Get the free 7430 F4

Show details

This document serves as a certification for employees who have received training on Personal Protective Equipment (PPE). It includes sections for employee details, training dates, instructor information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 7430 f4

Edit your 7430 f4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 7430 f4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 7430 f4 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 7430 f4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 7430 f4

How to fill out 7430 F4

01

Begin by downloading the 7430 F4 form from the official website.

02

Fill in your personal information such as name, address, and contact details in the designated sections.

03

Provide any identification numbers required, such as Social Security Number or other relevant IDs.

04

Complete the specific sections related to the purpose of the form, ensuring you answer each question accurately.

05

Review the filled form for any errors or omissions.

06

Sign and date the form where indicated.

07

Submit the completed form by following the instructions provided for submission, whether by mail or online.

Who needs 7430 F4?

01

Individuals or businesses that are required to report specific information to a government agency or organization.

02

Taxpayers needing to file necessary forms for tax adjustments or claims.

03

Persons applying for certain benefits or permits that require this specific documentation.

Fill

form

: Try Risk Free

People Also Ask about

How do I turn off the F4 key light on my Dell laptop?

While holding down FN, press the F4 button. The light should be gone, which means the Mic is working.

What does F4 do on Dell?

Enable Mute using the keyboard: Press the Fn and F4 keys simultaneously to mute the microphone. (A Light Emitting Diode (LED) on the F4 key lights up to show it has been activated.) You can press the F4 key to mute the microphone, if the Fn lock has been set in the BIOS.

How to unlock F4 key on Dell laptop?

Check Fn lock settings On most Dell laptops, you can turn the Fn lock on and off by pressing the Fn key + Esc key. If the function keys are locked, this will solve the problem.

What is the F4 key on a Dell laptop?

There is no dedicated Fn Lock key on most Dell laptops to disable the F1 to F12 Function keys. The Function Lock is enabled/disabled by pressing the Fn key (on the bottom row next to the Windows button) and the Esc key (on the top row next to the Function keys) together like a toggle switch.

Why won't my F4 light turn off?

If you have a light on that key (or whichever key has a blue mic with an X icon), hold Fn and tap F4. If the light stays on, your computer has Fn lock enabled, so simply hit F4 instead. If the mic and camera are set to block or ask, change them to 'Allow' by clicking on them.

Why is the F4 light on my Dell laptop?

Enable Mute using the keyboard: You can press the F4 key to mute the microphone, if the Fn lock has been set in the BIOS. (The LED lights up on the key to show it is in use.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

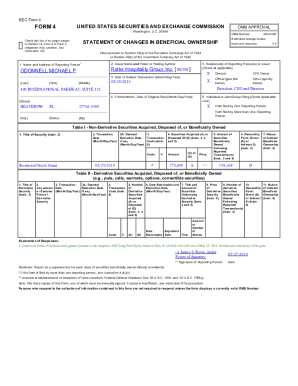

What is 7430 F4?

7430 F4 is a tax form used for reporting specific financial information related to certain types of transactions for tax purposes.

Who is required to file 7430 F4?

Individuals or entities that engage in the specified financial transactions outlined by the IRS and meet certain threshold requirements are required to file 7430 F4.

How to fill out 7430 F4?

To fill out 7430 F4, taxpayers must provide accurate financial data as instructed on the form, including names, addresses, identification numbers, and transaction details, ensuring all entries are correct and complete.

What is the purpose of 7430 F4?

The purpose of 7430 F4 is to ensure compliance with tax regulations by reporting detailed information about specific financial activities, which helps the IRS monitor and assess tax liabilities.

What information must be reported on 7430 F4?

The information that must be reported on 7430 F4 includes details of the transactions, parties involved, amounts, dates, and any other relevant data as specified by the IRS instructions for the form.

Fill out your 7430 f4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

7430 f4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.