Get the free NOTICE A MORTGAGE CONTINGENCY NOTIFICATION REQUEST FOR EXTENSION

Show details

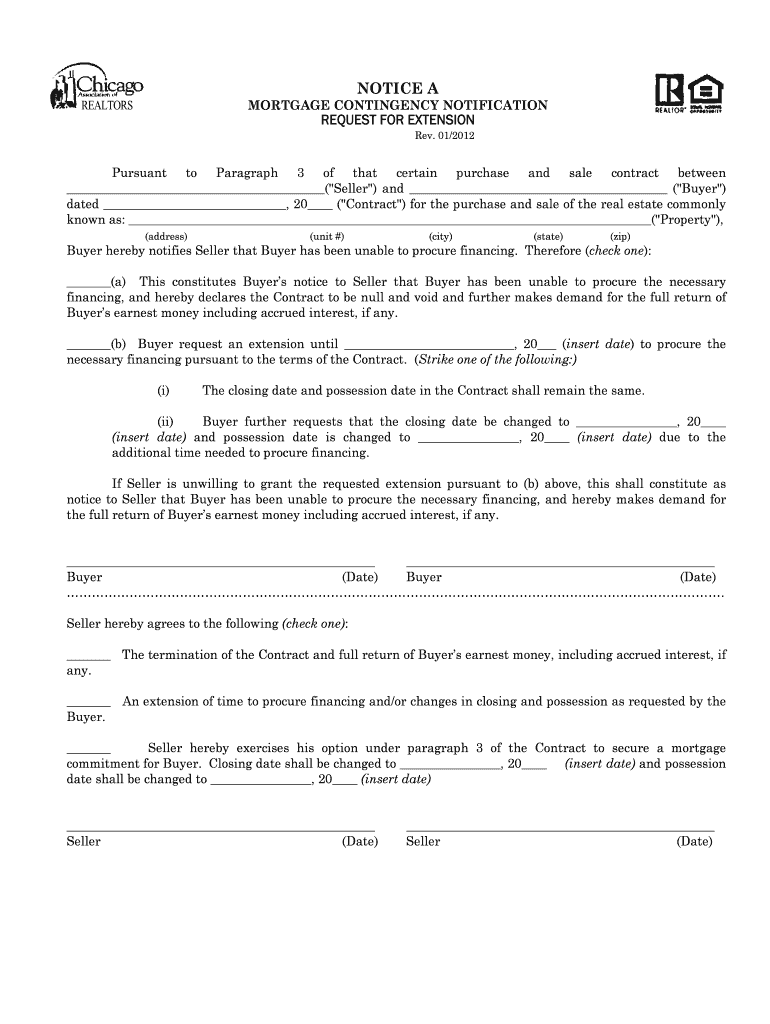

NOTICE A MORTGAGE CONTINGENCY NOTIFICATION REQUEST FOR EXTENSION Rev. 01/2012 Pursuant to Paragraph 3 of that certain purchase and sale contract between (“Seller “) and (“Buyer “) dated, 20

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice a mortgage contingency

Edit your notice a mortgage contingency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice a mortgage contingency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice a mortgage contingency online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice a mortgage contingency. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice a mortgage contingency

How to Fill Out Notice of a Mortgage Contingency:

01

Begin by providing your personal information: Include your full name, contact details, and address. It's important to ensure that the information provided is accurate and up-to-date.

02

Identify the parties involved: Clearly state the names of the buyer(s) and seller(s) involved in the mortgage contingency. This will help establish the context and ensure that the notice reaches the appropriate individuals.

03

Specify the property: Clearly describe the property subject to the mortgage contingency. Include the full address, along with any relevant identifiers such as plot numbers or lot numbers. This will avoid any confusion regarding which property is being referred to.

04

State the contingency date: Indicate the agreed-upon date by which the mortgage contingency is to be satisfied. This date should be aligned with the terms agreed upon in the initial contract or agreement.

05

Provide mortgage details: Include the essential information related to the mortgage, such as the anticipated loan amount, interest rate, and any relevant terms. This information will help the recipient understand the specific requirements and conditions for satisfying the mortgage contingency.

06

Explain the notice of contingency: Clearly state that the purpose of the notice is to inform the recipient(s) that the mortgage contingency is being fulfilled or waived. If the contingency is being fulfilled, specify how it is being satisfied, such as through providing mortgage approval documents or a commitment letter from a lender.

07

Include a deadline: Set a deadline for the recipient(s) to respond to the notice. This ensures that they have sufficient time to review the information and provide any necessary feedback or documentation.

08

Sign and date the notice: Affix your signature and date the notice to validate its authenticity. This will also serve as proof of when the notice was sent and received.

Who needs notice of a mortgage contingency?

01

Buyers: Buyers involved in a real estate transaction typically need to provide a notice of a mortgage contingency. This notice is essential to inform the seller(s) that the buyer(s) have satisfied or waived their mortgage contingency, thereby ensuring a smooth closing process.

02

Sellers: Sellers also need to be aware of the buyer's fulfillment or waiver of a mortgage contingency. This allows them to proceed with the transaction confidently, knowing that the buyer has secured their financing and can proceed with the purchase.

03

Real estate attorneys: Real estate attorneys representing either the buyer(s) or seller(s) need to be aware of the notice of a mortgage contingency. They can review the notice to ensure its accuracy and compliance with applicable legal requirements.

Note: The specific requirements for a notice of a mortgage contingency may vary depending on local laws and the contractual agreements between the parties involved. It is advisable to consult with a real estate attorney to ensure compliance with all legal obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute notice a mortgage contingency online?

pdfFiller has made it easy to fill out and sign notice a mortgage contingency. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the notice a mortgage contingency form on my smartphone?

Use the pdfFiller mobile app to fill out and sign notice a mortgage contingency. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit notice a mortgage contingency on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as notice a mortgage contingency. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is notice a mortgage contingency?

A notice of a mortgage contingency is a document that outlines the conditions that must be met before a real estate contract can be finalized, specifically related to securing a mortgage.

Who is required to file notice a mortgage contingency?

The buyer is typically required to file a notice of a mortgage contingency.

How to fill out notice a mortgage contingency?

The notice should include details about the buyer's financing, including the type of mortgage being sought and any relevant deadlines or conditions.

What is the purpose of notice a mortgage contingency?

The purpose of the notice is to protect the buyer in case they are unable to secure financing as outlined in the contract.

What information must be reported on notice a mortgage contingency?

Information such as the type of mortgage being sought, any applicable deadlines, and conditions related to securing financing must be reported on the notice.

Fill out your notice a mortgage contingency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice A Mortgage Contingency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.