Get the free 6611 F1

Show details

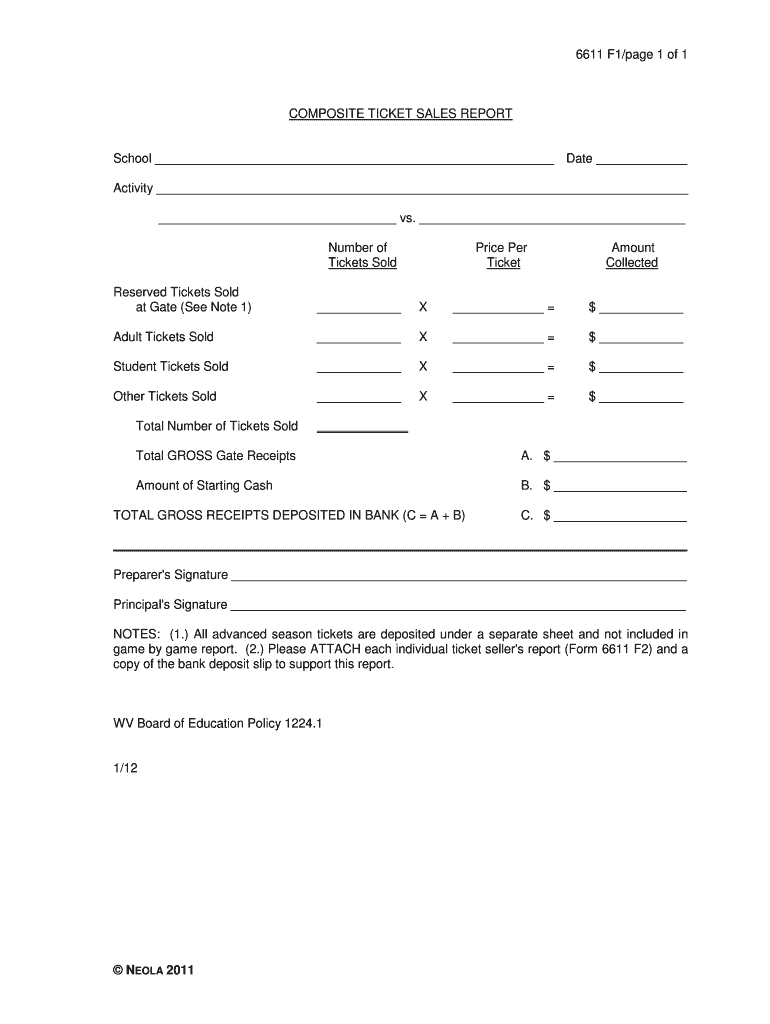

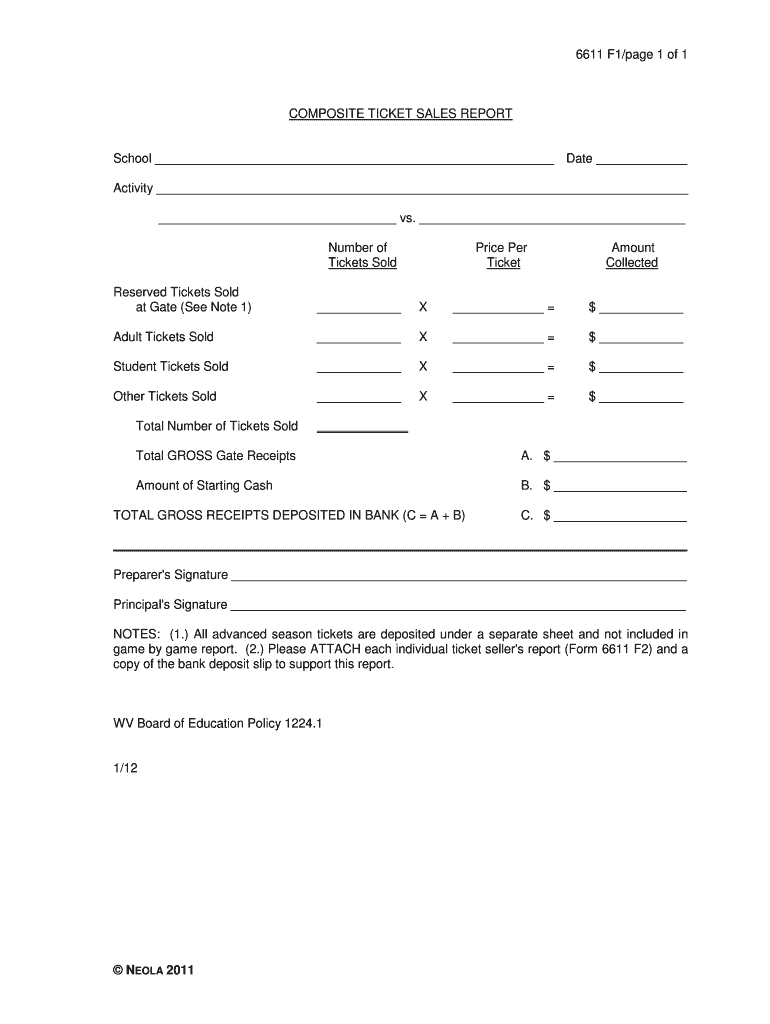

This document is a report used to summarize ticket sales for a specific school activity, detailing the number of tickets sold, prices, and total gross receipts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 6611 f1

Edit your 6611 f1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 6611 f1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 6611 f1 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 6611 f1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 6611 f1

How to fill out 6611 F1

01

Obtain the 6611 F1 form from the official website or your local IRS office.

02

Begin with the applicant's personal information, including name, address, and Social Security number.

03

Indicate the reason for filing the 6611 F1, ensuring it corresponds with your situation.

04

Fill out the specific sections relevant to your financial situation or tax inquiries.

05

Carefully review all entered information for accuracy before submission.

06

Sign and date the form at the designated location.

07

Submit the completed form to the appropriate IRS address or office as instructed.

Who needs 6611 F1?

01

Individuals or businesses seeking a refund of overpaid taxes.

02

Taxpayers who need to claim a credit for a prior year’s taxes.

03

Anyone filing an appeal for an IRS decision related to tax refunds.

Fill

form

: Try Risk Free

People Also Ask about

Is F1 TV only in English?

No, F1 TV is not only in English. If you'd like to access commentary in French, German, Spanish, Portuguese, or Dutch, you'll need to head to the F1 International channel and pick your language through settings. However, all live F1 race translations are only available with English commentary.

Is number 69 allowed in F1?

Drivers allowed to choose their own, permanent numbers from 0 through 99 except 1. Only the World Drivers' Champion is allowed to use No. 1 at their discretion, though they are not required to do so.

Why do they speak English in F1?

English is the most common language spoken among F1 drivers, as it is the official language of the sport.

Does F1 radio have to be in English?

This is actually an F1 rule. They chose English as the universal radio language for the FIA and their stewards. They aren't allowed any other language. It wasn't always like this though, but they did bring it into law eventually.

Do you have to know English to be in F1?

