Get the free STEP UP HOME LOAN APPLICATION FORM

Show details

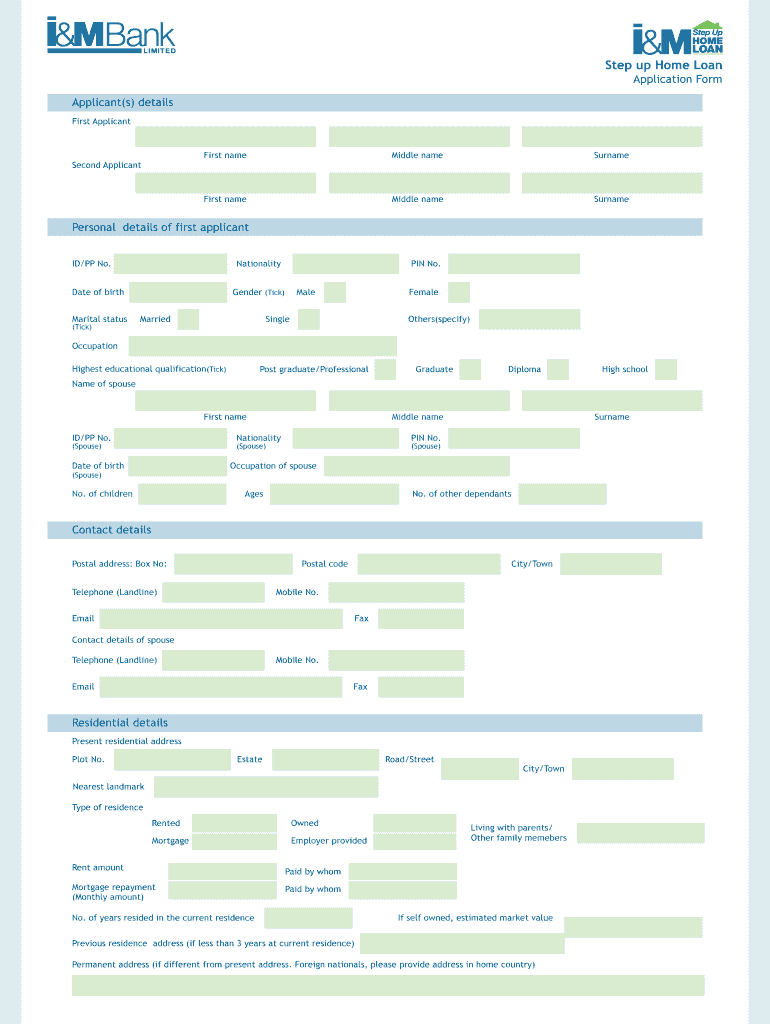

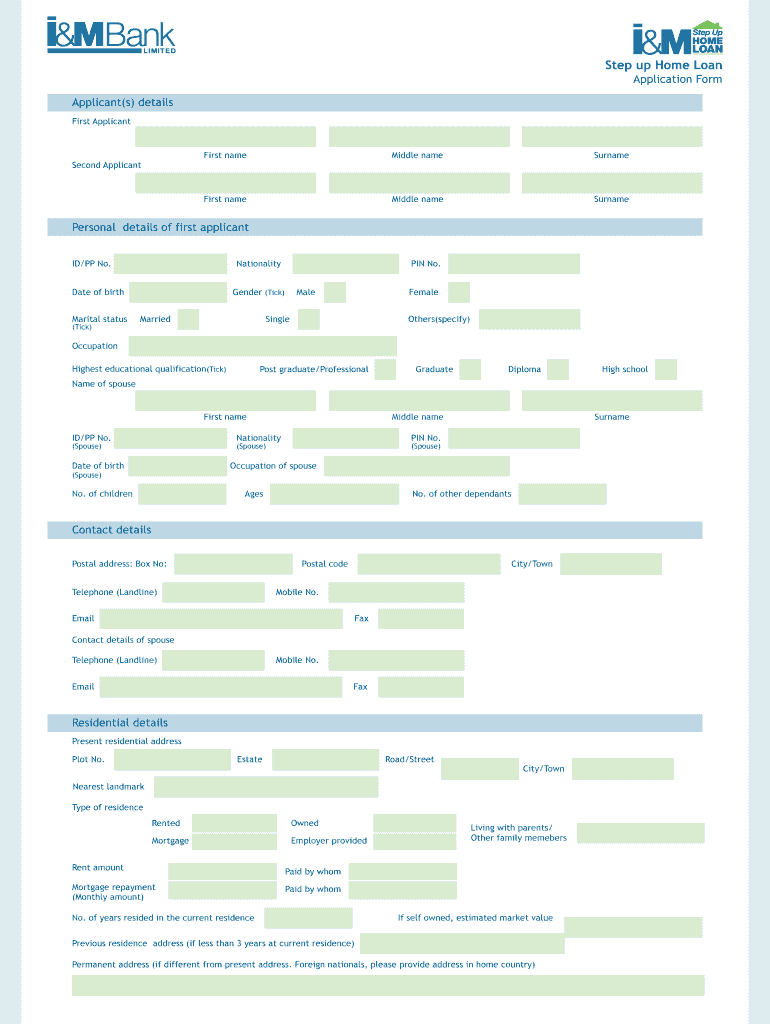

Step up Home Loan Application Form Applicant(s) details First Applicant First name Middle name Surname First name Second Applicant Middle name Surname Personal details of first applicant ID/PP No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign step up home loan

Edit your step up home loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your step up home loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing step up home loan online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit step up home loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out step up home loan

How to fill out a step-up home loan:

01

Research and Understand the Loan: First, familiarize yourself with the concept of a step-up home loan. It is an adjustable-rate mortgage where the interest rates gradually increase over time. Gather information about the loan terms, eligibility criteria, and any additional requirements.

02

Find a Lender: Identify reputable lenders who offer step-up home loans. Research their interest rates, fees, and customer reviews. Compare multiple lenders to ensure you get the best deal.

03

Gather Necessary Documents: Prepare the required documents such as identity proof, income proof, bank statements, address proof, and property-related documents. Each lender may have specific document requirements, so be sure to check their guidelines.

04

Calculate Loan Eligibility: Use online calculators or consult with the lender to determine the loan amount you are eligible for. The loan amount depends on factors such as your income, credit history, existing debts, and the value of the property you intend to purchase.

05

Complete the Application: Fill out the loan application form provided by the lender. Provide accurate and complete information to avoid any delays or complications.

06

Submit the Documents: Attach all the necessary documents to the application form. Make sure you have photocopies or scanned copies of the original documents.

07

Pay Any Required Fees: Some lenders may charge application fees or processing fees. Ensure you have the necessary funds available to cover these costs.

08

Await Loan Approval: After submitting your application, the lender will review your documents, verify your information, and assess your creditworthiness. It may take some time for them to process your request.

09

Sign the Loan Agreement: Once your application is approved, carefully read the loan agreement provided by the lender. Ensure you understand the terms and conditions before signing it.

10

