Get the free RETURNED ITEM CHARGE AUTHORIZATION

Show details

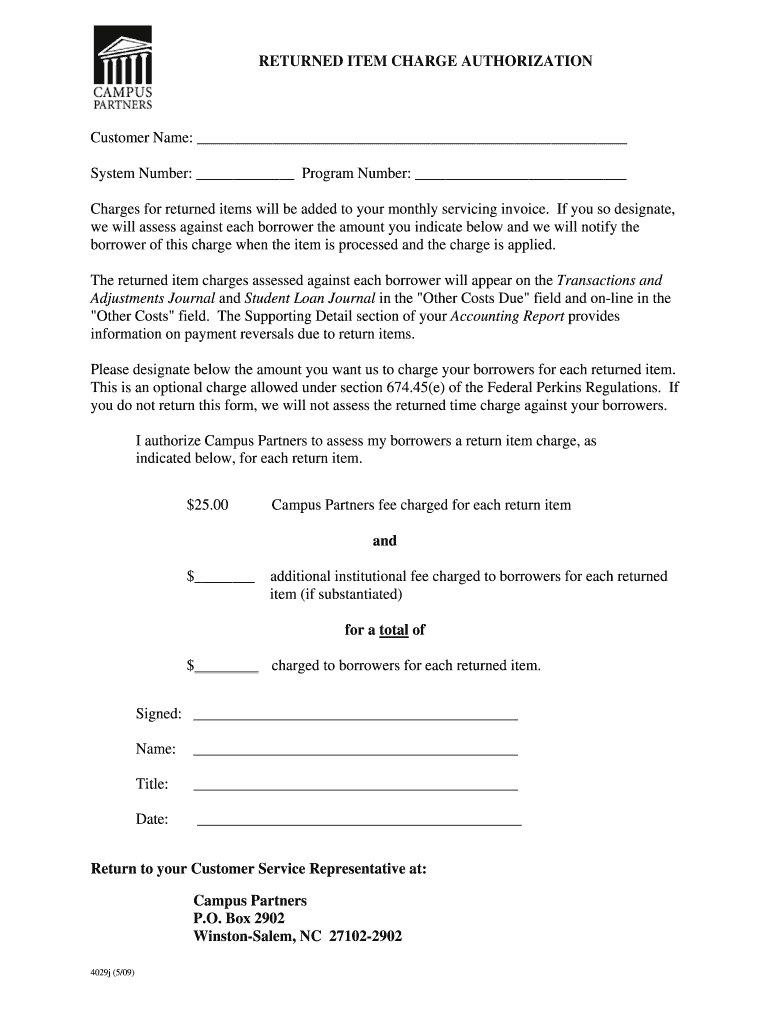

This document authorizes charges for returned items to be added to the monthly servicing invoice. It specifies the charges to be assessed against borrowers and outlines the process for notification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign returned item charge authorization

Edit your returned item charge authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your returned item charge authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit returned item charge authorization online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit returned item charge authorization. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out returned item charge authorization

How to fill out RETURNED ITEM CHARGE AUTHORIZATION

01

Obtain a copy of the RETURNED ITEM CHARGE AUTHORIZATION form.

02

Fill in your name and account information in the designated fields.

03

Provide the details of the returned item, including item description and reason for return.

04

Indicate the charge amount you are authorizing for the returned item.

05

Sign and date the form to confirm your authorization.

06

Submit the completed form to the appropriate department or receiver.

Who needs RETURNED ITEM CHARGE AUTHORIZATION?

01

Customers returning items to a retailer or service provider.

02

Businesses processing returns and needing authorization for charges.

03

Financial institutions handling returned checks or transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is a return item charge back?

A return item chargeback is a fee assessed to a banking customer who attempts to deposit or cash a third-party check, but said check is rejected. These fees occur as debits to the consumer's checking account. A return item chargeback is something a bank issues to their own customer.

What is a returned item fee charge?

A returned item fee/NSF fee is a charge imposed when you lack enough funds in your checking account to cover a transaction — and you don't have overdraft protection. It may also be referred to as a return check fee or returned payment fee.

What is a returned item fee?

A returned item fee, or non-sufficient funds (NSF) fee, is what your financial institution charges when it declines or returns a transaction because of insufficient funds in your account. Returned items.

What is the returned item charge?

Returned item charges are bank fees that are assessed when you don't have enough money in your account to cover a check (or online payment) and the bank doesn't cover that payment. Instead, they return the check or deny the electronic payment, and hit you with a penalty fee.

How do I avoid returned payment fees?

Q: How can I prevent returned check fees? To prevent returned check fees, ensure there are sufficient funds in your account before issuing a check. Regularly balance your checkbook, set up overdraft protection, or maintain a budget to avoid accidental overdrafts.

What is an authorization charge?

Authorization hold (also card authorization, preauthorization, or preauth) is a service offered by credit and debit card providers whereby the provider puts a hold of the amount approved by the cardholder, reducing the balance of available funds until the merchant clears the transaction (also called settlement), after

What does returned payment charge mean?

The returned payment fee is applied to your account if payment from your direct debit or cheque has been rejected because of insufficient funds in the account you are making the payment from. The charge can be avoided by making sure there is enough money in the account you pay your credit card bill from.

Why am I being charged a return fee?

Key Takeaways. A returned payment fee is a charge incurred when a consumer bounces a payment. Payments may be returned because of insufficient funds in a consumer's account, closed accounts, or frozen accounts. Banks and other financial institutions charge their consumers returned payment fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RETURNED ITEM CHARGE AUTHORIZATION?

RETURNED ITEM CHARGE AUTHORIZATION is a formal request or approval process that allows a financial institution to charge a fee for items that are returned due to insufficient funds or other reasons.

Who is required to file RETURNED ITEM CHARGE AUTHORIZATION?

Typically, merchants, businesses, or financial institutions that handle checks or electronic transactions are required to file RETURNED ITEM CHARGE AUTHORIZATION.

How to fill out RETURNED ITEM CHARGE AUTHORIZATION?

To fill out RETURNED ITEM CHARGE AUTHORIZATION, the filer must provide details such as the account holder's information, the reason for the returned item, the amount of the charge, and any applicable supporting documentation.

What is the purpose of RETURNED ITEM CHARGE AUTHORIZATION?

The purpose of RETURNED ITEM CHARGE AUTHORIZATION is to ensure that financial institutions and businesses have the legal authority to charge fees for returned items, thus mitigating losses due to insufficient funds.

What information must be reported on RETURNED ITEM CHARGE AUTHORIZATION?

The information that must be reported includes the account number, the name of the account holder, the date of the returned item, the item amount, the reason for the return, and any relevant transaction details.

Fill out your returned item charge authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Returned Item Charge Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.