Get the free CREDIT CARD REQUISITION

Show details

This document is used to requisition a credit card for purchases, including necessary information for processing and approvals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card requisition

Edit your credit card requisition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card requisition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card requisition online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit card requisition. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

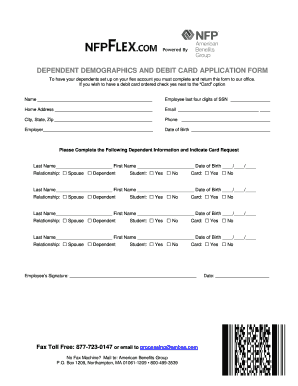

How to fill out credit card requisition

How to fill out CREDIT CARD REQUISITION

01

Obtain a CREDIT CARD REQUISITION form from the finance department or download it from the company's internal portal.

02

Fill in your name, employee ID, and department at the top of the form.

03

Specify the purpose of the credit card requisition under the 'Purpose' section.

04

Enter the estimated amount needed for the requisition in the 'Amount' field.

05

List the specific items or services you intend to purchase with the credit card in the designated section.

06

Attach any required supporting documentation, such as quotes or invoices, to justify the requisition.

07

Have your supervisor or manager review and approve the form by signing it.

08

Submit the completed form along with any attachments to the finance department for processing.

Who needs CREDIT CARD REQUISITION?

01

Employees who need to make purchases for work-related purposes using company funds.

02

Managers who oversee budget allocations and require additional credit for project expenses.

03

Departments that frequently make purchases and require a streamlined purchasing process.

Fill

form

: Try Risk Free

People Also Ask about

What is a credit card confirmation?

What is Card Verification? Simply put, card verification is the step in the payment process where a combination of features in ATM, debit, and credit cards are used to confirm the owner's identity.

How do I get a $5000 credit card?

You can get a credit card with a $5,000 limit if you have good to excellent credit, a high income and minimal debt. For example, the Chase Sapphire Preferred® Card is a premium card that offers a credit limit of $5,000 or higher.

How do you request a new credit card?

Check your online account or latest credit card statement for the correct phone number to call. Online: The card issuer's website usually has an option to request a new credit card online. Mobile app: You can use many credit cards' mobile apps to request a replacement credit card directly within the app.

How to get a US credit card for non-residents?

What you'll need to apply for a credit card as a foreigner Full legal name. Date of birth. U.S. address. Contact information. SSN or ITIN. Citizenship status. Country of citizenship. Passport and passport number.

How do you get a credit card?

To apply for a credit card, you'll provide personal and financial information to the issuer, and they'll use that to decide whether to offer you the card. Approval of your application will depend on various factors, such as credit score, income, and credit history.

How to write a credit card authorization letter?

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

How do you request a credit card?

Here are seven steps to help you find the right card for you and apply with confidence: Check your credit reports and scores. Explore credit cards. Understand the terms and fees. Understand what you need to apply. Find out whether you're pre-approved. Submit your credit card application. Use your card responsibly.

Is it CCV or CVV on a credit card?

A card security code (CSC; also known as CVC, CVV, or several other names) is a series of numbers that, in addition to the bank card number, is printed (but not embossed) on a credit or debit card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT CARD REQUISITION?

A CREDIT CARD REQUISITION is a formal request to obtain or use a company-issued credit card for business-related expenses.

Who is required to file CREDIT CARD REQUISITION?

Employees who need to use the company credit card for business purposes must file a CREDIT CARD REQUISITION.

How to fill out CREDIT CARD REQUISITION?

To fill out a CREDIT CARD REQUISITION, provide personal and departmental information, specify the purpose of the request, and include estimated expenses with necessary approvals.

What is the purpose of CREDIT CARD REQUISITION?

The purpose of a CREDIT CARD REQUISITION is to ensure proper authorization and tracking of business-related expenses incurred through the use of a company credit card.

What information must be reported on CREDIT CARD REQUISITION?

Information required includes the requester's name, department, purpose of the credit card use, estimated amount of expenses, and necessary approvals from supervisors.

Fill out your credit card requisition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Requisition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.