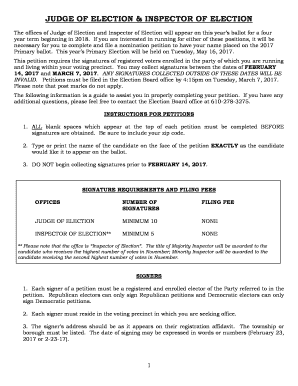

Minnesota statutes allow a property owner to demand any party having a lien against his/her property to supply the property owner with necessary information about the lien. Specifically, with this form the owner requests an itemized and verified account of the person's lien claim, the amount of it, and the claimant's name and address. The owner must make this request within fifteen (15) days after the completion of the contract. No action to enforce the lien may be taken by the lien claimant until the requested information is provided.

Get the free OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL

Show details

A form used by property owners to request lien information from lien holders regarding improvement projects on their property, outlining the details of the lien claim and the request for an itemized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign owners request for lien

Edit your owners request for lien form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your owners request for lien form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out owners request for lien

How to fill out OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL

01

Obtain the OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL form from the appropriate authority or website.

02

Fill in your personal information, including your name, address, and contact details.

03

Identify the property in question by providing its address and any relevant property identification numbers.

04

Specify the purpose of your request clearly.

05

Sign and date the form to verify your identity and intention.

06

Submit the completed form to the relevant office either via mail or in-person, depending on local guidelines.

Who needs OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

01

Individuals seeking information about any liens placed on their property.

02

Property owners who want to verify the status of liens before selling or refinancing their property.

03

Individuals involved in real estate transactions needing clarity on a property's lien history.

Fill

form

: Try Risk Free

People Also Ask about

How to write a letter requesting lien release?

Include essential details like VIN, year, make, model, owner name, and lienholder information. Ask your lienholder to complete a letter of non-interest if they have no further interest in collecting on the lien. Once you have these documents, mail copies to each address listed for your lienholder via certified mail.

Can an individual be a lien holder?

The lienholder can be a financial institution, a third party, or an individual.

Can someone put a lien on your car without you knowing?

No. He would not have a basis for filing a lien against your vehicle unless he obtains a judgment against you through a lawsuit typically. If he attempts to attach your vehicle, you could sue him for wrongful attachment if he has not obtained a court judgment for the amount allegedly owed.

Is lien good or bad?

Liens won't automatically hurt your credit. Consensual liens are harmless, so long as they're repaid. Others, such as mechanic's or judgement liens, can negatively impact your financial situation. Aim to keep all of your liens consensual to keep your credit score and report in good standing.

Who is considered the lien holder?

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender — which can be a bank, financial institution or private party — holds a lien, or legal claim, on the property because they lent you the money to purchase it.

What happens when a lien is placed on you?

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

Can I put a lien on myself?

A property owner can choose to place a lien on their property. A voluntary lien is a claim over the property that a homeowner agrees to give to a creditor as security for the payment of a debt. A mortgage lien is the most common type of voluntary real estate lien, also called a deed of trust lien in some states.

Is lienholder the same as owner?

If a vehicle is part of a financing agreement, the legal owner will be the individual or entity that provides the financing, and is referred to as the lienholder. The registered owner is responsible for maintaining compliance with DMV laws and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL is a formal request made by an individual property owner to obtain information regarding any liens that may be placed against their property.

Who is required to file OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

Individuals who own real property and want to inquire about the existence of liens on their property are required to file OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL.

How to fill out OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

To fill out the OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL, the property owner must provide details such as their name, address, and the specific property in question, along with any required fees as outlined by the lien holder or relevant authority.

What is the purpose of OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

The purpose of OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL is to allow property owners to verify if any encumbrances exist on their property, which could affect ownership rights or property value.

What information must be reported on OWNER'S REQUEST FOR LIEN INFORMATION--INDIVIDUAL?

The information that must be reported includes the property owner's name, address, the property's legal description, and any other identifying details required by the authority processing the request.

Fill out your owners request for lien online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Owners Request For Lien is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.