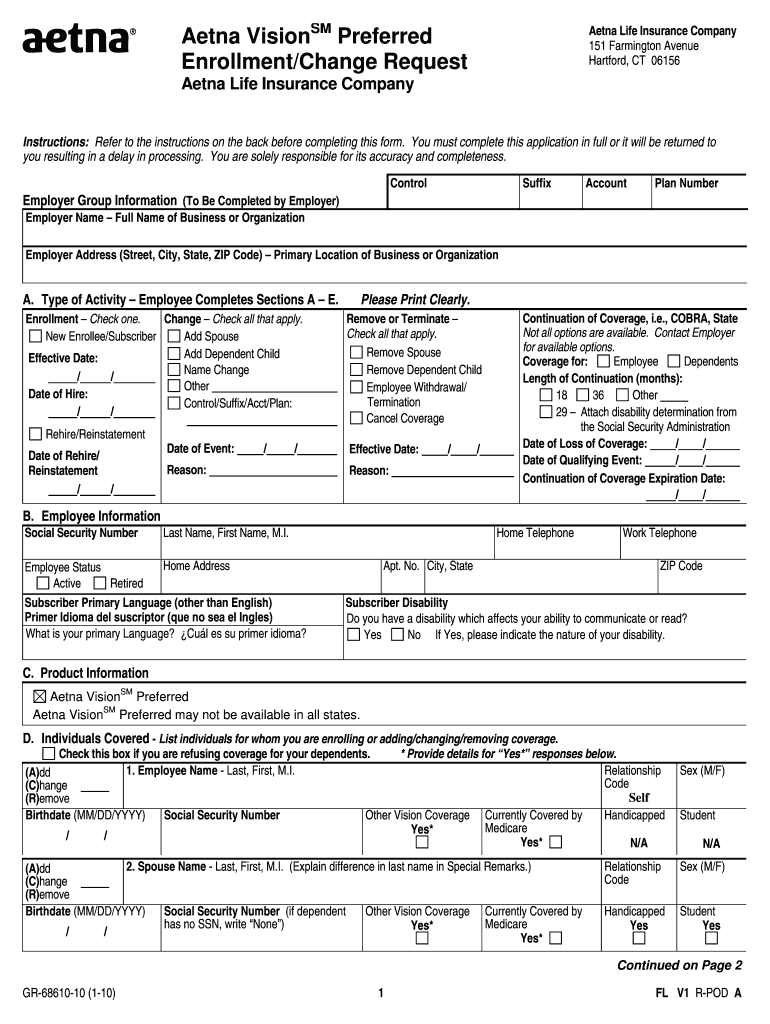

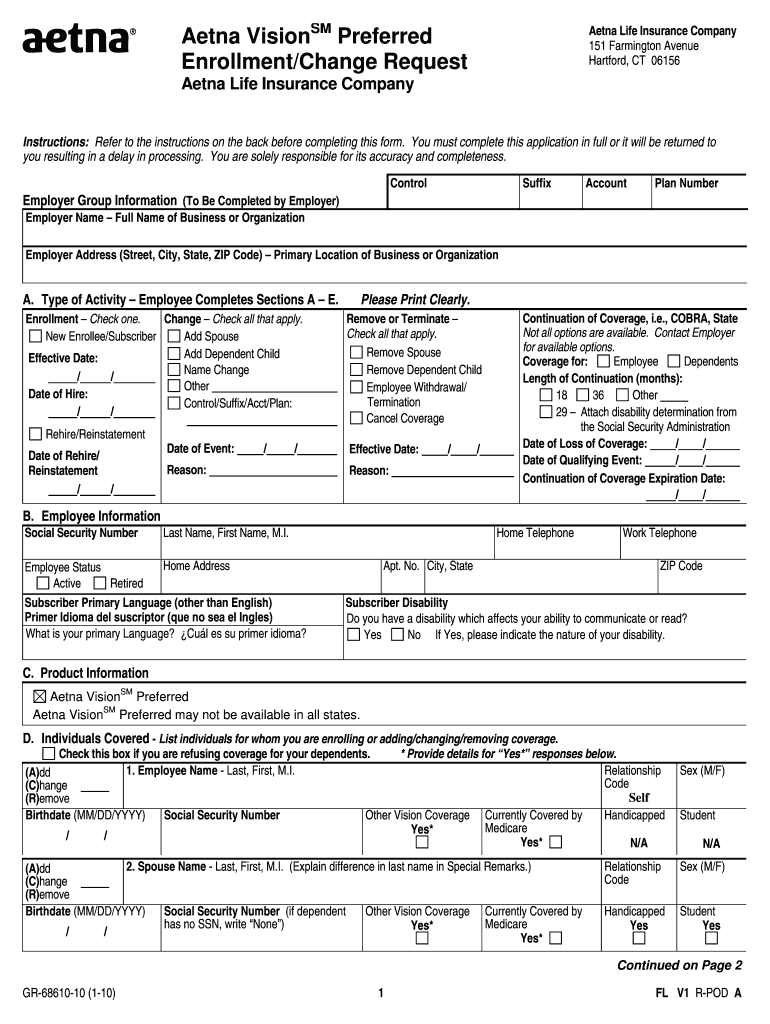

Instructions: Refer to the instructions on the back before completing this form. You must complete this application in full ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aetna life insurance company

