Get the free RDS Sales Tax Holiday Remittance Form - revdscom

Show details

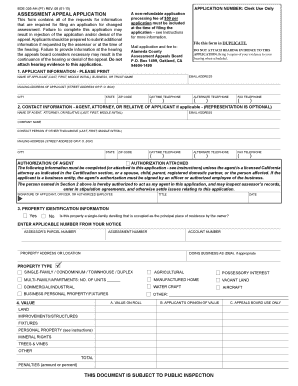

City of Thomasville RDS Sales Tax Holiday Remittance Form Remit To: Tax Division PO Box 830725 Birmingham, AL 352830725 Phone:(800) 5567274 Fax: (205) 4234099 Website: www.revds.com Business Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rds sales tax holiday

Edit your rds sales tax holiday form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rds sales tax holiday form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rds sales tax holiday online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rds sales tax holiday. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rds sales tax holiday

How to fill out rds sales tax holiday:

01

Start by gathering all the necessary documents and information required for the application.

02

Visit the official website of the relevant tax authority or the designated online platform for rds sales tax holiday.

03

Create an account or log in if you already have one.

04

Follow the instructions provided on the website or platform to access the application form for rds sales tax holiday.

05

Carefully complete all the required fields in the application form, providing accurate and up-to-date information.

06

Double-check your entries for any errors or omissions before submitting the form.

07

If there are any supporting documents required, make sure to upload them as instructed.

08

Review the application one final time to ensure all information is accurate and complete.

09

Submit the application and keep a copy for your records.

Who needs rds sales tax holiday:

01

Businesses that operate in states or regions where sales tax holidays are implemented.

02

Individuals who plan to make qualifying purchases during the sales tax holiday period.

03

Retailers and merchants who want to offer discounts and promotions during the sales tax holiday to attract customers.

Note: The specific eligibility criteria and requirements for rds sales tax holiday may vary depending on the jurisdiction and applicable tax laws. It is advised to consult the official guidelines or seek professional advice for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rds sales tax holiday for eSignature?

When you're ready to share your rds sales tax holiday, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit rds sales tax holiday on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing rds sales tax holiday.

How can I fill out rds sales tax holiday on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your rds sales tax holiday, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is rds sales tax holiday?

The rds sales tax holiday is a period during which certain items are exempt from sales tax.

Who is required to file rds sales tax holiday?

Businesses that sell eligible items during the sales tax holiday are required to file rds sales tax holiday.

How to fill out rds sales tax holiday?

To fill out rds sales tax holiday, businesses must report the total sales of eligible items during the tax holiday period.

What is the purpose of rds sales tax holiday?

The purpose of rds sales tax holiday is to stimulate economic activity by encouraging consumers to make purchases during the tax-free period.

What information must be reported on rds sales tax holiday?

Businesses must report the total sales of eligible items during the tax holiday period, as well as any exemptions or deductions claimed.

Fill out your rds sales tax holiday online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rds Sales Tax Holiday is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.