Get the free 2013 Application for Property and Business Tax Exemption - calgary

Show details

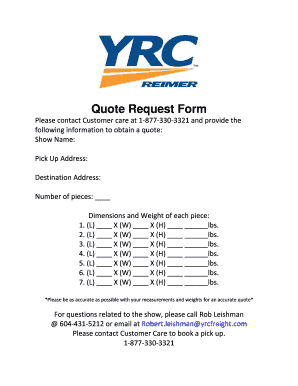

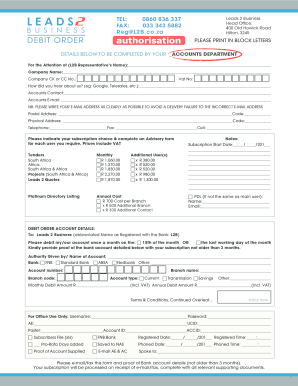

This document is an application form for a property and business tax exemption for facilities used by ethno-cultural associations in Calgary, detailing requirements for property information, organization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 application for property

Edit your 2013 application for property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 application for property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 application for property online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 application for property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 application for property

How to fill out 2013 Application for Property and Business Tax Exemption

01

Obtain the 2013 Application for Property and Business Tax Exemption form from your local tax authority or their website.

02

Read the instructions carefully to understand eligibility and requirements.

03

Fill out your personal information, including name, address, and contact details.

04

Provide information about the property or business for which you are requesting the exemption.

05

Indicate the type of exemption you are applying for by checking the appropriate boxes.

06

Provide any necessary documentation to support your application, such as financial statements or property records.

07

Review your application for accuracy and completeness.

08

Sign and date the application form.

09

Submit the completed application to the appropriate tax authority by the specified deadline.

Who needs 2013 Application for Property and Business Tax Exemption?

01

Individuals or businesses that own property or operate a business and wish to apply for tax exemptions available in 2013.

02

Non-profit organizations seeking tax exemption for their properties.

03

Property owners who qualify for specific exemptions based on property use or ownership status.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for CA property tax exemption?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

Do property taxes go down after age 65?

Often, if you're 65 or older, you'll be able to reduce your property tax bill not only on a house but mobile and manufactured homes, houseboats, townhomes, iniums and so on. You will have to apply: You typically need to apply for a senior freeze.

How do I get a tax exemption certificate in USA?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

Who qualifies for tax exemption California?

State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

Who is exempt from paying property taxes in Kentucky?

In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

Who qualifies for California homeowners property tax exemption?

You may qualify for the Homeowners' Exemption if: You own the property. It was your principal residence on January 1st at 12:01 a.m. You don't already have a Homeowners' Exemption on any other property. And you submit a completed application for Homeowner's Exemption .

What age in California do you stop paying property taxes?

State Property Tax Postponement Program – Seniors The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement.

How do I fill out a tax exemption certificate?

The exemption certificate is properly completed and legible: Name and address of the purchaser. Description of the item to be purchased. The reason the purchase is exempt. Signature of purchaser and date; and. Name and address of the seller.

How do I apply for property tax exemption in California?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

At what age do seniors stop paying property taxes in Kentucky?

Homestead Exemption Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined to be totally disabled and are receiving payments pursuant to their disability. Find out more about the homestead exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2013 Application for Property and Business Tax Exemption?

The 2013 Application for Property and Business Tax Exemption is a form used by property owners to apply for exemptions from certain property taxes on their business assets and real estate.

Who is required to file 2013 Application for Property and Business Tax Exemption?

Property owners who wish to claim an exemption on their property taxes for business-related assets must file the 2013 Application for Property and Business Tax Exemption.

How to fill out 2013 Application for Property and Business Tax Exemption?

To fill out the 2013 Application for Property and Business Tax Exemption, property owners need to provide details regarding their business, the type of property being claimed for exemption, and any supporting documentation as required.

What is the purpose of 2013 Application for Property and Business Tax Exemption?

The purpose of the 2013 Application for Property and Business Tax Exemption is to formally request tax relief for eligible properties and promote economic growth by relieving the tax burden on businesses.

What information must be reported on 2013 Application for Property and Business Tax Exemption?

The application must report information such as the property owner's name, business type, description of the property, and any relevant financial data that supports the exemption claim.

Fill out your 2013 application for property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Application For Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.