Get the free Check Diversion Program

Show details

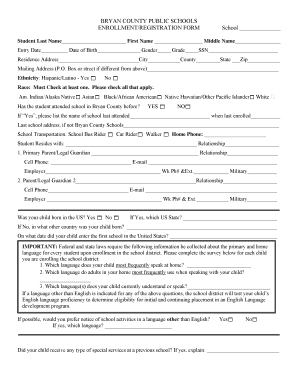

This document serves as a guide for Fergus Falls merchants and residents on the worthless check diversion program implemented by the Fergus Falls Police Department, detailing the process for restitution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check diversion program

Edit your check diversion program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check diversion program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check diversion program online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit check diversion program. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check diversion program

How to fill out Check Diversion Program

01

Obtain the Check Diversion Program application form from the relevant authority.

02

Read the instructions carefully to understand the eligibility criteria.

03

Fill out the application form with your personal details accurately.

04

Provide any required documentation, such as ID or proof of income.

05

Review the application for any errors or missing information.

06

Submit the completed application by the deadline, either online or by mail.

07

Wait for confirmation of your application status from the program administrators.

Who needs Check Diversion Program?

01

Individuals who have unpaid checks due to insufficient funds.

02

People looking for a way to avoid criminal charges related to bounced checks.

03

Those interested in financial education resources and managing their finances effectively.

Fill

form

: Try Risk Free

People Also Ask about

Is there a statute of limitations on a bad check?

Make no mistake about it, writing bad checks is always illegal. However, just about every state has a statute of limitations (SoL) on the collection of bad checks; typically 2 or 3 years. If you receive a collection notice or call about a bad check, don't panic!

What is the bad check restitution program?

A bad check restitution program (BCRP) is a program in the United States that works to retrieve funds from bad check writers in order to repay moneys owed to the recipients of the checks. In other words, these are debt collection operations.

What is the statute of bad checks in California?

California Penal Code Section 476A PC: Writing Or Passing ”Bad Checks” While many incidents of check fraud involve using a or altered check to obtain money, it is also illegal to use a real check to try and obtain goods, services or cash when there are insufficient funds in the account associated with the check.

What happens if you don't pay back a bad check?

If you don't repay the checks, they can go to court, file a lawsuit, and get a judgment against you for the amount of the checks. A court judgment could damage your credit rating, and should be avoided if at all possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Check Diversion Program?

The Check Diversion Program is a regulatory framework established to prevent the misuse of checks and ensure that they are processed correctly through the banking system.

Who is required to file Check Diversion Program?

Entities involved in check processing, including banks, financial institutions, and certain businesses that issue checks, are required to file under the Check Diversion Program.

How to fill out Check Diversion Program?

To fill out the Check Diversion Program, individuals or entities must complete the prescribed forms, providing accurate information about their check processing practices and any incidents of diversion.

What is the purpose of Check Diversion Program?

The purpose of the Check Diversion Program is to enhance the security of check transactions, minimize fraud, and promote compliance with regulations governing check processing.

What information must be reported on Check Diversion Program?

The information that must be reported on the Check Diversion Program includes details about the entity's check processing protocols, instances of check diversion, and measures taken to mitigate risks.

Fill out your check diversion program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Diversion Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.