Get the free Income and Assets - Second Innings

Show details

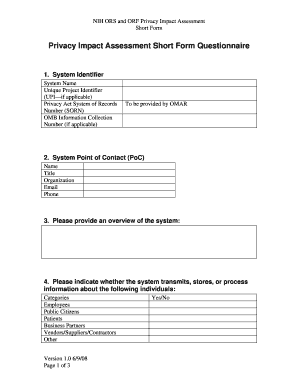

Income and Assets Purpose of this form asks you to provide information about your income and assets. This information is used to calculate your Centrelink payment. Definition of a partner For the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income and assets

Edit your income and assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income and assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income and assets online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income and assets. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income and assets

How to fill out income and assets:

01

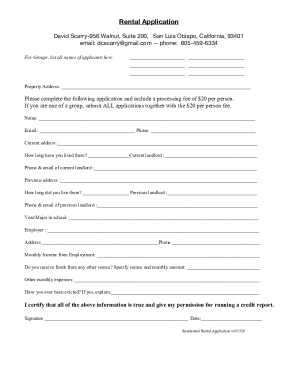

Begin by gathering all relevant financial documents, such as pay stubs, bank statements, investment statements, and any other sources of income documentation.

02

Create a list of all sources of income, including wages, salaries, bonuses, rental income, interest income, and any other types of income received.

03

Organize the income information into categories and list them accordingly on the income section of the form. Be sure to include the exact amounts received for each source of income.

04

When it comes to assets, make a list of all valuable belongings such as properties, vehicles, jewelry, savings accounts, retirement accounts, stocks, and any other significant assets.

05

Include the approximate value of each asset on the assets section of the form. For properties and vehicles, consider obtaining appraisals to ensure accurate values are reported.

06

Double-check all the information entered to avoid errors or omissions that could lead to incomplete or inaccurate forms.

07

It is essential to fill out income and assets forms for various purposes, such as applying for loans, submitting financial aid applications, or during divorce or bankruptcy proceedings.

08

Individuals, families, or businesses who are legally required to report their income and assets must fill out these forms accurately and honestly within the specified timeframe.

Who needs income and assets:

01

Individuals applying for loans or mortgages may be required to disclose their income and assets to determine their eligibility and repayment capacity.

02

When applying for financial aid, students and their families must provide income and assets information to assess their financial need and eligibility for grants, scholarships, or tuition assistance.

03

During divorce or separation proceedings, income and assets need to be disclosed to ensure a fair division of property and determine spousal or child support obligations.

04

Individuals filing for bankruptcy must declare their income and assets as part of the bankruptcy process to help determine their ability to repay debts and establish a repayment plan.

05

Some government assistance programs or benefits may require applicants to provide income and assets information to determine eligibility and the level of assistance they qualify for.

06

Businesses or organizations may also need to provide income and assets information when applying for loans, grants, contracts, or during audits to ensure proper financial reporting and transparency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income and assets in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your income and assets, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete income and assets on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your income and assets. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit income and assets on an Android device?

You can edit, sign, and distribute income and assets on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is income and assets?

Income refers to the money that an individual or entity earns on a regular basis. Assets refer to the valuable resources owned by an individual or entity.

Who is required to file income and assets?

Individuals and entities who earn income and own assets are required to file income and assets.

How to fill out income and assets?

Income and assets can be filled out by providing accurate and detailed information about all sources of income and assets owned.

What is the purpose of income and assets?

The purpose of income and assets is to assess an individual's or entity's financial situation, determine tax liabilities, and ensure compliance with financial regulations.

What information must be reported on income and assets?

Information such as sources of income, amount of income earned, types of assets owned, and their value must be reported on income and assets forms.

Fill out your income and assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income And Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.