Get the free LOYAL AMERICAN LIFE INSURANCE COMPANY P

Show details

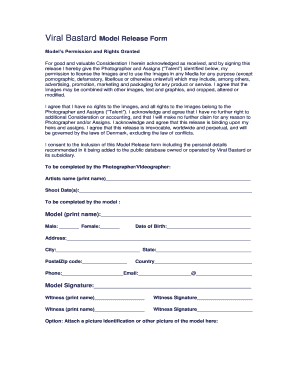

These expenses include the Medicare deductibles for Part A and Part B, but do not include the plan#39’s separate foreign travel emergency deductible. LY-OC-AA- ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loyal american life insurance

Edit your loyal american life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loyal american life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loyal american life insurance online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loyal american life insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loyal american life insurance

How to fill out loyal american life insurance:

01

Gather necessary information: Before filling out the form, collect all the required information such as personal identification details, contact information, and beneficiary information. Make sure to have the policy number handy if applicable.

02

Review the form: Carefully read the loyal american life insurance form to understand the sections and the information requested. Look out for any specific instructions or additional documents required.

03

Personal information: Start by providing your full legal name, date of birth, social security number, and current address. Ensure accuracy and double-check for any errors.

04

Contact information: Fill in your phone number, email address, and any preferred method of communication.

05

Beneficiary details: Specify the name, relationship, and contact details of the beneficiary who will receive the life insurance benefits in the event of your passing. It's important to choose someone you trust and ensure their information is accurate.

06

Health questions: Loyalty american life insurance forms often include questions about your current health status, medical history, and any pre-existing conditions. Answer these questions honestly and disclose all relevant information to avoid any complications during the claims process.

07

Additional disclosures: Some forms may require you to disclose your occupation, hobbies, or engage in a lifestyle-related questionnaire. Follow the instructions and provide accurate information to enable a correct coverage assessment.

08

Review and sign: Carefully review all the information provided in the form to ensure it is accurate and complete. If there are any errors, make the necessary corrections. Finally, sign and date the form before submitting it.

09

Submitting the form: Once you have completed the loyal american life insurance form, follow the instructions on how to submit it. This may involve mailing it to the company's address or submitting it online, depending on the available options.

Who needs loyal american life insurance:

01

Breadwinners: Loyal american life insurance is essential for anyone who is the primary income earner in their family. It provides financial protection to replace lost income and secure the well-being of the dependents in case of their untimely passing.

02

Parents: Parents with children who are financially dependent on them should consider loyal american life insurance. It ensures that their children's education expenses, daily living costs, and other needs are taken care of even if they are no longer there to provide for them.

03

Homeowners: Buying a home often involves taking a mortgage. Loyal american life insurance can help homeowners ensure that their outstanding mortgage balance is paid off, preventing their family from losing the house due to financial difficulties after their death.

04

Business owners: If you are a business owner, loyal american life insurance can be crucial. It can protect your family and business interests by providing funds to cover business debts, pay off partners, or buy out shares in the event of your demise.

05

Individuals with financial obligations: People with significant financial obligations such as debts, loans, or cosigned agreements can benefit from loyal american life insurance. It ensures that these obligations do not become burdensome for their loved ones if they pass away unexpectedly.

06

Those seeking to leave a legacy: For individuals who wish to leave money behind for their loved ones, loyal american life insurance can serve as a means to create a financial legacy. It allows for the accumulation of cash value over time, which can be inherited by the beneficiaries.

07

Anyone concerned about funeral expenses: Funeral costs can be overwhelming for families facing the loss of a loved one. Loyal american life insurance can help cover these expenses, relieving the financial burden on the family during an already challenging time.

08

Individuals with specific financial goals: Loyal american life insurance can be part of a comprehensive financial plan, especially for individuals with specific financial goals such as saving for retirement, building wealth, or leaving money to a charitable cause.

09

People seeking peace of mind: Ultimately, loyal american life insurance provides peace of mind to policyholders. It reassures individuals that their loved ones' financial security will be protected even if they are no longer around.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loyal american life insurance?

Loyal American Life Insurance is a type of insurance policy that provides coverage in the event of the policyholder's death.

Who is required to file loyal american life insurance?

Individuals who have purchased a Loyal American Life Insurance policy are required to file the insurance claim in the event of the policyholder's death.

How to fill out loyal american life insurance?

To file a Loyal American Life Insurance claim, the beneficiary must contact the insurance company and provide the necessary information and documentation.

What is the purpose of loyal american life insurance?

The purpose of Loyal American Life Insurance is to provide financial protection for the policyholder's beneficiaries in the event of the policyholder's death.

What information must be reported on loyal american life insurance?

The beneficiary must report the policyholder's personal information, policy details, and proof of death to file a Loyal American Life Insurance claim.

Where do I find loyal american life insurance?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific loyal american life insurance and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit loyal american life insurance straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing loyal american life insurance right away.

How do I fill out loyal american life insurance using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign loyal american life insurance and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your loyal american life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loyal American Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.