Get the free BAD DEBT REPORT FORM FOR FUND RAISERS

Show details

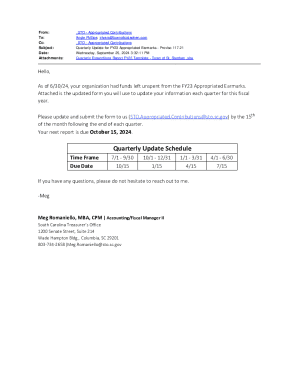

This document is intended for teachers and activity treasurers to document efforts made to collect funds from students who have merchandise out but have not turned in any money.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bad debt report form

Edit your bad debt report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bad debt report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bad debt report form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bad debt report form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bad debt report form

How to fill out BAD DEBT REPORT FORM FOR FUND RAISERS

01

Obtain a copy of the BAD DEBT REPORT FORM FOR FUND RAISERS.

02

Fill in the basic information such as your name, contact details, and date of the report.

03

List each individual or organization that owes money, including their contact information.

04

Provide details of the fundraising event, including the name of the event, date, and amount raised.

05

Specify the amount owed by each debtor and any repayments received, including dates.

06

Explain the steps taken to collect the debt, including any communication efforts made.

07

Sign and date the report to certify the information provided is accurate.

Who needs BAD DEBT REPORT FORM FOR FUND RAISERS?

01

Fundraising organizations that have outstanding debts.

02

Event organizers needing to document unpaid contributions.

03

Financial officers of charities or non-profits managing funds from events.

Fill

form

: Try Risk Free

People Also Ask about

What is the best way to write off a bad debt?

How to Write off Bad Debts Assess the debt. Before proceeding with any actions, it is essential to carefully assess the debt to determine its collectability. Record the bad debt expense. Review options. Document everything. Adjust your books. Seek professional advice. Automate debt collection to reduce future write-offs.

Is bad debts cr or dr?

Here, bad debt is directly written off to a receivable account. While the bad debts account is debited, the accounts receivable account is credited. Although through this method, the exact amount of uncollectible debt is recorded, it does not follow the matching principle of accrual accounting.

How do you report bad debt expense?

When reporting bad debts expenses, a company can use the direct write-off method or the allowance method. The direct write off method reports the bad debt on an organization's income statement when the non-paying customer's account is actually written off, sometimes months after the credit transaction took place.

How do I write-off a bad debt from previous years?

Include the income in your tax return You can only claim a bad debt deduction for amounts you have included in your assessable income, either in your tax return for the year you claim the deduction or in an earlier income year.

What is an acceptable bad debt percentage?

The bad debt rate must remain permanently below 1%, ideally below 0.2%, although the definition of an acceptable rate depends on a company's profitability, industry and type of customer base. Otherwise, you must make significant progress in securing your business and in trade receivable collection management processes.

How do I write-off an unpaid debt?

Using the Direct Write-Off Method, you should debit the bad debt expense and credit accounts receivable to clear the specific amount that can't be collected. With the Allowance Method, debit the bad debt expense and credit an allowance for doubtful accounts, which covers estimated uncollectible amounts.

What is the best way to write-off debt?

Which debt solutions write off debts? Bankruptcy: Writes off unsecured debts if you cannot repay them. Any assets like a house or car may be sold. Debt relief order (DRO): Writes off debts if you have a relatively low level of debt. Must also have few assets. Individual voluntary arrangement (IVA): A formal agreement.

Which method is best for accounting for bad debts?

While both allowance and direct write-off methods are used to write off bad debt in the accounting books of a company, the former is considered to be more accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BAD DEBT REPORT FORM FOR FUND RAISERS?

The BAD DEBT REPORT FORM FOR FUND RAISERS is a document used to report uncollectible debts incurred during fundraising activities, ensuring transparency and accountability in financial reporting.

Who is required to file BAD DEBT REPORT FORM FOR FUND RAISERS?

Fundraising organizations, charities, and nonprofits that have incurred bad debts as part of their fundraising efforts are required to file this form.

How to fill out BAD DEBT REPORT FORM FOR FUND RAISERS?

To fill out the BAD DEBT REPORT FORM, organizations need to provide details regarding the debts they are reporting, including the debtor's information, the amount owed, the date of the debt, and the reason the debt is deemed uncollectible.

What is the purpose of BAD DEBT REPORT FORM FOR FUND RAISERS?

The purpose of the BAD DEBT REPORT FORM is to document and report debts that are unlikely to be collected, allowing organizations to better manage their finances and maintain accurate records.

What information must be reported on BAD DEBT REPORT FORM FOR FUND RAISERS?

The information that must be reported includes the debtor's name, contact information, amount of the debt, the nature of the fundraising campaign, the date the debt was incurred, and explanation of efforts made to collect the debt.

Fill out your bad debt report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bad Debt Report Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.