Get the free Deposit Summary

Show details

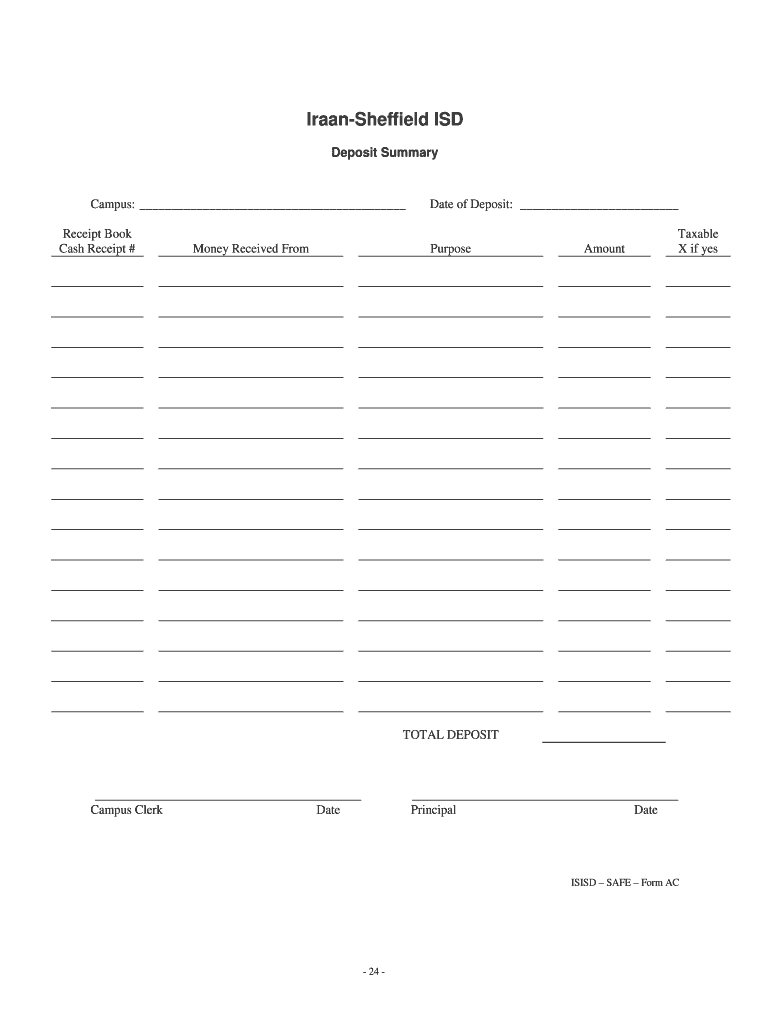

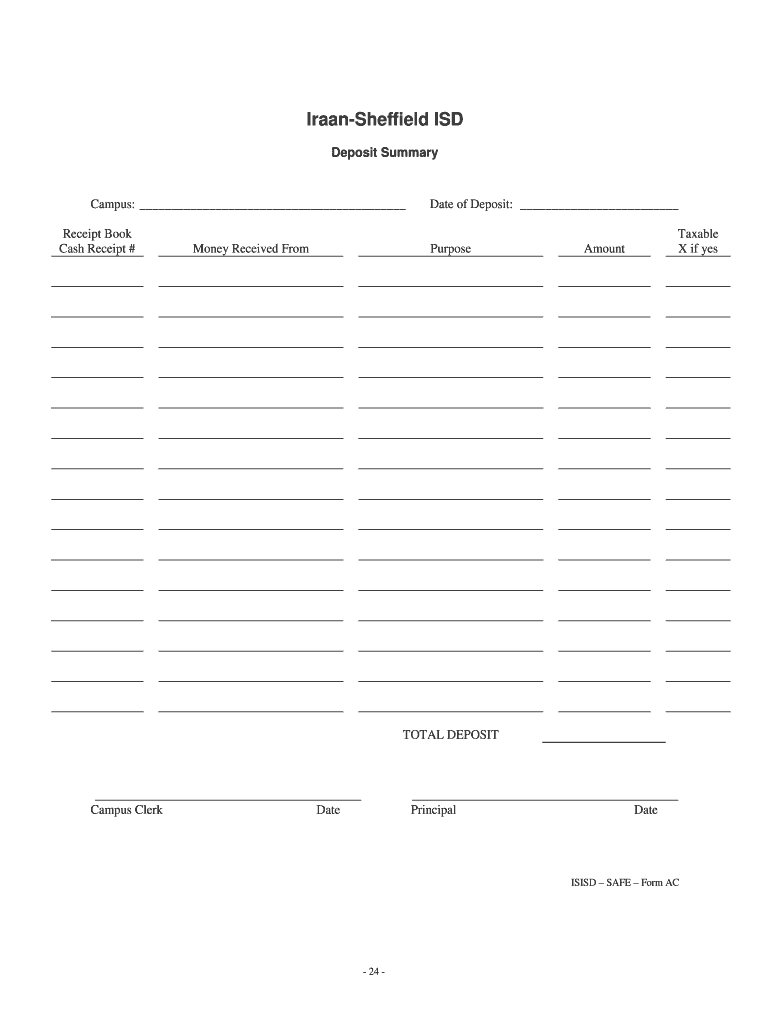

IraanSheffield ISD Deposit Summary Campus: Receipt Book Cash Receipt # Money Received From Date of Deposit: Purpose Amount Taxable X if yes TOTAL DEPOSIT Campus Clerk Date Principal Date ISIS SAFE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit summary

Edit your deposit summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deposit summary online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deposit summary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit summary

How to fill out a deposit summary:

01

Start by collecting all the necessary information related to the deposit. This includes the date of the deposit, the amount deposited, and any details or notes associated with the deposit.

02

Ensure that you have the appropriate paperwork, such as deposit slips or forms, to accurately record the deposit information.

03

Double-check the accuracy of the information before filling out the deposit summary. Accuracy is crucial to avoid any discrepancies or errors in the deposit records.

04

Enter the date of the deposit in the designated field on the deposit summary form. This should be the date when the funds were actually deposited into the account, not the date of the transaction.

05

Write down the amount of the deposit in the respective section of the summary form. Be careful to include the correct currency and decimal places, if applicable.

06

If there are any additional details or notes regarding the deposit, such as the source of the funds or any special instructions, ensure that you provide clear and concise information in the appropriate section of the summary form.

07

Review the completed deposit summary for any errors before submitting it. Mistakes or omissions can cause confusion and may require additional effort to rectify later on.

08

Submit the deposit summary form to the relevant department or personnel responsible for processing deposits. Follow any specific procedures or guidelines that are in place in your organization.

09

Keep a copy of the completed deposit summary for your records. It is important to maintain accurate documentation for future reference or auditing purposes.

Who needs a deposit summary:

