Get the free CREDIT CARD EXPENDITURES

Show details

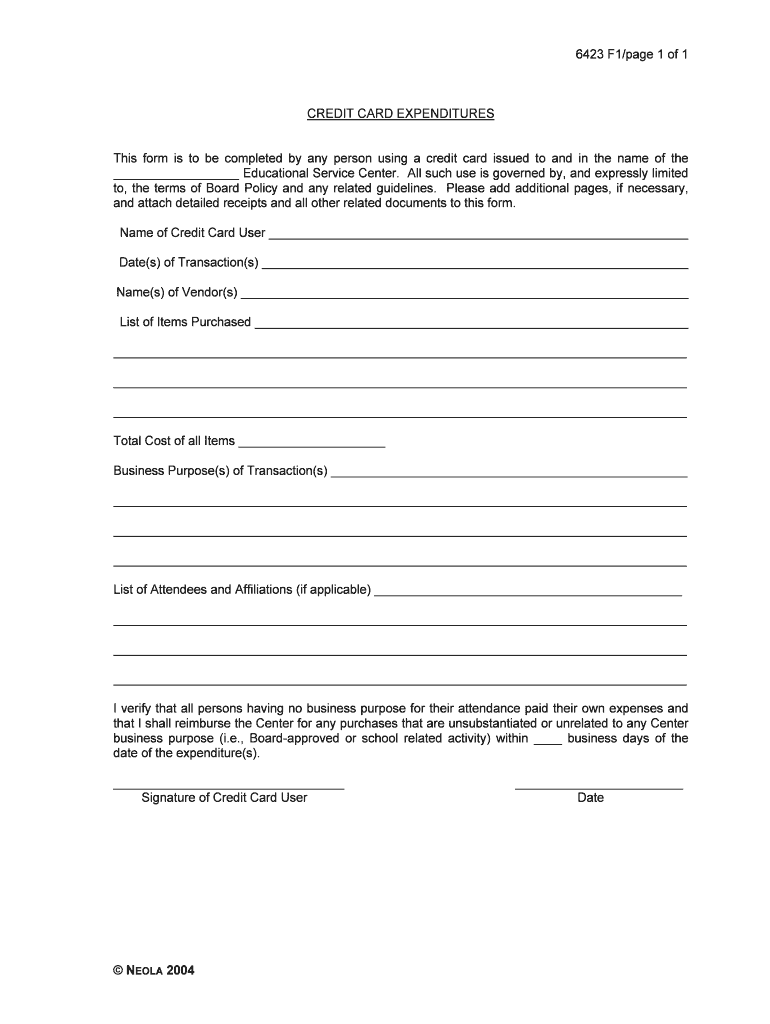

This form is to document the expenditures made using a credit card issued by the Educational Service Center, ensuring all transactions align with Board Policy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card expenditures

Edit your credit card expenditures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card expenditures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card expenditures online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit card expenditures. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card expenditures

How to fill out CREDIT CARD EXPENDITURES

01

Gather all your credit card statements for the relevant period.

02

Open a spreadsheet or use a budgeting app to record expenditures.

03

List the date of each transaction.

04

Specify the merchant or vendor name for each purchase.

05

Enter the amount spent for each transaction.

06

Categorize each expense (e.g., groceries, dining, utilities).

07

Total your expenditures by category to see where your money goes.

08

Review and adjust your budget as needed based on your findings.

Who needs CREDIT CARD EXPENDITURES?

01

Individuals looking to track their spending habits.

02

Small business owners managing business expenses.

03

Financial planners helping clients budget effectively.

04

Anyone preparing for tax season who needs detailed expense records.

05

Students wanting to manage their personal finances better.

Fill

form

: Try Risk Free

People Also Ask about

What's a good credit card utilization?

A general rule of thumb is to keep your credit utilization ratio below 30%. And if you really want to be an overachiever, aim for 10%. According to Experian, people who keep their credit utilization under 10% for each of their cards also tend to have exceptional credit scores (a FICO® Score☉ of 800 or higher).

Is it better to have 0% or 1% credit utilization?

While a 0% utilization is certainly better than having a high CUR, it's not as good as something in the single digits. Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score.

What is an example of credit card utilization?

Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. So, for example, if you have two credit cards, each with a $1,000 limit, and owe $500 on one and $250 on the other, your credit utilization ratio is $750 divided by $2,000, or 37.5 percent.

What is credit card 30% utilisation?

It serves as a tool for evaluating how effectively you are managing your current debts. Keeping your credit card balances below 30% of your total available revolving credit is generally recommended to maintain a good credit utilisation ratio.

How bad is 100% credit utilization?

Credit scoring models may consider the highest utilization rate on a revolving account in addition to your overall utilization rate. Having a card with a very high utilization rate, such as 100%, can hurt your credit score even if your overall utilization is relatively low.

What is credit card utilisation?

Credit utilization is the percentage of your total credit used from the total credit available to you. Learn more about credit utilization and how it can impact your credit. [

How to check credit card expenditure?

If you use a Credit Card, you will receive a statement every month, which records all the transactions you have made during the previous one month. Depending on how you have opted to receive it, you will get the Credit Card statement via courier at your correspondence address or as an email statement or both.

What is the Utilisation of a credit card?

Your credit utilization ratio, generally expressed as a percentage, represents the amount of revolving credit you're using divided by the total credit available to you. Lenders use your credit utilization ratio to help determine how well you're managing your current debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT CARD EXPENDITURES?

CREDIT CARD EXPENDITURES refer to the expenses incurred through transactions made using a credit card, including purchases, fees, and interest charges associated with credit card use.

Who is required to file CREDIT CARD EXPENDITURES?

Individuals and businesses that use credit cards for their expenses and require documentation for accounting or tax purposes may be required to file CREDIT CARD EXPENDITURES.

How to fill out CREDIT CARD EXPENDITURES?

To fill out CREDIT CARD EXPENDITURES, gather all relevant receipts, categorize the expenses, and provide details such as date, description of purchase, amount spent, and the associated credit card used.

What is the purpose of CREDIT CARD EXPENDITURES?

The purpose of CREDIT CARD EXPENDITURES is to track and record expenses for budgeting, accounting, and tax reporting, ensuring accurate financial records and responsible spending.

What information must be reported on CREDIT CARD EXPENDITURES?

The information that must be reported on CREDIT CARD EXPENDITURES includes the date of transaction, merchant name, amount spent, purpose of the expense, and the credit card used for the transaction.

Fill out your credit card expenditures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Expenditures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.