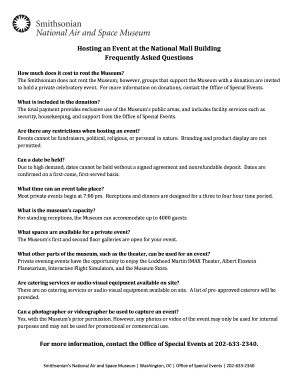

Get the free Protect your retirement savings from future market dips

Show details

Protect your retirement savings from future market dips. An Allianz annuity can help. With Allianz fixed index annuities, an unpredictable market isn't so intimidating. Allianz fixed index annuities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign protect your retirement savings

Edit your protect your retirement savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your protect your retirement savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit protect your retirement savings online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit protect your retirement savings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out protect your retirement savings

How to Protect Your Retirement Savings:

01

Start by creating a budget: Assess your current financial situation and identify your retirement savings goals. Determine the amount you need to save and strategically allocate your funds towards achieving those goals.

02

Diversify your investments: Don't put all your eggs in one basket. Spread your investments across various asset classes such as stocks, bonds, real estate, and mutual funds. Diversification helps mitigate risks and smoothens the overall performance of your portfolio.

03

Build an emergency fund: Establish a separate savings account to serve as an emergency fund. This will provide a safety net in case unexpected expenses arise, preventing you from tapping into your retirement savings prematurely.

04

Contribute consistently to retirement accounts: Take full advantage of retirement vehicles such as Employer-Sponsored Retirement Plans (e.g., 401(k)) or Individual Retirement Accounts (IRAs). Regularly contribute to these accounts and max out any employer matches to maximize your savings potential.

05

Monitor and adjust your investment strategy: Regularly review your investment portfolio and assess its performance. Make necessary adjustments based on your risk tolerance and market conditions. Consult with a financial advisor to ensure your investment strategy aligns with your retirement goals.

06

Consider insurance options: Protect your retirement savings against potential risks like medical emergencies, disability, or long-term care needs. Explore insurance policies such as health insurance, long-term care insurance, or disability insurance to safeguard your assets.

07

Minimize debt and control expenses: Reducing debt and maintaining control over your expenses are crucial elements in protecting your retirement savings. Pay off high-interest debt and adopt a frugal mindset to free up more funds for savings and investment purposes.

08

Stay informed and seek professional advice: Keep up-to-date with financial news and trends to make informed decisions about your retirement savings. If needed, consult with a financial advisor who can provide personalized guidance based on your unique circumstances and retirement aspirations.

Who needs to protect their retirement savings?

01

Individuals approaching retirement age: As retirement approaches, protecting your savings becomes paramount. Ensuring your funds are preserved and grow steadily enables you to enjoy a comfortable retirement.

02

Young professionals: Even at the early stages of your career, it's crucial to start protecting your retirement savings. By taking appropriate measures early on, you can capitalize on the power of compound interest and set a solid foundation for your future.

03

Self-employed or gig economy workers: Individuals who don't have access to traditional employer-sponsored retirement plans need to take proactive steps to protect their retirement savings. They can explore options such as contributing to IRAs or setting up a Solo 401(k) to secure their financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify protect your retirement savings without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including protect your retirement savings, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit protect your retirement savings online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your protect your retirement savings to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the protect your retirement savings electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your protect your retirement savings in seconds.

What is protect your retirement savings?

Protect your retirement savings refers to the process of safeguarding the funds set aside for retirement from potential risks or losses.

Who is required to file protect your retirement savings?

Individuals who have retirement savings accounts are typically required to protect their retirement savings.

How to fill out protect your retirement savings?

To fill out protect your retirement savings, individuals need to review and assess their retirement savings accounts, identify potential risks, and take appropriate measures to protect them.

What is the purpose of protect your retirement savings?

The purpose of protect your retirement savings is to ensure that individuals can retire comfortably and securely without losing their hard-earned savings to unforeseen circumstances or events.

What information must be reported on protect your retirement savings?

Information such as the current balance of retirement savings accounts, investment portfolio details, and any potential risks or vulnerabilities must be reported on protect your retirement savings.

Fill out your protect your retirement savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Protect Your Retirement Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.