01

Financial institutions: Banks, credit unions, and other financial institutions require deposit summaries to accurately record and track customer deposits. These summaries help in maintaining accurate account statements and ensuring the proper handling of funds.

02

Businesses: Companies that frequently receive cash or check deposits, such as retail stores or restaurants, use deposit summaries to record and reconcile their daily or periodic deposits. These summaries help in tracking sales, identifying discrepancies, and managing cash flow effectively.

03

Individuals: Individuals may also need deposit summaries to keep track of their personal deposits, especially if they maintain multiple bank accounts or engage in various financial transactions. These summaries provide a consolidated view of their deposit activity and can be helpful in managing personal finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deposit summary without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including deposit summary. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in deposit summary without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing deposit summary and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete deposit summary on an Android device?

Use the pdfFiller mobile app and complete your deposit summary and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is deposit summary?

The deposit summary is a document that provides a summary of all deposits made during a certain period of time.

Who is required to file deposit summary?

Businesses and individuals who receive deposits as part of their regular activities are required to file deposit summary.

How to fill out deposit summary?

To fill out a deposit summary, you need to list all deposits received, including the date, amount, source, and purpose of each deposit.

What is the purpose of deposit summary?

The purpose of deposit summary is to accurately report all deposits made during a specific period and provide a clear overview of financial activities.

What information must be reported on deposit summary?

The information that must be reported on deposit summary includes the date, amount, source, and purpose of each deposit.

Fill out your deposit summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.