Get the free mary kay tax worksheet 2024 pdf download

Show details

Income Tax Deductions for AVON & Mary Kay Businesses A. Income: 1. Grand totals of sale slips excluding sales Tax & Discounts given 2. Returns and Allowances: a) Cash back to customer b) Discounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mary kay tax worksheet

Edit your mary kay tax worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mary kay tax worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mary kay tax worksheet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mary kay tax worksheet. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

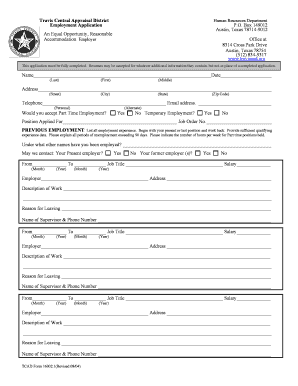

How to fill out mary kay tax worksheet

How to fill out Mary Kay tax worksheet:

01

Gather all necessary financial records and documents, such as receipts, invoices, and expense records related to your Mary Kay business.

02

Start filling out the worksheet by entering your personal information, such as your name, address, and tax identification number.

03

Follow the prompts on the worksheet to input your taxable income from your Mary Kay business. This can include earnings from sales, commissions, and bonuses.

04

Deduct any eligible business expenses, such as inventory purchases, marketing costs, and office supplies. Make sure to keep accurate records of these expenses.

05

If applicable, report any self-employment taxes, such as Medicare and Social Security taxes, that you may owe as a Mary Kay business owner.

06

Double-check all the information you have entered on the worksheet for accuracy and completeness.

07

Once you are satisfied with the information on the tax worksheet, transfer the relevant figures to your federal and state tax forms.

08

Submit your completed tax forms, along with any required payments, to the appropriate tax authorities by the deadline.

Who needs Mary Kay tax worksheet:

01

Mary Kay independent beauty consultants who generate income from their Mary Kay business.

02

Individuals who need to report their Mary Kay business income and expenses on their tax returns.

03

Any person who is required by the tax authorities to maintain accurate records of their Mary Kay business revenue and expenses.

Fill

form

: Try Risk Free

People Also Ask about

Is selling Mary Kay considered self employment?

Because Mary Kay consultants are independent distributors, they are subject to self-employment tax. Federal self-employment taxes must be paid on a quarterly basis.

Does Mary Kay send you a 1099?

Income Advisory Statements are also available on Mary Kay JnTouch®. If your wholesale purchases totaled more than $5,000 or you ·received $600 or more in commissions, prizes and awards, or you had any amount of income tax withheld during the tax year, you should also receive a Form 1099-MISC from Mary Kay.

Do I have to report Mary Kay on my taxes?

Do you have to file taxes with Mary Kay? Yes, you must file this income. Mary Kay will send you a Form 1099-MISC, which they also file with the IRS, so the IRS knows. Because you earned money, the IRS will not regard this as a hobby.

Does Mary Kay send w2?

If you earn less than $600 in a tax year, Mary Kay does not have to send you a Form 1099-MISC, but as a business owner, consultants must report their income to the Internal Revenue Service using Schedule C.

What can I write off for my Mary Kay business?

These items are travel-sized skin care, mini-brush sets, beauty roll up bags and purse mirrors. Include Mary Kay pins, jewelry, like the Pearls of Sharing, and any other prizes you use as sales incentives and awards for your team members. These items are all tax deductible.

Is Mary Kay a sole proprietorship?

As a Mary Kay Independent Beauty Consultant or Independent Sales Director, you are the sole proprietor of a business and are considered to be a self-employed or an independent contractor for federal income tax purposes under the Internal Revenue Code Section 162.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mary kay tax worksheet without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including mary kay tax worksheet. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit mary kay tax worksheet straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing mary kay tax worksheet.

How do I complete mary kay tax worksheet on an Android device?

Use the pdfFiller mobile app and complete your mary kay tax worksheet and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is mary kay tax worksheet?

The Mary Kay tax worksheet is a document used by Mary Kay consultants to organize and report their business income and expenses for tax purposes.

Who is required to file mary kay tax worksheet?

Mary Kay consultants who earn income from their business activities are required to file the Mary Kay tax worksheet to accurately report their earnings and expenses.

How to fill out mary kay tax worksheet?

To fill out the Mary Kay tax worksheet, consultants should gather records of their income and business-related expenses, then enter this information into the designated sections of the worksheet as instructed.

What is the purpose of mary kay tax worksheet?

The purpose of the Mary Kay tax worksheet is to help consultants track their business finances and ensure accurate reporting of their income and deductible expenses during tax time.

What information must be reported on mary kay tax worksheet?

Consultants must report their total sales, commission income, any bonuses received, and all business-related expenses such as product purchases, advertising, and operational costs on the Mary Kay tax worksheet.

Fill out your mary kay tax worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mary Kay Tax Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.