Get the free MONTHLY PRE-AUTHORIZED TAX PAYMENT PLAN General Information

Show details

THE CORPORATION OF THE TOWNSHIP OF WILMOT Finance Department Revenue Services 60 Snyders Road West Baden ON N3A 1A1 5196348444 18004695576 (fax) 5196345522 tax Wilmot.ca water Wilmot.ca www.wilmot.ca/finance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monthly pre-authorized tax payment

Edit your monthly pre-authorized tax payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monthly pre-authorized tax payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monthly pre-authorized tax payment online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit monthly pre-authorized tax payment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monthly pre-authorized tax payment

How to Fill Out Monthly Pre-Authorized Tax Payment:

01

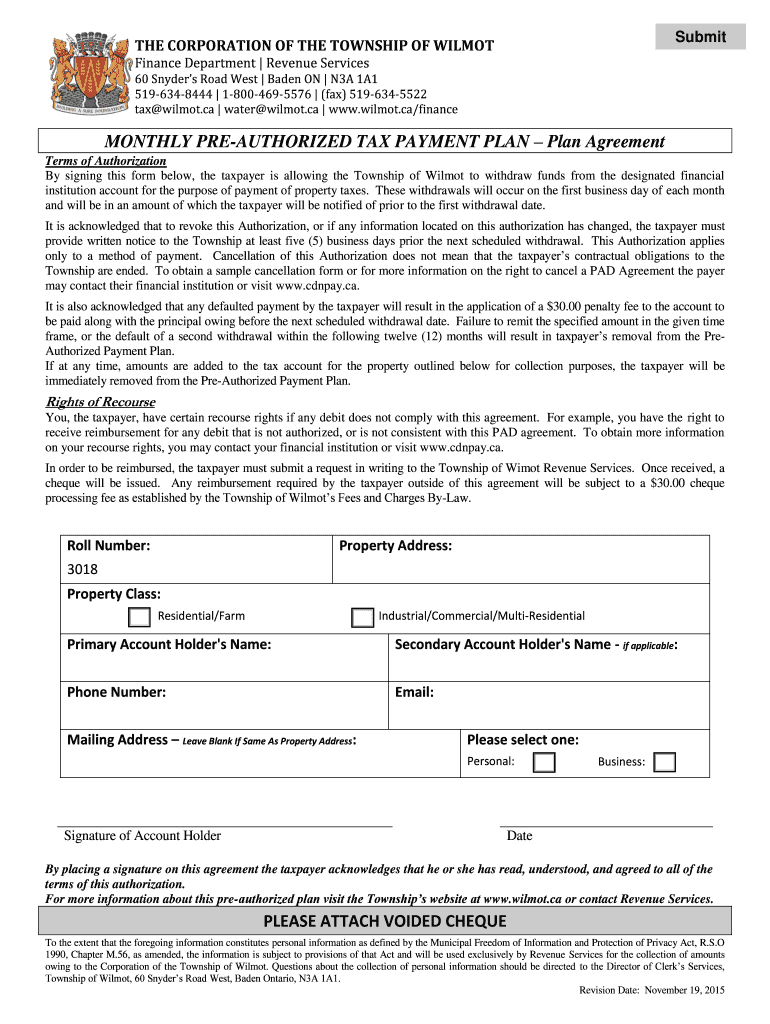

Gather necessary information: Before filling out the form, gather all the required information such as your social insurance number, contact details, tax account number, and banking information.

02

Download the form: Visit the tax authority's website or contact them to obtain the monthly pre-authorized tax payment form. Download and print the form for convenience.

03

Complete personal information: Start by entering your personal information accurately. Include your full name, address, social insurance number, and contact details as requested on the form.

04

Provide tax account details: Fill in your tax account number or identification number, which is usually provided on your tax notice or return. Ensure accuracy to avoid any confusion or complications.

05

Choose the payment frequency: Determine the frequency at which you want to make your tax payments. Common options include monthly, quarterly, or annually. Select the monthly option for pre-authorized monthly tax payments.

06

Select the payment method: Indicate your preferred payment method. This can be done through automatic withdrawal from your bank account, credit card payment, or any other method accepted by the tax authority. For pre-authorized monthly tax payments, selecting the automatic withdrawal option is most common.

07

Fill in banking information: Provide your banking information, including the account holder's name, financial institution name, branch number, and account number. Double-check these details for accuracy to avoid payment errors.

08

Calculate the tax payment amount: Calculate the appropriate tax payment amount for each month. This is typically based on your estimated income and tax obligations. Consult with a tax professional or refer to the tax authority's guidelines for assistance in determining this amount accurately.

09

Sign and date: Once you have completed all the necessary information, carefully review the form for any errors or omissions. Sign and date the form to certify its accuracy and completeness.

Who Needs Monthly Pre-Authorized Tax Payment:

01

Self-employed individuals: Entrepreneurs, freelancers, consultants, and anyone operating their own business are often required to make estimated tax payments on a regular basis. Monthly pre-authorized tax payments can help them stay organized and meet their tax obligations promptly.

02

Individuals with inconsistent income: If you have irregular or varying income throughout the year, making monthly tax payments can help you avoid large lump-sum tax payments when filing your annual tax return. Pre-authorized payments allow you to spread out the tax liability and make it more manageable.

03

Those subject to income tax withholding exemptions: If you are exempt from the standard income tax withholding, such as retirees, individuals with certain tax credits, or those earning non-employment income, pre-authorized tax payments can be a convenient way to fulfill your tax obligations. It ensures that you are meeting your tax responsibilities regularly.

04

Individuals who want to avoid interest and penalties: Making regular monthly tax payments can help you avoid interest charges and penalties that may be imposed if you fail to pay your taxes on time or in full. By spreading your tax payments evenly throughout the year, you can stay compliant and minimize the financial burden associated with late or insufficient tax payments.

Remember, it is always recommended to consult with a tax professional or contact your local tax authority for specific guidance on filling out the monthly pre-authorized tax payment form and determining your tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send monthly pre-authorized tax payment to be eSigned by others?

When you're ready to share your monthly pre-authorized tax payment, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the monthly pre-authorized tax payment in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your monthly pre-authorized tax payment right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit monthly pre-authorized tax payment on an Android device?

You can make any changes to PDF files, such as monthly pre-authorized tax payment, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is monthly pre-authorized tax payment?

Monthly pre-authorized tax payment is a system where taxpayers authorize the government to withdraw a fixed amount from their bank account on a monthly basis to cover their tax obligations.

Who is required to file monthly pre-authorized tax payment?

Individuals or businesses with regular tax obligations are required to file monthly pre-authorized tax payments.

How to fill out monthly pre-authorized tax payment?

Taxpayers can set up pre-authorized payments through their financial institution or through the government's online portal by providing their bank account information.

What is the purpose of monthly pre-authorized tax payment?

The purpose of monthly pre-authorized tax payments is to help taxpayers budget and manage their tax obligations more effectively by spreading out payments over the year.

What information must be reported on monthly pre-authorized tax payment?

Taxpayers must report their personal or business information, tax identification number, and the amount they wish to authorize for monthly withdrawal.

Fill out your monthly pre-authorized tax payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monthly Pre-Authorized Tax Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.