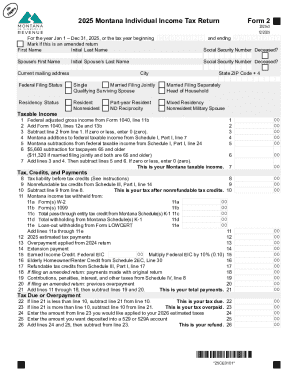

MT Form 2 2014 free printable template

Instructions and Help about MT Form 2

How to edit MT Form 2

How to fill out MT Form 2

About MT Form 2 2014 previous version

What is MT Form 2?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about MT Form 2

How can I correct mistakes after filing the clear form form 2ez?

If you realize that you've made an error on your submitted clear form form 2ez, you should file an amended version as soon as possible. This involves clearly indicating which parts of the original form were incorrect and providing the correct information. Ensure that you follow the submission guidelines for amended forms to avoid further complications.

What should I do if I receive a notice after filing the clear form form 2ez?

Receiving a notice or letter after submitting your clear form form 2ez can be concerning. It's essential to read the notice carefully to understand the nature of the issue. Prepare any requested documentation and respond promptly to mitigate any potential penalties or complications.

Are electronic signatures acceptable for the clear form form 2ez?

Yes, e-signatures are generally acceptable for the clear form form 2ez, provided that they meet the specific requirements set by the IRS. It's important to ensure that your electronic submission complies with all regulations regarding digital signatures to maintain the integrity of your filing.

What common errors should I be aware of when submitting the clear form form 2ez?

When filing the clear form form 2ez, be mindful of common errors such as incorrect taxpayer identification numbers, misreporting of income, or failing to include required attachments. Double-check your entries and ensure all information is accurate to avoid rejection of your form.

How can I verify the status of my submitted clear form form 2ez?

To track the status of your clear form form 2ez submission, you can use the IRS online tracking tool or reach out to their customer service. It's helpful to have your submission receipt handy, as well as any related information, to expedite the process of verifying your filing status.