There is no strict language requirement, but some teams encourage drivers to learn languages that match the team's home country, such as Italian for Ferrari. English is the primary language used in F1 for communication, but learning additional languages is beneficial.

How does the radio work in F1?

0:00 0:59 1 is that drivers are having full conversations. At 200 mph. And it's important to know that radiosMore1 is that drivers are having full conversations. At 200 mph. And it's important to know that radios are used in the garage. And on track so that the engineers. And mechanics who are constantly.

Can I listen to the F1 race on the radio?

Listen to the Live Radio Broadcast of Formula 1® Races, Plus Interviews and F1 Talk Shows. All Formula 1® races, F1 Sprint events, and qualifying sessions are available on ESPN Xtra (Ch.

What is F1 in English?

Formula One (F1) is a motorsport championship controlled by the Fédération Internationale de l'Automobile. Teams compete in a series of Grand Prix races, held in different countries around the world. Some of the most popular races are held in Monaco, Singapore, Italy and Britain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 6611 F1?

Form 6611 F1 is a document used by taxpayers in the United States to claim a tax refund on overpayments of taxes. It is specifically related to Form 6611, which is used for interest computation for overpayments or underpayments of tax.

Who is required to file 6611 F1?

Taxpayers who have made an overpayment of their taxes and wish to claim a refund, especially those seeking interest on the overpayment, are required to file Form 6611 F1.

How to fill out 6611 F1?

To fill out Form 6611 F1, taxpayers need to provide their personal information, including Social Security Number, the tax periods involved, the amounts of overpayment, and any relevant calculations for determining interest. The form should be completed carefully to ensure accuracy.

What is the purpose of 6611 F1?

The purpose of Form 6611 F1 is to allow taxpayers to claim a refund for overpaid taxes and to calculate any interest owed on that overpayment, thereby ensuring that they receive the correct amount from the IRS.

What information must be reported on 6611 F1?

On Form 6611 F1, taxpayers must report their identifying information, the tax periods for which they are claiming a refund, the total amount of overpayment, and any calculations related to interest.

Fill out your 6611 f1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

6611 f1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.