Get the free WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM - woodbury nj

Show details

Este formulario está diseñado para proporcionar a WCLF/CBAC la información suficiente para permitir la consideración efectiva de su solicitud de préstamo. Una solicitud completamente rellenada

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign woodbury american dream assistance

Edit your woodbury american dream assistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your woodbury american dream assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing woodbury american dream assistance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit woodbury american dream assistance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out woodbury american dream assistance

How to fill out WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM

01

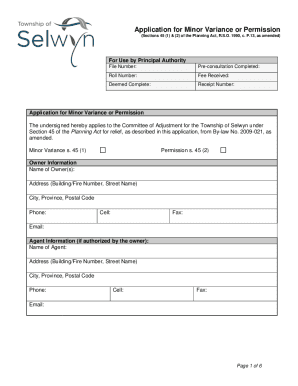

Obtain the application form from the Woodbury American Dream Assistance Program website or office.

02

Fill out personal information, including your name, address, and contact details.

03

Provide financial information, including income and expenses, to demonstrate eligibility.

04

Include documentation such as proof of income, tax returns, and any other required financial documents.

05

Describe your housing needs and plans, specifying how the assistance will help you achieve your homeownership goals.

06

Review the application for completeness and accuracy.

07

Submit the application by the specified deadline, either online or in person.

Who needs WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

01

Individuals or families who are first-time homebuyers.

02

Those seeking financial assistance for down payment or closing costs.

03

Residents of Woodbury who meet income and eligibility requirements.

04

People looking to achieve homeownership in the Woodbury area.

Fill

form

: Try Risk Free

People Also Ask about

What is the biggest negative when using down payment assistance?

Most plans are operated by local governments or nonprofit groups and provide assistance buyers can put toward a down payment or closing costs. You May Pay More Over Time. You May Not Qualify. You Can Overextend Yourself. Closing May Take Longer. You May Have Occupancy Requirements.

What is the America Home Grant?

Our America's Home Grant® program offers a lender credit of up to $7,500 that can be used towards non-recurring closing costs, like title insurance and recording fees, or to permanently buy down the interest rate. The funds do not require repayment.

What are the disadvantages of a down payment?

However, the downsides include tying up a significant amount of your money in one asset, potentially missing out on higher returns elsewhere, the risk of your home depreciating in value, and difficulty accessing your funds in case of a financial emergency.

What is the impact of a down payment?

A down payment lowers the overall loan amount, which can lead to better loan terms and potentially lower interest rates for the borrower. The amount you pay is generally a percentage of the total purchase price, typically ranging from 3% – 20%, depending on the type of loan and your borrower profile.

What is the Arkansas Dream Downpayment Initiative Addi?

Under this Arkansas Dream down payment initiative (ADDI), homebuyers can get up to 10% of the purchase price of their home or up to $10,000. It is for low-income borrowers. The US Department of Housing and Urban Development funds the Arkansas Dream down payment initiative. It is a second loan assistance.

What are the advantages and disadvantages of a small down payment?

It's important to note that making a smaller down payment can mean you'll have higher monthly mortgage payments and more interest charges over the life of the mortgage. However, it may be a worthwhile tradeoff if it means you can afford to purchase a home sooner rather than later.

How to get the money for a down payment?

Creative Down Payment Strategies: Finding Funds to Make Homeownership a Reality Traditional Savings. 401(k) Loans or Withdrawals. Gifts from Family or Friends. Income Tax Refunds. Grant Programs and Assistance. Refinancing an Auto Loan. Lender-Paid and Seller-Paid Costs. Other Creative Strategies.

What are the problems with down payments?

With a down payment of less than 20%, you may be subject to private mortgage insurance, or PMI, which is added to the monthly mortgage payment. Meanwhile, mortgage lenders tend to offer better loan terms to borrowers who put more cash up front, or make 20% down payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

The Woodbury American Dream Assistance Program is a funding initiative designed to provide financial assistance to eligible homebuyers in the Woodbury area, facilitating access to affordable housing.

Who is required to file WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

Individuals and families who wish to apply for financial assistance to purchase a home under the Woodbury American Dream Assistance Program are required to file the application.

How to fill out WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

To fill out the Woodbury American Dream Assistance Program application, applicants need to provide personal information, income details, and a description of the intended use of the funds, along with any required documentation.

What is the purpose of WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

The purpose of the Woodbury American Dream Assistance Program is to promote homeownership and provide financial support to residents, helping them overcome barriers to purchasing a home.

What information must be reported on WOODBURY AMERICAN DREAM ASSISTANCE PROGRAM?

Applicants must report their personal identification information, income sources, employment status, credit history, housing situation, and any other relevant financial details as specified in the application guidelines.

Fill out your woodbury american dream assistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Woodbury American Dream Assistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.