Get the free PROFIT WARNING

Show details

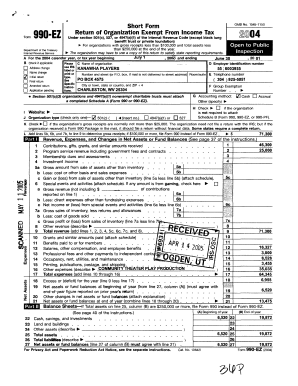

This announcement informs shareholders and potential investors about the expected loss in the unaudited interim results of Top Form International Limited for the six months ended 31st December, 2008,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign profit warning

Edit your profit warning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit warning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing profit warning online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit profit warning. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out profit warning

How to fill out profit warning:

01

Gather necessary financial information: Collect accurate data on your company's financial performance, including revenue, expenses, and profit margins. This will ensure you have a clear understanding of the financial situation.

02

Review financial forecasts: Evaluate your company's financial forecasts, considering any changes in market conditions or internal factors that may impact future profitability. This will help you assess the potential risks and uncertainties that should be highlighted in the profit warning.

03

Provide a detailed explanation: Clearly explain the factors or events that have led to the decline in profitability or the potential risks that may affect future earnings. Be transparent and honest in your communication, ensuring that stakeholders have a clear understanding of the situation.

04

Quantify the impact: Quantify the expected impact on financial performance, such as a projected decrease in revenue or an increase in expenses. Providing concrete figures will give stakeholders a better understanding of the magnitude of the issue.

05

Present a recovery plan: Outline the steps your company is taking or planning to take to address the challenges and improve profitability. This may include cost-cutting measures, strategic initiatives, or adjustments to the business model.

Who needs profit warning:

01

Shareholders: Shareholders have a vested interest in the financial performance of the company. They need to be informed about any significant changes in profitability to make informed decisions regarding their investment.

02

Investors: Potential investors or existing investors who are considering additional investments may need a profit warning to assess the potential risks involved. It helps them evaluate if it is a suitable time to invest or if they need to adjust their investment strategy.

03

Creditors and lenders: Profit warnings can alert creditors and lenders about potential financial difficulties a company may face. This allows them to reassess the creditworthiness of the business and take necessary precautions to protect their interests.

04

Employees: Employees may need to be aware of a profit warning as it may impact job security or employee benefits. Clear communication regarding the company's financial situation can help manage employee expectations and foster trust.

05

Regulatory authorities: Depending on the jurisdiction, companies may be required to inform regulatory authorities about profit warnings. Compliance with regulatory obligations ensures transparency and protects the interests of the broader market.

In summary, filling out a profit warning involves gathering financial information, reviewing forecasts, providing a detailed explanation, quantifying the impact, and presenting a recovery plan. The profit warning is essential for shareholders, investors, creditors, employees, and regulatory authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my profit warning directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your profit warning and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for signing my profit warning in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your profit warning and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit profit warning on an Android device?

With the pdfFiller Android app, you can edit, sign, and share profit warning on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is profit warning?

A profit warning is a statement issued by a company to notify investors and the public that its expected profits or financial results will be lower than previously anticipated.

Who is required to file profit warning?

Publicly traded companies are required to file a profit warning if they anticipate that their financial results will fall significantly below the market's expectations.

How to fill out profit warning?

To fill out a profit warning, companies should provide a clear and concise explanation of the reasons behind the anticipated lower profits, quantify the expected impact on financial results, and ensure timely communication to investors and regulatory authorities.

What is the purpose of profit warning?

The purpose of a profit warning is to manage expectations and keep shareholders, investors, and the market informed about potential negative financial performance, allowing them to make informed decisions.

What information must be reported on profit warning?

A profit warning should include details on the reasons for the anticipated lower profits, the expected impact on financial results, and any other relevant information that could help stakeholders understand the situation.

Fill out your profit warning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Profit Warning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.