Get the free Flexible Credit Application and Plan

Show details

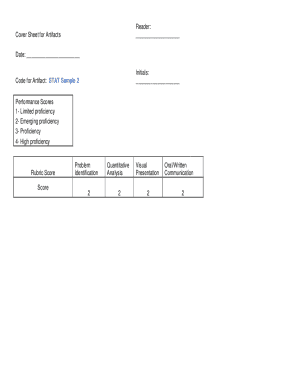

This document is an application for students to request flexible credit options which allows them to earn credits toward graduation through various methods, including examinations and demonstrating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible credit application and

Edit your flexible credit application and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible credit application and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible credit application and online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flexible credit application and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible credit application and

How to fill out Flexible Credit Application and Plan

01

Download the Flexible Credit Application and Plan from the official website.

02

Read the instructions carefully to understand the requirements.

03

Gather necessary documents such as income proof, identity verification, and financial statements.

04

Fill out personal information, including your name, address, and contact details.

05

Provide information about your employment status and income.

06

Disclose any existing debts or credit obligations.

07

Review your application to ensure all information is accurate and complete.

08

Submit the application online or via the specified mailing address.

Who needs Flexible Credit Application and Plan?

01

Individuals seeking to manage their finances with flexible payment options.

02

People looking to consolidate debt or improve their credit score.

03

Those requiring financial assistance for unexpected expenses.

04

Borrowers who prefer customized repayment plans.

Fill

form

: Try Risk Free

People Also Ask about

What does a flexible loan mean?

Flex loans are actually a line of credit, rather than a traditional loan. Flex loans allow you to access cash in an amount up to an approved credit limit. Flex loans may be an option for people with poor or no credit history, but lenders typically charge high interest rates.

How does flexible credit work?

Flexible credit is an unsecured credit account allowing you to withdraw money up to the agreed credit limit. Flexible credit is paid off monthly. You can also repay the loan early to reduce the credit costs. Flexible credit may also be referred to as a flexible loan or a flexible overdraft.

What does Flexi credit mean?

“FlexiCredit” means a type of committed credit facility which allows the Borrower to borrow on an ongoing basis while repaying the balance in regular payments.

What is a flexible line of credit?

What is a Flex Line of Credit? It's a loan approved for a predetermined amount, or credit limit. You decide how much you'd like to use and for what. You can use it all, or part of it, anytime you want without having to reapply, all with no annual fees or cash advance fees.

What does flexible credit limit mean?

A flexible spending credit card is a product offered by certain financial institutions that may have a variable credit limit based on your ongoing account activity. The credit limit on a traditional credit card usually cannot be exceeded but can also be changed in certain situations.

How does Currys flexible credit work?

Currys flexpay account offers you flexible credit on tech when you spend over £99 at Currys – that means you choose what you want to buy and then work out how long you want to pay, or how much you can afford each month. There's no need for a deposit and you select a monthly payment you can afford. Simple!

What is FCL in banking terms?

Foreign Currency Loans (FCL) and Foreign Currency Term Loans (FCTL) are provided by banks to Indian corporations to help them with working capital needs in place of WCDLs and to convert rupee term loans into FCTLs. Working capital (FCL) is made available to exporters and importers for 180 days.

What does "flexible credit" mean?

Flexible credit is an unsecured credit account allowing you to withdraw money up to the agreed credit limit. Flexible credit is paid off monthly. You can also repay the loan early to reduce the credit costs. Flexible credit may also be referred to as a flexible loan or a flexible overdraft.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Flexible Credit Application and Plan?

The Flexible Credit Application and Plan is a financial tool or program designed to provide borrowers with flexible credit options, allowing them to apply for credit and manage payments according to their specific financial situations.

Who is required to file Flexible Credit Application and Plan?

Individuals or businesses seeking to obtain flexible credit options from lenders or financial institutions are typically required to file the Flexible Credit Application and Plan.

How to fill out Flexible Credit Application and Plan?

To fill out the Flexible Credit Application and Plan, applicants need to provide personal and financial information such as income, employment details, existing debts, and requested credit amount, ensuring all details are accurate and complete.

What is the purpose of Flexible Credit Application and Plan?

The purpose of the Flexible Credit Application and Plan is to assess the creditworthiness of applicants while offering them tailored credit solutions that accommodate their unique financial needs.

What information must be reported on Flexible Credit Application and Plan?

Key information that must be reported includes personal identification details, financial status, income, existing liabilities, and any other relevant data that influences credit evaluation.

Fill out your flexible credit application and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Credit Application And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.