Get the free Life Insurance Collateral Assignments

Show details

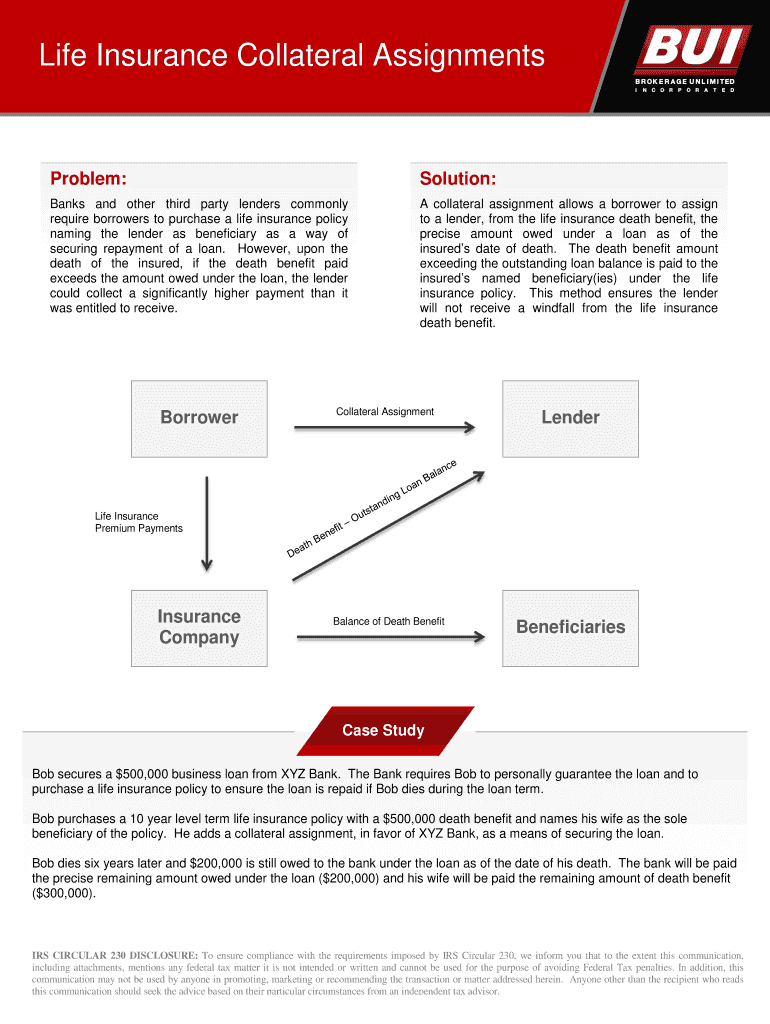

Life Insurance Collateral AssignmentsProblem:Solution:Banks and other third party lenders commonly

require borrowers to purchase a life insurance policy

naming the lender as beneficiary as a way of

securing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance collateral assignments

Edit your life insurance collateral assignments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance collateral assignments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance collateral assignments online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life insurance collateral assignments. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance collateral assignments

How to fill out life insurance collateral assignments:

01

Gather necessary information: Before starting the process, gather all the information and documentation required for filling out the life insurance collateral assignments. This may include the policy information, collateral assignment form, and any relevant legal documents.

02

Understand the purpose: It is important to understand why a collateral assignment is necessary and how it impacts the life insurance policy. A collateral assignment allows the policyholder to use their policy as collateral for a loan or other financial obligation. By assigning the policy to a lender or creditor, they can legally access the policy's cash value in case of default.

03

Read and comprehend the collateral assignment form: Thoroughly go through the collateral assignment form provided by the insurance company or lender. Understand the terms, conditions, and any specific instructions mentioned in the form. This will help ensure accuracy when filling out the form.

04

Provide accurate policy information: Fill out the policyholder's name, policy number, and any other required details accurately. Mistakes or incorrect information may lead to complications later on.

05

Specify the collateral assignment details: Clearly state the name of the assignee, usually the lender or creditor, who will have rights to the policy's cash value. Include their contact information and any additional instructions mentioned in the form.

06

Determine the assignment amount or percentage: Decide on the amount or percentage of the life insurance policy's cash value that will be assigned as collateral. This should be based on the loan or financial obligation being secured. Make sure to indicate the specific amount or percentage clearly in the form.

07

Consider additional beneficiaries: If there are additional beneficiaries listed on the policy, consider whether their rights may be impacted by the collateral assignment. Seek professional advice if needed.

Who needs life insurance collateral assignments:

01

Borrowers seeking loans: Individuals or businesses who need to secure a loan from a lender may require life insurance collateral assignments. Lenders often require this to mitigate their risk in case of default.

02

Business owners securing funding: Business owners looking to obtain funding, whether for expansion, investment, or other purposes, may be required to assign their life insurance policies as collateral.

03

Individuals with financial obligations: Those who have significant financial obligations, such as outstanding debts or legal obligations, may choose to assign their life insurance policies as collateral to secure these obligations.

04

Policyholders exploring liquidity options: Some policyholders may want to access the cash value of their life insurance policies without surrendering the policy altogether. Collateral assignments allow them to do so, providing a liquidity option.

05

Estate planning purposes: In certain estate planning scenarios, collateral assignments can be utilized to protect assets, ensure financial stability, or facilitate gifting strategies. It is essential to consult with a financial advisor or estate planning attorney in such cases.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get life insurance collateral assignments?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the life insurance collateral assignments in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute life insurance collateral assignments online?

Filling out and eSigning life insurance collateral assignments is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the life insurance collateral assignments form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign life insurance collateral assignments and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is life insurance collateral assignments?

Life insurance collateral assignments are agreements where the policyholder assigns the benefits of their life insurance policy to a lender as collateral for a loan.

Who is required to file life insurance collateral assignments?

The policyholder who is using their life insurance policy as collateral for a loan is required to file the collateral assignment.

How to fill out life insurance collateral assignments?

To fill out a life insurance collateral assignment, the policyholder must provide their policy information, loan details, and sign the assignment form.

What is the purpose of life insurance collateral assignments?

The purpose of life insurance collateral assignments is to provide security to the lender in case the borrower defaults on the loan.

What information must be reported on life insurance collateral assignments?

The information that must be reported on life insurance collateral assignments includes policy details, lender information, loan amount, and the assignment date.

Fill out your life insurance collateral assignments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Collateral Assignments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.