Edit your aetna life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aetna life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aetna life insurance company online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aetna life insurance company. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aetna life insurance company

How to fill out Aetna Life Insurance Company:

01

Start by gathering all the necessary information: Before filling out the Aetna Life Insurance Company form, make sure you have all the required details at hand, including personal information such as your name, address, Social Security number, and contact details.

02

Understand the different types of insurance coverage offered: Aetna Life Insurance Company provides various types of life insurance coverage, including term life insurance, whole life insurance, and universal life insurance. Familiarize yourself with these options to determine which one suits your needs best.

03

Determine the coverage amount: Decide on the appropriate coverage amount based on your financial responsibilities, including any outstanding debts, mortgage, education expenses, and future financial goals. A higher coverage amount may require you to pay higher premiums, so carefully assess your needs and budget.

04

Choose additional rider options: Aetna Life Insurance Company offers additional coverage options, also known as riders, which can further enhance your policy. These may include accidental death benefit riders, critical illness riders, or disability income riders. Evaluate your needs and consider adding these riders if they align with your requirements.

05

Review the application form: Take the time to carefully read through the application form provided by Aetna Life Insurance Company. Pay attention to any specific instructions or questions asked and ensure you understand them before proceeding.

06

Complete the application form accurately: Fill out the application form accurately and provide truthful information. Ensure that all contact details and personal information are correct to avoid any complications during the underwriting process.

07

Seek professional advice if needed: If you are unsure about any aspect of the application process or have specific concerns, it is advisable to consult with a licensed insurance agent or financial advisor. They can guide you through the process, answer any questions you may have, and help you make informed decisions.

08

Submit the application: Once you have completed the application form, review it one last time to double-check for any errors or omissions. Make any necessary corrections and submit the application to Aetna Life Insurance Company as per their preferred method, whether it be through an online portal, email, or physical mail.

Who needs Aetna Life Insurance Company:

01

Individuals with dependents: Aetna Life Insurance Company is ideal for individuals who have dependents, such as a spouse, children, or aging parents, who rely on their income for financial support. Life insurance coverage can provide financial security and ensure that your loved ones are taken care of in the event of your untimely demise.

02

Individuals with outstanding debts: If you have any outstanding debts, such as a mortgage, car loan, or student loans, Aetna Life Insurance Company can be beneficial. Life insurance coverage can help cover these debts and prevent them from becoming a burden to your loved ones.

03

Those seeking to provide for future financial goals: Aetna Life Insurance Company can also be suitable for individuals who wish to leave behind a legacy or provide for future financial goals, such as funding their children's education, leaving an inheritance, or supporting a charitable cause.

04

Business owners: Aetna Life Insurance Company offers customizable options for business owners, including key person insurance, buy-sell agreements, and business succession planning. These policies can help protect the business and ensure a smooth transition in the event of the owner's death.

In summary, anyone looking for financial protection for their loved ones, coverage for outstanding debts, provision for future financial goals, or business-related coverage can benefit from Aetna Life Insurance Company. It is important to assess your needs, carefully fill out the application form, and seek guidance if necessary, to ensure you find the right life insurance coverage for your specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit aetna life insurance company online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your aetna life insurance company to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my aetna life insurance company in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your aetna life insurance company and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit aetna life insurance company straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing aetna life insurance company.

What is aetna life insurance company?

Aetna Life Insurance Company is a subsidiary of Aetna, which offers life insurance products and services to individuals and businesses.

Who is required to file aetna life insurance company?

Individuals and businesses who have purchased life insurance policies from Aetna are required to file Aetna Life Insurance Company forms.

How to fill out aetna life insurance company?

Aetna Life Insurance Company forms can be filled out online through the Aetna website or by contacting Aetna customer service.

What is the purpose of aetna life insurance company?

The purpose of Aetna Life Insurance Company is to provide financial protection and security to policyholders and their beneficiaries in the event of the insured's death.

What information must be reported on aetna life insurance company?

Aetna Life Insurance Company forms typically require information about the policyholder, beneficiaries, coverage amount, and any changes to the policy.

Fill out your aetna life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aetna Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.