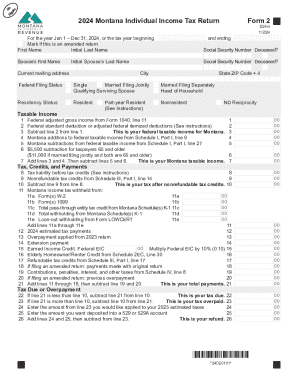

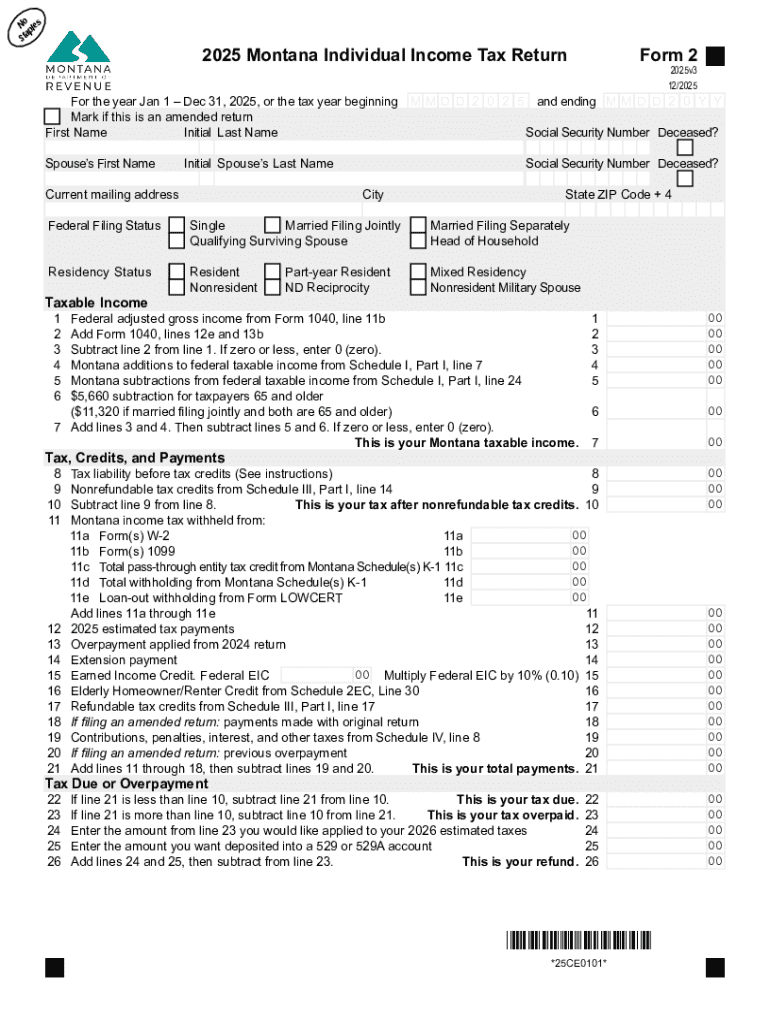

MT Form 2 2025-2026 free printable template

Instructions and Help about MT Form 2

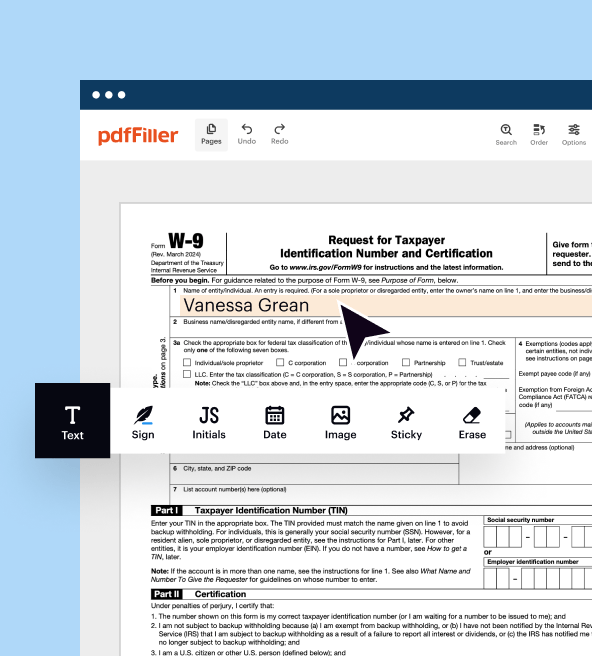

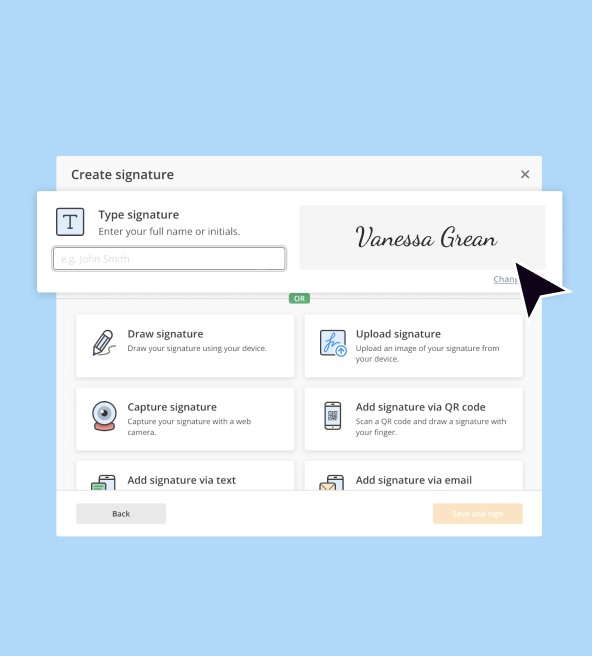

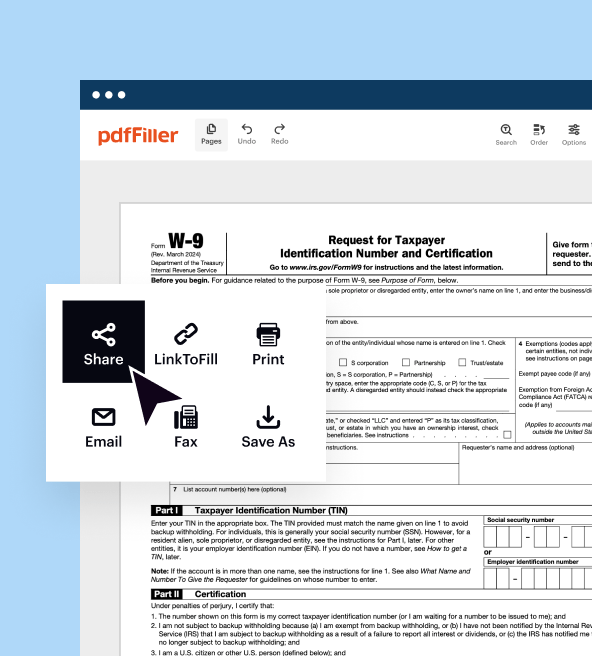

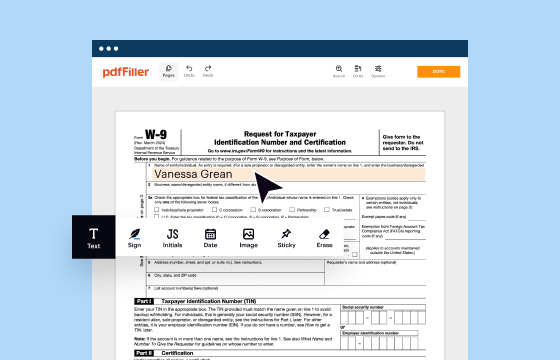

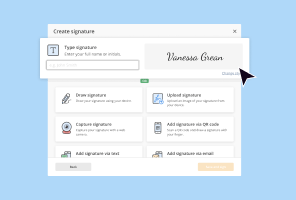

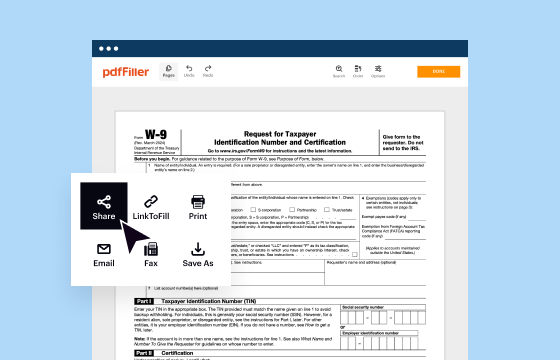

How to edit MT Form 2

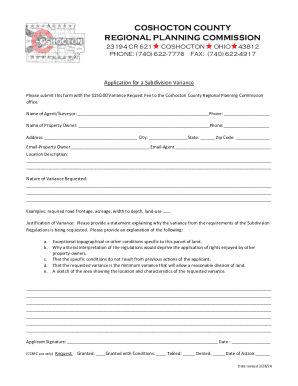

How to fill out MT Form 2

Latest updates to MT Form 2

All You Need to Know About MT Form 2

What is MT Form 2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MT Form 2

What should I do if I need to correct an error after submitting MT Form 2?

If you need to correct mistakes on your MT Form 2 after submission, you should file an amended form. Make sure to clearly indicate that it is a correction, and provide accurate information to avoid processing delays.

How can I track the status of my submitted MT Form 2?

To track the status of your submitted MT Form 2, you can check with the relevant tax authority's online portal or contact their support line. Be prepared with your submission details for reference.

What should I be aware of regarding data privacy when filing MT Form 2?

When filing MT Form 2, it's essential to ensure your data is secure. Understand the privacy policies and data retention periods of the filing agency, and utilize secure methods, especially for electronic submissions.

Are there any common mistakes filers make with MT Form 2, and how can I avoid them?

Common errors when filing the MT Form 2 include incorrect taxpayer identification numbers and failing to report all required payments. To avoid these, double-check your entries and review the requirements before submission.

What technical requirements should I consider for e-filing the MT Form 2?

For e-filing the MT Form 2, ensure you are using compatible software and browsers, and check for any specific technical requirements on the filing agency's website to facilitate a smooth submission process.