Get the free Creditor or IRS problems

Show details

Benefits of

A

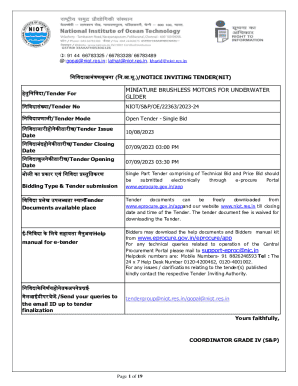

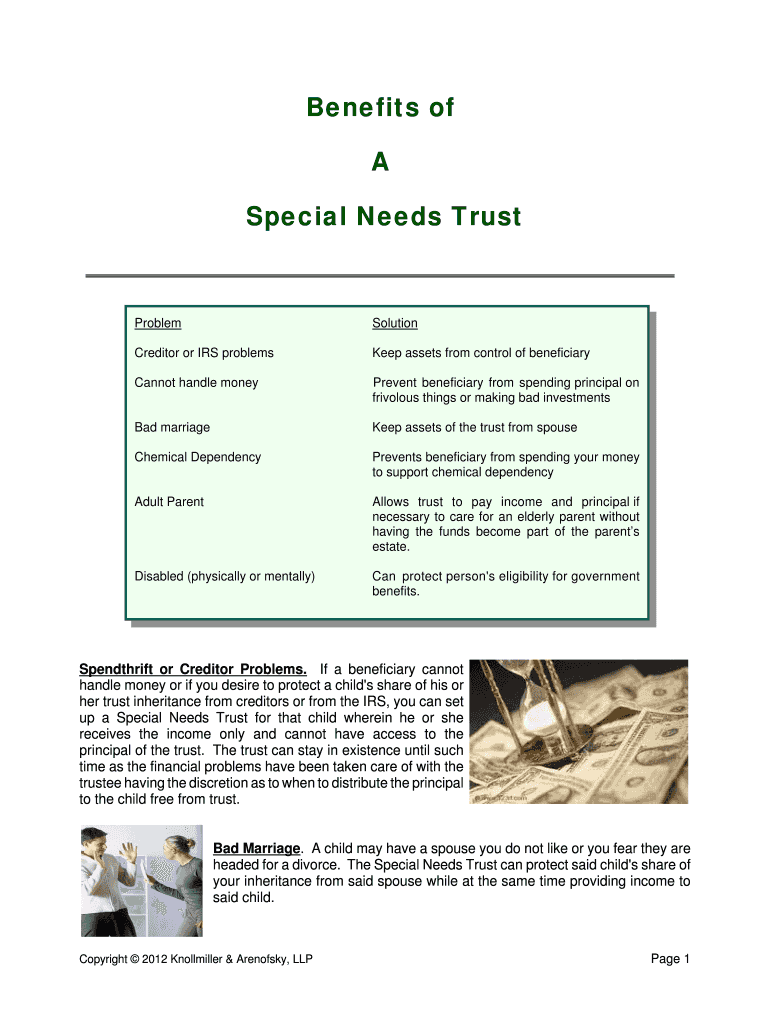

Special Needs TrustProblemSolutionCreditor or IRS problemsKeep assets from control of beneficiaryCannot handle moneyPrevent beneficiary from spending principal on

frivolous things or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creditor or irs problems

Edit your creditor or irs problems form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditor or irs problems form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing creditor or irs problems online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit creditor or irs problems. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditor or irs problems

How to fill out creditor or IRS problems:

01

Understand the problem: Take the time to analyze and understand the specific issue you are facing with creditors or the IRS. Identify the root cause and gather all relevant information, such as debt amounts, outstanding payments, or tax-related documentation.

02

Seek professional help: If you are unsure about how to address creditor or IRS problems, consider consulting with a financial advisor, tax professional, or attorney specializing in debt or tax issues. They can provide valuable guidance and assist you in navigating the complex procedures involved.

03

Communicate with creditors: If you are struggling to make timely payments to your creditors, reach out to them and explain your situation. Try to negotiate a new payment plan or request a temporary suspension of payments, if applicable. Being proactive and transparent can often result in finding a mutually agreeable solution with creditors.

04

Understand your rights: As a debtor, it is crucial that you are aware of your rights. Research and familiarize yourself with consumer protection laws relevant to creditor or IRS problems, such as the Fair Debt Collection Practices Act (FDCPA) or the Internal Revenue Code. Knowing your rights can help you advocate for yourself and handle any unfair or improper practices.

05

Gather necessary documentation: Prepare all the required documents and paperwork needed to address your creditor or IRS problems effectively. This may include financial statements, bank statements, tax returns, proof of income, or any other documentation relevant to your specific situation. Having these documents readily available will streamline the process and ensure that you have all the necessary information at hand.

06

Respond promptly and accurately: It is essential to promptly respond to any communication or notices received from creditors or the IRS. Ignoring or neglecting these notices may further aggravate the situation. Ensure that your responses are accurate and honest to avoid any potential repercussions.

Who needs creditor or IRS problems?

01

Individuals struggling with outstanding debts: People who are finding it challenging to make payments to their creditors or are being pursued by debt collectors may find themselves in need of assistance with creditor problems.

02

Businesses facing financial difficulties: Small business owners or entrepreneurs dealing with mounting debts or financial challenges might require help addressing creditor issues to protect their business interests.

03

Individuals or businesses experiencing tax-related issues: Taxpayers who are facing difficulties with the IRS, such as unpaid taxes, audits, or disputes, may need assistance to resolve their tax problems appropriately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my creditor or irs problems in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your creditor or irs problems and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit creditor or irs problems from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including creditor or irs problems, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the creditor or irs problems in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is creditor or irs problems?

Creditor or IRS problems refer to issues related to repayment of debts or tax obligations.

Who is required to file creditor or irs problems?

Individuals or businesses who have outstanding debts or tax liabilities are required to file creditor or IRS problems.

How to fill out creditor or irs problems?

To fill out creditor or IRS problems, one must provide detailed information about the debts or tax liabilities, and any efforts made to resolve them.

What is the purpose of creditor or irs problems?

The purpose of creditor or IRS problems is to report and address outstanding debts or tax obligations to creditors or the IRS.

What information must be reported on creditor or irs problems?

Information such as the amount owed, the creditor or tax authority involved, and any payment plans or negotiations should be reported on creditor or IRS problems.

Fill out your creditor or irs problems online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creditor Or Irs Problems is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.