Get the free How much LIFE INSURANCE is enough - bwawanesacomb

Show details

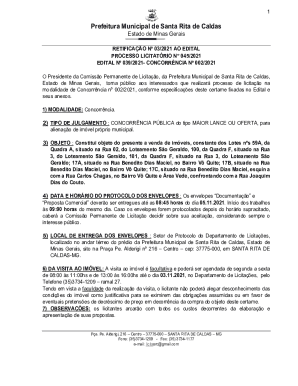

JAPANESE LIFE EARNING YOUR TRUST The Japanese Life Insurance Company has been a proud member of the Japanese Group of Companies since 1960. Japanese Life complements the insurance lines of Japanese

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how much life insurance

Edit your how much life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how much life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how much life insurance online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how much life insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how much life insurance

How to determine the amount of life insurance:

01

Evaluate your financial obligations: Calculate your current debts, such as mortgage, car loans, credit card balances, and other outstanding loans. Consider the amount needed to pay off these debts in the event of your untimely death.

02

Consider your dependents: If you have dependents, such as children or a non-working spouse, factor in their financial needs. Determine how much money they would require to maintain their current lifestyle and cover expenses like education, childcare, and daily living costs.

03

Assess your income replacement needs: Consider how much income your family would need to replace in case of your death. This may involve estimating the number of years they would require financial support until they become self-sufficient or reach retirement age.

04

Account for future expenses: Anticipate any future expenses that your family might face, such as college tuition fees, major healthcare costs, or other financial goals that you wish to fund even after you're gone.

05

Think about the duration: Decide on how long you want the life insurance coverage to last. Some individuals may opt for coverage until their children are financially independent, while others may desire coverage until retirement age.

06

Factor in inflation: Consider the impact of inflation on future expenses when determining the amount of life insurance. It's essential to ensure that the coverage amount accounts for the rising costs of living over time.

07

Consult with a financial advisor: If you're unsure about the appropriate amount of life insurance, it's advisable to seek guidance from a qualified financial advisor who can help you assess your specific needs and create a comprehensive financial plan.

Who needs how much life insurance:

01

Individuals with dependents: Those who have dependents relying on their income should consider obtaining life insurance to provide financial security and replace lost income in the event of their death.

02

Breadwinners: If you are the primary earner in your family or contribute significantly to the household's financial stability, it is crucial to have adequate life insurance coverage to protect your loved ones' financial future.

03

Stay-at-home parents: Even if you don't generate income, life insurance is essential for stay-at-home parents as they provide valuable services that would require financial support if they were no longer there, such as childcare or household maintenance.

04

Business owners and partners: Business owners or partners may need life insurance to ensure the continuity and financial stability of the business in case of their untimely demise. It can be used to cover outstanding debts, buy out the deceased partner's shares, or provide funds for succession planning.

05

Individuals with debts: If you have outstanding debts, such as a mortgage, car loans, or student loans, life insurance can help cover those liabilities and prevent passing the burden onto your loved ones.

06

Those with specific financial goals: If you have specific financial goals, such as funding your child's education or leaving an inheritance, life insurance can provide the necessary funds to achieve these objectives, even if you pass away before achieving them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get how much life insurance?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the how much life insurance. Open it immediately and start altering it with sophisticated capabilities.

How do I execute how much life insurance online?

Filling out and eSigning how much life insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the how much life insurance form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign how much life insurance and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is how much life insurance?

Life insurance is a policy that provides a cash payment to beneficiaries in the event of the policyholder's death.

Who is required to file how much life insurance?

Individuals who want to financially protect their loved ones should consider purchasing life insurance.

How to fill out how much life insurance?

To fill out a life insurance policy, individuals must provide information about their personal details, health history, and desired coverage amount.

What is the purpose of how much life insurance?

The purpose of life insurance is to provide financial protection to the insured's beneficiaries in the event of the insured's death.

What information must be reported on how much life insurance?

Information such as the insured's personal details, medical history, and desired coverage amount must be reported on a life insurance policy.

Fill out your how much life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Much Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.