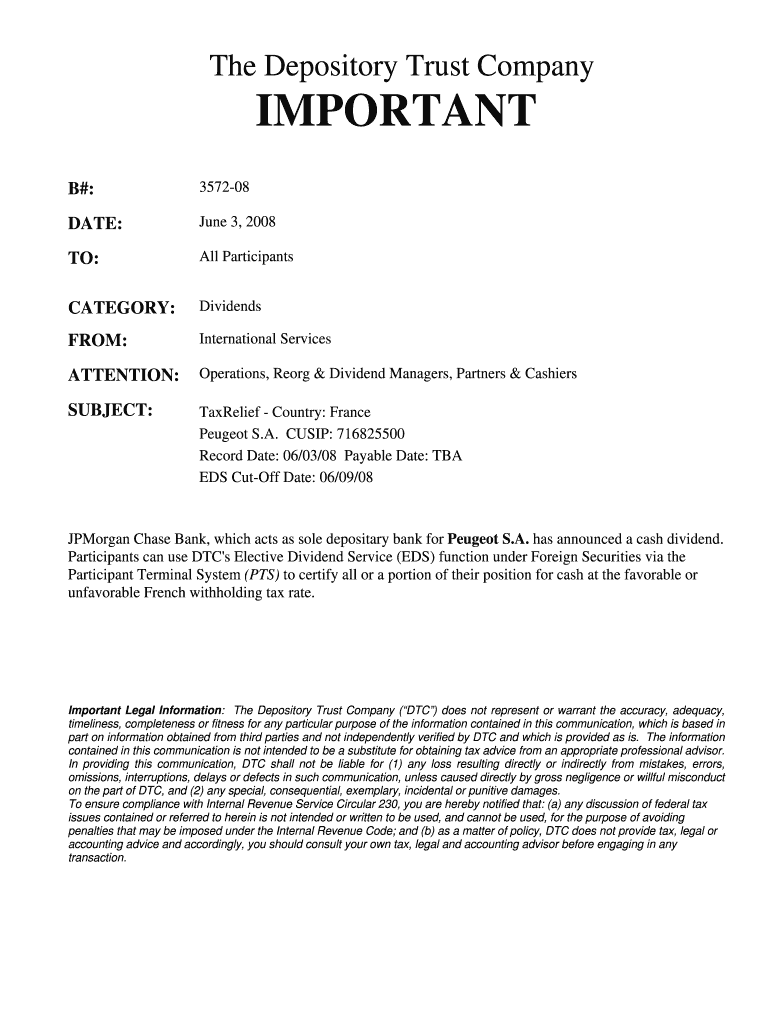

Get the free TaxRelief - Country: France

Show details

This document provides essential information and procedures regarding the cash dividend distribution by Peugeot S.A. and applicable tax rates for U.S. and Canadian residents. It outlines the process

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxrelief - country france

Edit your taxrelief - country france form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxrelief - country france form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxrelief - country france online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxrelief - country france. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxrelief - country france

How to fill out TaxRelief - Country: France

01

Gather all necessary documents, including your income statements, tax returns, and any relevant financial information.

02

Visit the official French tax administration website or a local tax office to access the Tax Relief application form.

03

Fill out the application form with your personal information and financial details as instructed.

04

Check the eligibility criteria outlined in the form to ensure you qualify for the tax relief.

05

Submit the completed application form along with any required attachments before the deadline.

06

Await confirmation from the tax authorities regarding your application status.

Who needs TaxRelief - Country: France?

01

Individuals or families facing financial difficulties in France.

02

Those who have experienced a significant decrease in income due to unforeseen circumstances.

03

Taxpayers who are struggling to pay their tax obligations on time.

04

Small business owners impacted by economic downturns or crises.

05

Residents who meet specific eligibility criteria for tax relief provided by the French government.

Fill

form

: Try Risk Free

People Also Ask about

How to claim tax free in France?

You can easily obtain an electronic duty-free slip by using the Pablo terminals at the airports. For an immediate VAT refund, you should present all your documents at the tax refund desk at the airport, the port or the train station from which you are departing.

What is the 17.2% tax in France?

CSG/CRDS on passive income and capital gains is increased by a social tax surcharge, resulting in a total rate of 17.2%. A non-resident's tax liability may not be less than 20% of net taxable income for income between €0 and €27,478 and 30% for income exceeding €27,478.

How can I reduce my income tax in France?

27 TAX REDUCTIONS IN FRANCE THAT COULD REDUCE YOUR INCOME TAX BILL Donations and grants to a charitable organisation. The cost of employing help in the home. The purchase of shares in small and medium enterprises. Subscription to mutual fund units for innovation (Fonds Commun de Placement dans l'Innovation – FCPI)

Is there a 30% exit tax in France?

Taxation is triggered upon departure at a flat rate of 30%, but may be deferred depending on the destination country and compliance with reporting requirements. If the taxpayer still holds the assets after 2 or 5 years (depending on their value), or returns to France, the Exit Tax is waived.

What happens if you don't pay tourist tax in France?

Yes, failing to pay the tourist tax can result in fines and penalties. Municipalities are responsible for enforcing tourist tax regulations, and non-compliance can lead to financial penalties, legal action, or other consequences as revoking your permit to rent.

What percentage of your income is taxed in France?

The tax wedge for the average single worker in France decreased by 0.2 percentage points from 47.0% in 2022 to 46.8% in 2023. The OECD average tax wedge in 2023 was 34.8% (2022, 34.7%). In 2023, France had the 4th highest tax wedge among the 38 OECD member countries, compared with 3rd in 2022.

What is the 30% flat tax in France?

Single flat-rate levy of 30% For French residents : the 30% flat-rate levy (12.8% for income tax and 17.2% for social contributions) applies in particular to dividends, interest and capital gains on the sale of securities. The 40% allowance on dividends and similar income does not apply.

What is the 30% tax rule in France?

Single flat-rate levy of 30% For French residents : the 30% flat-rate levy (12.8% for income tax and 17.2% for social contributions) applies in particular to dividends, interest and capital gains on the sale of securities. The 40% allowance on dividends and similar income does not apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TaxRelief - Country: France?

TaxRelief in France refers to measures and mechanisms that provide taxpayers with reductions or exemptions on their tax liabilities, aimed at alleviating the tax burden for individuals and businesses.

Who is required to file TaxRelief - Country: France?

Individuals and businesses who meet certain criteria, such as income thresholds or specific circumstances like having dependents or engaging in eligible activities, are required to file for TaxRelief in France.

How to fill out TaxRelief - Country: France?

To fill out TaxRelief in France, taxpayers must complete the relevant tax forms, providing necessary personal and financial information, and submit these forms to the tax authorities, either online or via mail.

What is the purpose of TaxRelief - Country: France?

The purpose of TaxRelief in France is to provide financial support to individuals and businesses, encourage economic growth, and address social issues by reducing the tax burden.

What information must be reported on TaxRelief - Country: France?

Taxpayers must report their income, deductible expenses, personal details, and any applicable allowances or benefits that qualify them for tax relief on the relevant forms.

Fill out your taxrelief - country france online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxrelief - Country France is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.