Get the free Offsets To Operating Expenditures

Show details

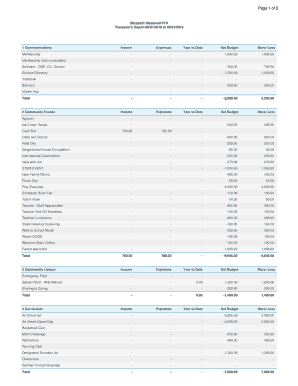

12/21/2011 11 : 21 Image# 11953336276 PAGE 1 / 9 REPORT OF RECEIPTS AND DISBURSEMENTS FEC FORM 3X For Other Than An Authorized Committee OFCE Use Only 1. TYPE OR PRINT NAME OF COMMITTEE (in full)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offsets to operating expenditures

Edit your offsets to operating expenditures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offsets to operating expenditures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offsets to operating expenditures online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit offsets to operating expenditures. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offsets to operating expenditures

How to fill out offsets to operating expenditures:

01

Start by gathering all relevant financial records and documentation related to operating expenditures. This will include receipts, invoices, and any supporting documents.

02

Identify the specific expenses that can be offset with available funds. These may include expenses related to equipment purchases, maintenance costs, utilities, and other operational expenses.

03

Calculate the total amount of offsets available. This can be done by referring to any surplus funds, grants, subsidies, or any other sources of income that can be used to offset the operating expenditures.

04

Allocate the offsets to the corresponding expenses. Create a breakdown of the expenses and allocate the calculated offsets to each category accordingly. This will help ensure accurate recording and reporting of the financial transactions.

05

Complete the necessary forms or reports required for offsetting operating expenditures. This may include filling out specific sections of financial statements, tax forms, or any other official documentation required by the organization or regulatory bodies.

06

Double-check all the information provided and ensure accuracy. Review all calculations, amounts, and supporting documents to avoid any mistakes or discrepancies that may affect the offsetting process.

Who needs offsets to operating expenditures:

01

Organizations or businesses that have surplus funds or alternative sources of income can benefit from using offsets to reduce their overall operating expenses. It allows them to minimize expenses, optimize financial resources, and potentially improve their financial position.

02

Non-profit organizations and government entities often require offsets to operating expenditures to ensure efficient use of funds and compliance with budget regulations. By offsetting expenses, they can redirect available funds to other priority areas or projects.

03

Start-up companies or small businesses with limited financial resources may also consider offsets to operating expenditures as a means to manage and control expenses. It can help alleviate financial strain and improve cash flow, especially during the early stages of business development.

In conclusion, filling out offsets to operating expenditures involves gathering financial records, calculating available offsets, allocating them to expenses, completing necessary forms, and ensuring accuracy. Organizations, non-profits, government entities, and small businesses can benefit from using offsets to manage expenses effectively and optimize financial resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is offsets to operating expenditures?

Offsets to operating expenditures are deductions or reductions from income or revenues that are used to cover operating expenses.

Who is required to file offsets to operating expenditures?

All businesses or organizations that have operating expenditures are required to file offsets to operating expenditures.

How to fill out offsets to operating expenditures?

Offsets to operating expenditures can be filled out by listing the specific deductions or reductions from income or revenues that are being used to cover operating expenses.

What is the purpose of offsets to operating expenditures?

The purpose of offsets to operating expenditures is to accurately account for how income or revenues are being used to cover operating expenses.

What information must be reported on offsets to operating expenditures?

Information such as the specific deductions or reductions from income or revenues, the corresponding operating expenses being covered, and the total amount of offsets must be reported on offsets to operating expenditures.

How do I execute offsets to operating expenditures online?

Easy online offsets to operating expenditures completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in offsets to operating expenditures without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit offsets to operating expenditures and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out offsets to operating expenditures on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your offsets to operating expenditures, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your offsets to operating expenditures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offsets To Operating Expenditures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.