Get the free INSURANCE ANNUITY CUSTOMER PROFILE VA 111704 Pg

Show details

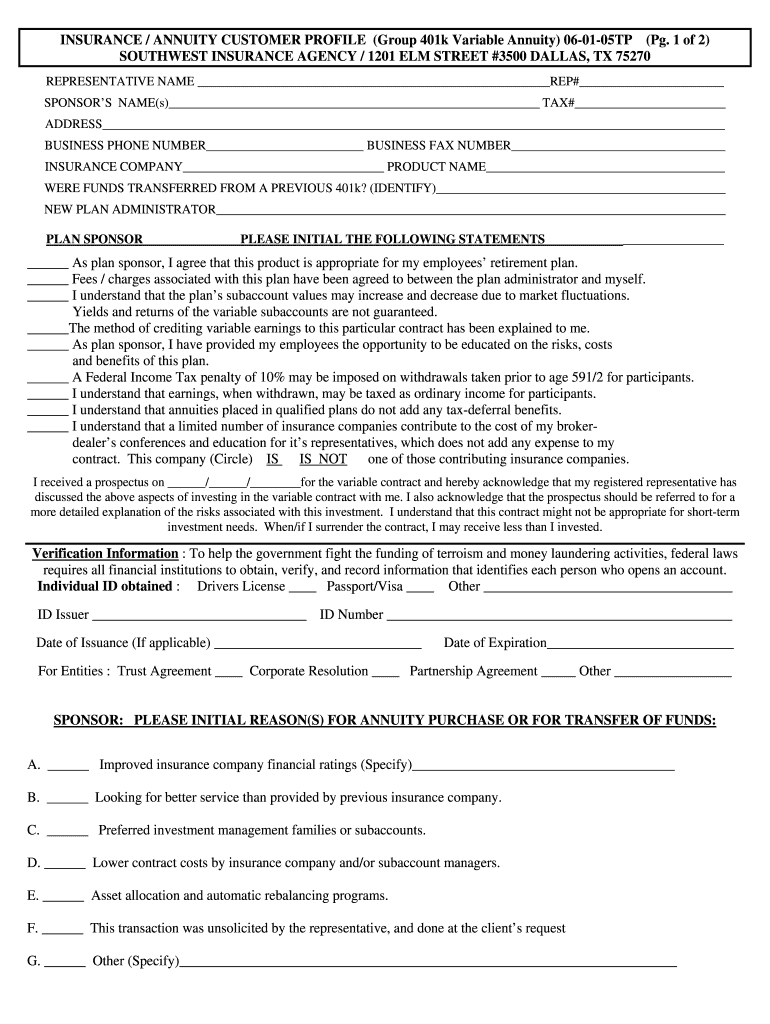

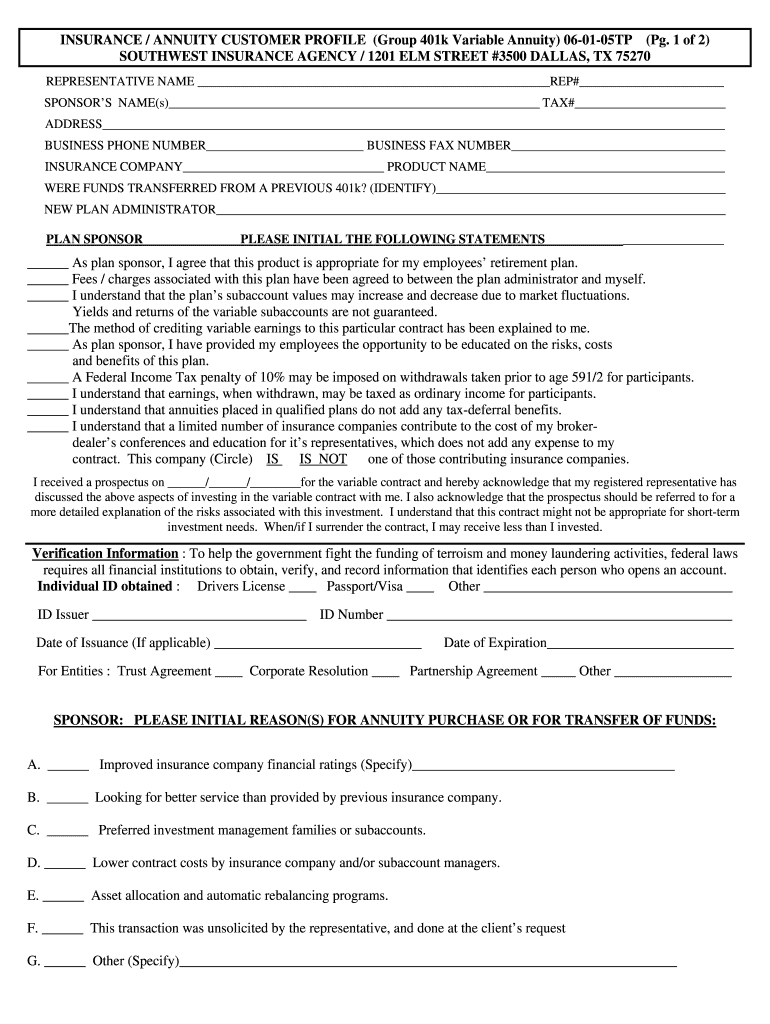

INSURANCE / ANNUITY CUSTOMER PROFILE (Group 401k Variable Annuity) 060105TP (Pg. 1 of 2) SOUTHWEST INSURANCE AGENCY / 1201 ELM STREET #3500 DALLAS, TX 75270 REPRESENTATIVE NAME REP# SPONSORS NAME(s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance annuity customer profile

Edit your insurance annuity customer profile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance annuity customer profile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance annuity customer profile online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance annuity customer profile. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance annuity customer profile

How to Fill Out Insurance Annuity Customer Profile:

01

Start by gathering all the necessary information. Make sure you have the customer's personal details such as their full name, address, phone number, and email address. Additionally, you may need their date of birth, social security number, and marital status.

02

Proceed to collect their financial information. This may include their annual income, assets, liabilities, and any outstanding debts. It is important to have an accurate understanding of their financial situation to determine the appropriate annuity plan for them.

03

Next, inquire about their investment goals and risk tolerance. Ask them about their investment experience, desired investment horizon, and how comfortable they are with market volatility. This will help you suggest the most suitable annuity options based on their preferences and risk appetite.

04

Be sure to ask about their current health condition. Some annuity plans may have specific health requirements or offer certain benefits based on the customer's health status. Inquire about any pre-existing medical conditions or if they are a smoker, as these factors may impact their annuity coverage.

05

Inquire about any beneficiaries the customer may want to designate. An annuity customer profile should include information about the primary and contingent beneficiaries. Obtain their full names, dates of birth, and social security numbers, if possible.

06

Finally, review the completed customer profile with the individual. Ensure all the provided information is accurate and complete. Address any questions or concerns they may have regarding the profile or the annuity options available to them.

Who Needs Insurance Annuity Customer Profile:

01

Individuals planning for retirement: A customer profile is essential for those who are considering an annuity as part of their retirement planning strategy. It helps insurance companies understand their financial situation, investment goals, and risk tolerance to recommend suitable annuity plans.

02