Disbursement of Funds: Upon signing the loan agreement, the lender will disburse the loan amount to the seller or builder, as per the agreed terms. Coordinate with the concerned parties to initiate the payment.

Who needs a step-up home loan?

01

Homebuyers with Low Current Income: This type of loan is suitable for individuals or families who have a relatively low current income but anticipate an increase in their income over time. The gradual increase in interest rates allows borrowers to manage their initial financial burden and make affordable repayments initially.

02

Young Professionals and First-time Homebuyers: Step-up home loans can be a great choice for young professionals or first-time homebuyers who expect their income to increase as their career progresses. It allows them to start with lower monthly installments and gradually adjust to higher payments in the future.

03

Those Planning to Upgrade Homes: Individuals or families planning to upgrade their current residence may find step-up home loans beneficial. As they move to a better or larger property, they may need additional funds that can be managed through a step-up loan structure.

Remember, it is essential to thoroughly research and consider your financial situation and future income prospects before opting for a step-up home loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my step up home loan in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign step up home loan and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send step up home loan to be eSigned by others?

To distribute your step up home loan, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit step up home loan on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign step up home loan right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is step up home loan?

A step up home loan is a type of mortgage where the borrower initially makes lower monthly payments which gradually increase over time.

Who is required to file step up home loan?

Individuals seeking to purchase a new home and requiring additional funds to meet the increased financial demands of a property purchase.

How to fill out step up home loan?

To fill out a step up home loan, individuals need to provide information on their personal finances, property details, and employment history.

What is the purpose of step up home loan?

The purpose of a step up home loan is to provide borrowers with the flexibility to make lower payments initially and gradually increase as their income grows.

What information must be reported on step up home loan?

Information such as personal details, financial information, property details, and employment history must be reported on a step up home loan application.

Fill out your step up home loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Step Up Home Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.