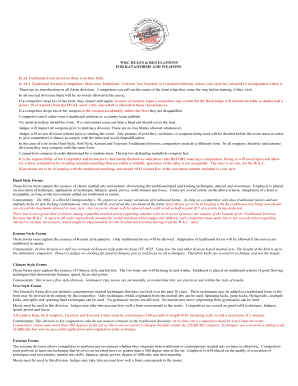

Get the free 8999701 TaxDeferred Savings Plan of Accelrys Inc - accelrys gethrinfo

Show details

A 8999701 Deferred Savings Plan of Access Inc. B Participant Information Paycheck Contribution Election 401(k) Plan Use black or blue ink when completing this form. For questions regarding this form,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8999701 taxdeferred savings plan

Edit your 8999701 taxdeferred savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8999701 taxdeferred savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8999701 taxdeferred savings plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 8999701 taxdeferred savings plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8999701 taxdeferred savings plan

01

To fill out the 8999701 taxdeferred savings plan, start by gathering all the required documentation. This may include personal identification, financial statements, and any additional information required by the plan provider.

02

Next, review the plan's terms and conditions to understand the eligibility criteria, contribution limits, and investment options available. It is important to be familiar with the plan's rules to make informed decisions.

03

Determine the desired contribution amount and frequency. This could be a specific percentage of your income or a fixed dollar amount. Consider your financial situation and goals when deciding how much to contribute.

04

Complete the necessary forms provided by the plan provider. This may involve providing personal and financial information, selecting investment options, and designating beneficiaries. Be sure to double-check all the information entered to avoid any errors or omissions.

05

If you have any questions or need assistance, reach out to the plan provider's customer service or consult a financial advisor. They can provide guidance on completing the forms accurately and ensuring compliance with tax and retirement regulations.

06

Once you have filled out the forms, submit them to the plan provider through the specified method, such as online submission or mailing. Keep copies of all the documents for your records.

07

Finally, regularly review and update your taxdeferred savings plan. As your financial situation and goals change, you may need to adjust your contributions or investment allocation. Periodically review the plan's performance and seek professional advice if needed.

In terms of who needs the 8999701 taxdeferred savings plan, it is a valuable investment and retirement tool for individuals who are looking to save for their future while enjoying potential tax benefits. It is suitable for those who have a steady income and want to build wealth over time. The plan can be utilized by employees, self-employed individuals, or anyone who is eligible and interested in growing their savings in a tax-efficient manner. It is always recommended to consult with a financial advisor to determine if this type of plan aligns with your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8999701 taxdeferred savings plan?

_The 8999701 taxdeferred savings plan is a retirement savings plan that allows individuals to contribute pre-tax income to their account, allowing for tax-deferred growth until withdrawals are made in retirement._

Who is required to file 8999701 taxdeferred savings plan?

_Individuals who meet certain income and eligibility requirements are required to file 8999701 taxdeferred savings plan. Typically, this includes employees whose employer offers a 8999701 plan as well as self-employed individuals._

How to fill out 8999701 taxdeferred savings plan?

_To fill out a 8999701 taxdeferred savings plan, individuals need to provide personal information, including their name, address, Social Security number, and employment information. They also need to specify how much they would like to contribute to their account each year._

What is the purpose of 8999701 taxdeferred savings plan?

_The purpose of a 8999701 taxdeferred savings plan is to help individuals save for retirement in a tax-efficient manner. By contributing pre-tax income to their account, individuals can reduce their taxable income and potentially lower their tax liability._

What information must be reported on 8999701 taxdeferred savings plan?

_Information that must be reported on a 8999701 taxdeferred savings plan includes the individual's contributions to the plan, any withdrawals made, and the account's balance at the end of the year._

How do I modify my 8999701 taxdeferred savings plan in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 8999701 taxdeferred savings plan and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for the 8999701 taxdeferred savings plan in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 8999701 taxdeferred savings plan.

How do I fill out 8999701 taxdeferred savings plan on an Android device?

Use the pdfFiller mobile app and complete your 8999701 taxdeferred savings plan and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your 8999701 taxdeferred savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8999701 Taxdeferred Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.