People seeking a guaranteed income stream: Annuities can provide a reliable source of income during retirement. Creating a customer profile allows insurance companies to customize annuity options based on an individual's income needs and financial circumstances.

03

Those who want to protect their beneficiaries: Annuities often offer death benefits that provide financial protection to beneficiaries after the customer's passing. The customer profile captures the necessary information required to designate beneficiaries and ensure their financial security.

04

Individuals with changing investment preferences: As people's financial goals and risk tolerance evolve, they may consider investing in annuities. A customer profile enables insurance companies to assess their changing needs and recommend annuity plans that align with their updated investment preferences.

05

People interested in tax-deferred growth: Annuities can provide tax advantages, such as tax-deferred growth, making them attractive to individuals looking to minimize their tax liabilities. By completing a customer profile, individuals can explore annuities as a tax-efficient investment option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my insurance annuity customer profile in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your insurance annuity customer profile as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out the insurance annuity customer profile form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign insurance annuity customer profile and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit insurance annuity customer profile on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share insurance annuity customer profile from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is insurance annuity customer profile?

Insurance annuity customer profile is a detailed document that profiles the customer's financial situation, risk tolerance, investment goals, and other relevant information.

Who is required to file insurance annuity customer profile?

Insurance agents, brokers, and other financial professionals are required to file insurance annuity customer profiles for their clients.

How to fill out insurance annuity customer profile?

Insurance annuity customer profile can be filled out by gathering information from the customer through interviews, questionnaires, and other data collection methods.

What is the purpose of insurance annuity customer profile?

The purpose of insurance annuity customer profile is to help insurance professionals better understand their clients' needs and provide suitable insurance products.

What information must be reported on insurance annuity customer profile?

Information such as customer's financial goals, risk tolerance, income, expenses, assets, liabilities, and investment preferences must be reported on insurance annuity customer profile.

Fill out your insurance annuity customer profile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Annuity Customer Profile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.